Top Growth Stocks This Week

Robust, high-growth companies such as Qiwi are appealing to investors for many reasons. They bring about a strong upside to your portfolio, and less downside risk as opposed to financially challenged companies. I would suggest taking a look at my list of companies that compare favourably in all criteria, and consider whether they would add value to your current portfolio.

Qiwi plc (NASDAQ:QIWI)

Qiwi plc, together with its subsidiaries, operates electronic online payment systems primarily in the Russian Federation, Kazakhstan, Moldova, Belarus, Romania, the United Arab Emirates, and internationally. Established in 2007, and currently run by Sergey Solonin, the company now has 2,264 employees and has a market cap of USD $1.13B, putting it in the small-cap group.

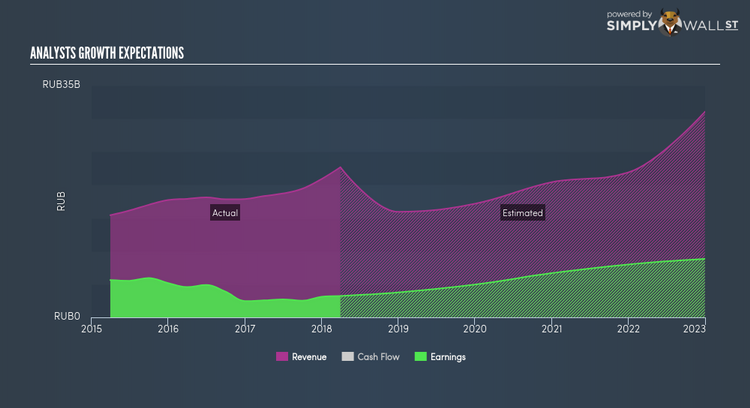

QIWI’s forecasted bottom line growth is an optimistic double-digit 21.99%, driven by the underlying triple-digit cash flow from operations growth over the next few years. An affirming signal is when net income increase is supported by operating cash flow growth. Since net income isn’t artificially inflated by one-off initiatives such as cost-cutting, we know this profit growth is more likely to be sustainable. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 32.24%. QIWI ticks the boxes for high-growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Considering QIWI as a potential investment? Take a look at its other fundamentals here.

LiveXLive Media, Inc. (NASDAQ:LIVX)

LiveXLive Media, Inc. operates Internet networks for live music and music-related video content. LiveXLive Media was started in 2009 and with the company’s market capitalisation at USD $209.59M, we can put it in the small-cap category.

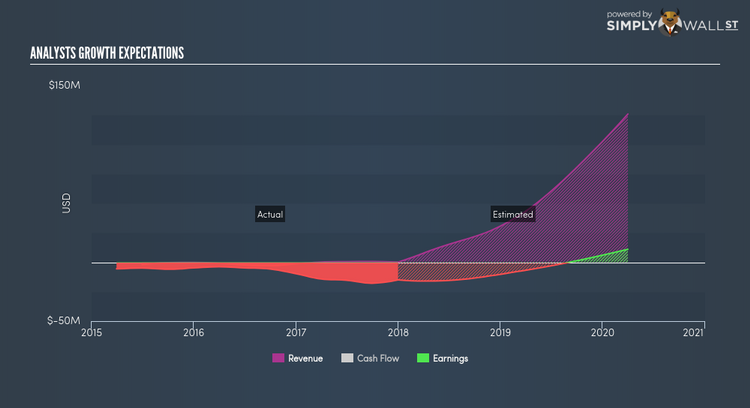

LIVX’s forecasted bottom line growth is an exceptional 96.71%, driven by underlying sales, which is expected to more than double, over the next few years. It appears that LIVX’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. LIVX ticks the boxes for high-growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. A potential addition to your portfolio? Take a look at its other fundamentals here.

Quaker Chemical Corporation (NYSE:KWR)

Quaker Chemical Corporation develops, produces, and markets various formulated chemical specialty products for a range of heavy industrial and manufacturing applications in North America, Europe, the Middle East, Africa, the Asia/Pacific, and South America. Started in 1918, and headed by CEO Michael Barry, the company employs 2,110 people and with the stock’s market cap sitting at USD $2.07B, it comes under the mid-cap stocks category.

An outstanding 67.21% earnings growth is forecasted for KWR, driven by strong underlying sales growth over the next few years. An affirming signal is when net income increase is supported by top-line growth. Since net income isn’t artificially inflated by one-off initiatives such as cost-cutting, we know this profit growth is more likely to be sustainable. KWR’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. Could this stock be your next pick? Other fundamental factors you should also consider can be found here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.