Top High Growth Stocks This Week

Investors tend to look for stocks that have a strong future outlook. Why invest in something that will grow slower than the rest of the market? In terms of profitability and returns, stocks such as SteadyMed and Myomo are expected to outperform its peers in the future. If your holdings could benefit from diversification towards growth stocks, whether it be in reputable tech stocks or green small-caps, take a look at my list of stocks with a bright future ahead.

SteadyMed Ltd. (NASDAQ:STDY)

SteadyMed Ltd., together with its subsidiaries, operates as a specialty pharmaceutical company that focuses on the development and commercialization of drug product candidates for the treatment of orphan and high-value diseases with unmet parenteral delivery needs. Started in 2005, and run by CEO Jonathan M. Rigby, the company now has 24 employees and with the market cap of USD $120.91M, it falls under the small-cap group.

Extreme optimism for STDY, as market analysts projected an outstanding earnings growth rate of 66.59% for the stock, supported by an equally strong sales. It appears that STDY’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. STDY’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. A potential addition to your portfolio? Take a look at its other fundamentals here.

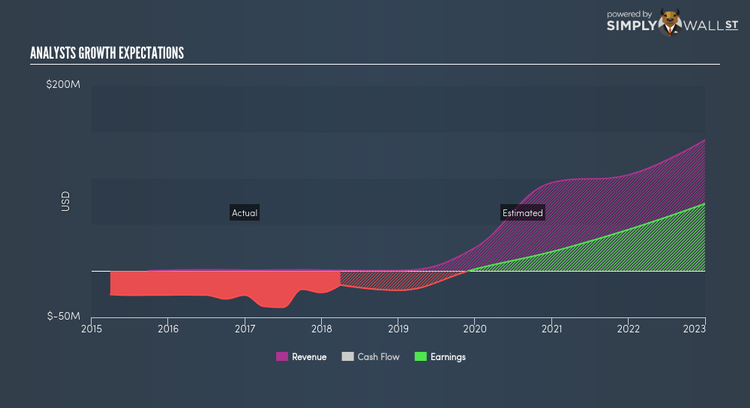

Myomo, Inc. (AMEX:MYO)

Myomo, Inc., a commercial stage medical robotics company, designs, develops, and produces myoelectric braces or orthotics for people suffering with neuromuscular disorders in the United States. Formed in 2004, and currently run by Paul Gudonis, the company employs 23 people and with the company’s market cap sitting at USD $39.46M, it falls under the small-cap stocks category.

Extreme optimism for MYO, as market analysts projected an outstanding earnings growth rate of 55.86% for the stock, supported by an equally strong sales. Profit growth, coupled with top-line expansion, is a positive indication. This is because net income isn’t artificially inflated by unsustainable activities such as one-off cost-reductions expected in the future. MYO’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. A potential addition to your portfolio? Other fundamental factors you should also consider can be found here.

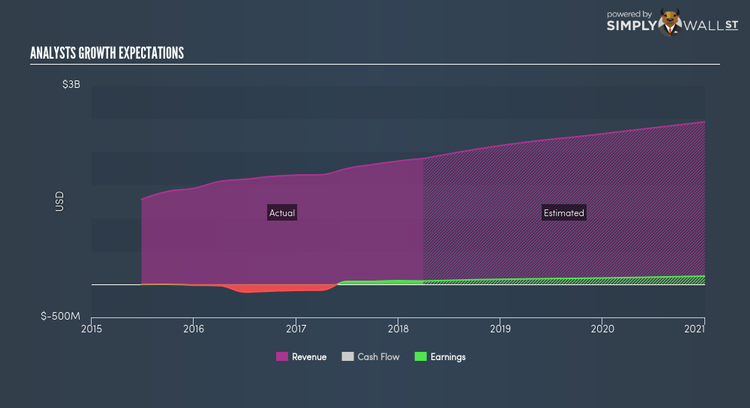

SiteOne Landscape Supply, Inc. (NYSE:SITE)

SiteOne Landscape Supply, Inc., through its subsidiaries, engages in the wholesale distribution of landscape supplies in the United States and Canada. The company size now stands at 3540 people and with the market cap of USD $3.48B, it falls under the mid-cap category.

SITE is expected to deliver an extremely high earnings growth over the next couple of years of 29.19%, driven by a positive double-digit revenue growth of 22.15% and cost-cutting initiatives. It appears that SITE’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 27.89%. SITE ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Interested to learn more about SITE? Have a browse through its key fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.