Top Medical Stocks to Buy Amid Market Volatility

While there is no guarantee that medical stocks will offer a hedge against market volatility, healthcare is essential even during economic uncertainty.

To that point, several stocks in the Zacks Medical sector are intriguing with inflationary concerns resurfacing over the last month and the Fed not prioritizing a soft landing. This has caused markets to slump in September but there is an opportunity among the Zacks Medical-Outpatient and Home Healthcare Industry in particular.

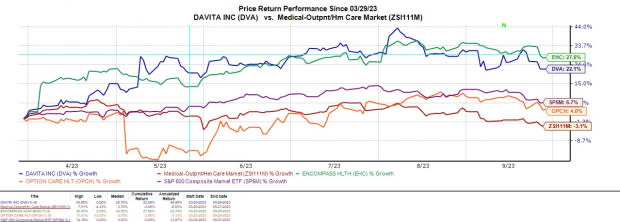

At the moment, the Zacks Medical-Outpatient and Home Healthcare Industry is in the top 10% of over 250 Zacks industries. Currently home to a slew of top-rated stocks, DaVita DVA, Encompass Health EHC, and Option Care Health OPCH stand out with a Zacks Rank #1 (Strong Buy).

Let’s see why now is a good time to buy these highly-ranked medical stocks as they look to build on stronger momentum over the last six months.

Image Source: Zacks Investment Research

DaVita: As shown in the performance reference chart, DaVita’s stock has soared +22% over the last six months and is in a prime position to benefit from the stronger business environment in regards to the Medical-Outpatient and Home Healthcare space.

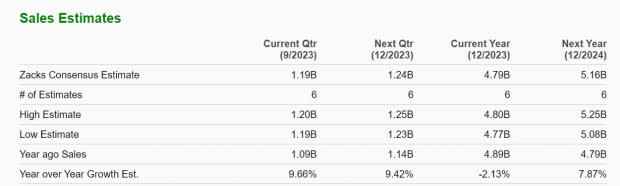

Correlating with such, in the last 60 days fiscal 2023 and FY24 earnings estimates have risen 8% and 5% respectively. DaVita is now expecting sound growth on its top and bottom lines as a leading provider of dialysis services operating kidney dialysis centers with outpatient and inpatient offerings across the United States.

Image Source: Zacks Investment Research

Total sales are forecasted to be up 2% this year and rise another 2% in FY24 to $12.16 billion. Plus, annual earnings are now projected to jump 12% in FY23 and rise another 4% in FY24 at $7.72 per share with DaVita’s stock trading attractively at 13.2X forward earnings.

Image Source: Zacks Investment Research

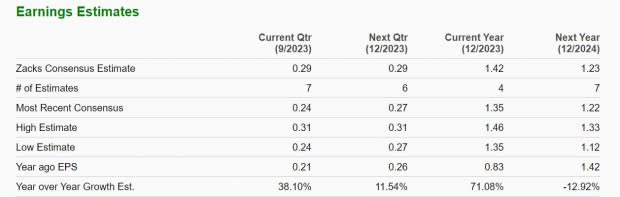

Encompass Health: Offering facility-based patient care through its network of rehabilitation hospitals, Encompass Health’s stock has soared +27% over the last six months.

The company’s bottom line expansion is very compelling with Encompass having a national footprint that includes 158 hospitals across 36 states and Puerto Rico. Annual earnings are anticipated to soar 21% in FY23 at $3.45 per share compared to EPS of $2.85 last year. Fiscal 2024 earnings are projected to climb another 8%.

Image Source: Zacks Investment Research

More importantly, FY23 EPS estimates are up 8% in the last two months with FY24 estimates rising 5%. Encompass stock also trades near the industry average of 19.1X forward earnings and slightly beneath the S&P 500’s 20X. Furthermore, total sales are forecasted to dip -2% this year but rebound and jump 8% in FY24 to $5.16 billion.

Image Source: Zacks Investment Research

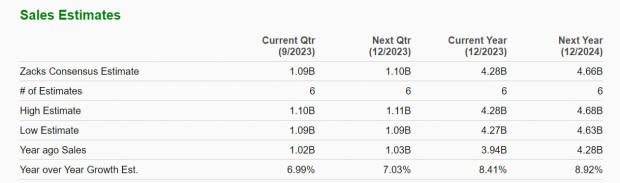

Option Care Health: Option Care Health’s stock is up a respectable +4% in the last six months with the company providing infusion and homecare management solutions.

Option Care offers products, services, and condition-specific clinical management programs for gastrointestinal abnormalities, infectious diseases, cancer, and heart failure among other serious conditions.

Fiscal 2023 EPS estimates have remained higher over the last quarter with earnings now expected at $1.42 per share skyrocketing 71% from $0.83 a share in 2022. Fiscal 2024 earnings are expected to dip -13% to $1.23 a share after what would be a tougher to compete against year but EPS estimates are still up over the last 90 days as well.

Image Source: Zacks Investment Research

Even better, FY24 EPS projections would still represent substantial growth over the last five years considering Option Care has not had sustainable profitability until 2021 with earnings at an adjusted loss of -$0.04 a share in 2020.

Investors aren’t paying a high premium for Option Care’s very expansive bottom-line growth with OPCH shares trading at 23.2X forward earnings and not at a stretched valuation to the industry. Option Care's sales are also expected to rise 8% in FY23 and climb another 9% in FY24 to $4.66 billion.

Image Source: Zacks Investment Research

Bottom Line

The trend of rising earnings estimates is abundant among the top-rated Zacks Medical-Outpatient and Home Healthcare Industry which is a strong sign that these stocks could move higher in the near future. This is especially true as broader market volatility begins to fade with DaVita, Encompass Health, and Option Care Health offering essential services that make their stocks viable long-term investments as well.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Encompass Health Corporation (EHC) : Free Stock Analysis Report

Option Care Health, Inc. (OPCH) : Free Stock Analysis Report