Top Picks For Dividend Rockstars

A & J Mucklow Group, Ocean Wilsons Holdings, and M.P. Evans Group are three of the best paying dividend stocks for creating diversified portfolio income. Dividends play a key role in compounding returns over time and can form a large part of our portfolio return. I’ve made a list of other value-adding dividend-paying stocks for you to consider for your investment portfolio.

A & J Mucklow Group Plc (LSE:MKLW)

A&J Mucklow Group Plc is a long established Midlands based property company focusing on the long term ownership and development of industrial and commercial property. Started in 1933, and currently headed by CEO David Parker, the company currently employs 11 people and with the company’s market cap sitting at GBP £333.56M, it falls under the small-cap stocks category.

MKLW has a juicy dividend yield of 4.11% and the company has a payout ratio of 28.16% , with analysts expecting this ratio in three years to be 89.37%. The company’s DPS has increased from UK£0.16 to UK£0.22 over the last 10 years. During this period, the company has not missed a dividend payment – as you would expect from a company increasing their dividend. A & J Mucklow Group’s earnings per share growth of 153.27% over the past 12 months outpaced the gb reits industry’s average growth rate of 56.78%. More on A & J Mucklow Group here.

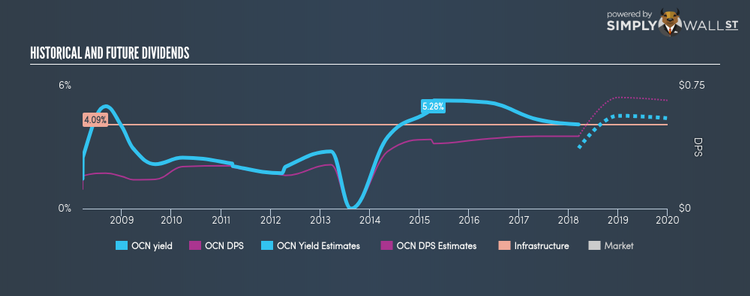

Ocean Wilsons Holdings Limited (LSE:OCN)

Ocean Wilsons Holdings Limited, an investment holding company, provides maritime and logistics services in Bermuda, Brazil, Panama, and Uruguay. The company now has 4436 employees and with the company’s market capitalisation at GBP £376.62M, we can put it in the small-cap group.

OCN has an appealing dividend yield of 4.11% and distributes 33.45% of its earnings to shareholders as dividends , with analysts expecting the payout ratio in three years to be 56.24%. Although there has been some volatility in the company’s dividend yield, the DPS over a 10 year period has increased from US$0.12 to US$0.44. The company outperformed the gb infrastructure industry’s earnings growth of 99.43%, reporting an EPS growth of 185.53% over the past 12 months. Continue research on Ocean Wilsons Holdings here.

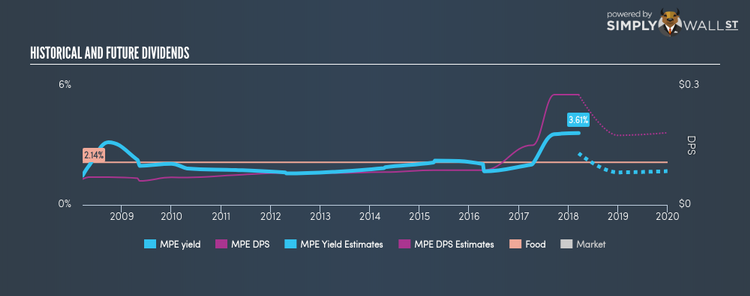

M.P. Evans Group plc (AIM:MPE)

M.P. Evans Group PLC, through its subsidiaries, operates oil palm plantations in Indonesia. Started in 1981, and run by CEO Tristan Price, the company currently employs 4,377 people and with the company’s market capitalisation at GBP £416.65M, we can put it in the small-cap group.

MPE has a nice dividend yield of 3.61% and has a payout ratio of 56.31% . MPE’s dividends have increased in the last 10 years, with DPS increasing from US$0.065 to US$0.28. They have been consistent too, not missing a payment during this 10 year period. M.P. Evans Group’s future earnings growth looks strong, with analysts expecting 51.19% EPS growth in the next three years. More detail on M.P. Evans Group here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers. Or create your own list by filtering LSE and AIM companies based on fundamentals such as intrinsic discount, health score and future outlook using this free stock screener.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.