Top Ranked Growth Stocks to Buy for January 26th

Here are four stocks with buy ranks and strong growth characteristics for investors to consider today, January 26th:

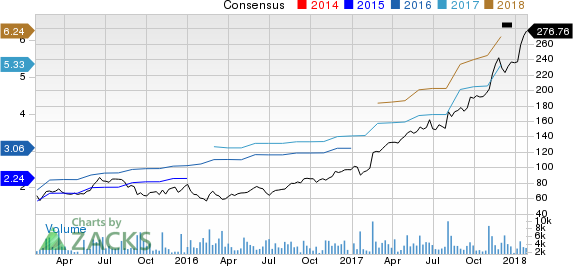

Arista Networks, Inc. (ANET): This cloud networking solutions supplier, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings advancing 0.2% over the last 60 days.

Arista Networks, Inc. Price and Consensus

Arista Networks, Inc. price-consensus-chart | Arista Networks, Inc. Quote

Arista Networks has a PEG ratio 2.09, compared with 2.10 for the industry. The company possesses a Growth Score of A.

Arista Networks, Inc. PEG Ratio (TTM)

Arista Networks, Inc. peg-ratio-ttm | Arista Networks, Inc. Quote

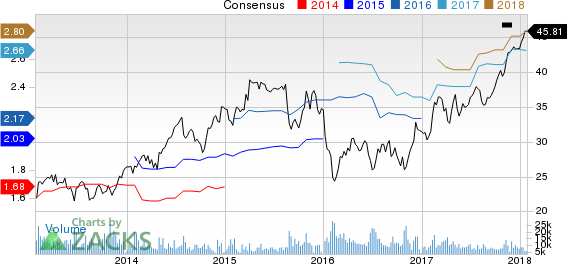

CBRE Group, Inc. (CBG): This commercial real estate services company, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 1.5% over the last 60 days.

CBRE Group, Inc. Price and Consensus

CBRE Group, Inc. price-consensus-chart | CBRE Group, Inc. Quote

CBRE Group has a PEG ratio 1.24, compared with 1.89 for the industry. The company possesses a Growth Score of A.

CBRE Group, Inc. PEG Ratio (TTM)

CBRE Group, Inc. peg-ratio-ttm | CBRE Group, Inc. Quote

EnPro Industries, Inc. (NPO): This developer of engineered industrial products, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings advancing 2.6% over the last 60 days.

EnPro Industries Price and Consensus

EnPro Industries price-consensus-chart | EnPro Industries Quote

EnPro Industries has a PEG ratio 1.70, compared with 1.96 for the industry. The company possesses a Growth Score of A.

EnPro Industries PEG Ratio (TTM)

EnPro Industries peg-ratio-ttm | EnPro Industries Quote

Global Medical REIT Inc. (GMRE): This REIT, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 3% over the last 60 days.

Global Medical REIT Inc. Price and Consensus

Global Medical REIT Inc. price-consensus-chart | Global Medical REIT Inc. Quote

Global Medical REIT has a PEG ratio 1.28, compared with 2.71 for the industry. The company possesses a Growth Score of A.

Global Medical REIT Inc. PEG Ratio (TTM)

Global Medical REIT Inc. peg-ratio-ttm | Global Medical REIT Inc. Quote

See the full list of top ranked stocks here

Learn more about the Growth score and how it is calculated here.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EnPro Industries (NPO) : Free Stock Analysis Report

Global Medical REIT Inc. (GMRE) : Free Stock Analysis Report

CBRE Group, Inc. (CBG) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research