Top Ranked Growth Stocks to Buy for October 16th

Here are three stocks with buy ranks and strong growth characteristics for investors to consider today, October 16th:

Avnet, Inc. (AVT): This marketer and seller of electronic components, which carries a Zacks Rank #1 (Strong Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 5.3% over the last 60 days.

Avnet, Inc. Price and Consensus

Avnet, Inc. price-consensus-chart | Avnet, Inc. Quote

Avnet has a PEG ratio of 1.02, compared with 1.17 for the industry. The company possesses a Growth Score of B.

Avnet, Inc. PEG Ratio (TTM)

Avnet, Inc. peg-ratio-ttm | Avnet, Inc. Quote

M.D.C. Holdings, Inc. (MDC): This company that is engaged in homebuilding and financial service businesses, which carries a Zacks Rank #1, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 2.4% over the last 60 days.

M.D.C. Holdings, Inc. Price and Consensus

M.D.C. Holdings, Inc. price-consensus-chart | M.D.C. Holdings, Inc. Quote

MDC has a PEG ratio of 0.75, compared with 1.06 for the industry. The company possesses a Growth Score of B.

M.D.C. Holdings, Inc. PEG Ratio (TTM)

M.D.C. Holdings, Inc. peg-ratio-ttm | M.D.C. Holdings, Inc. Quote

Copart, Inc. (CPRT): This provider of online auctions and vehicle remarketing services, which carries a Zacks Rank #1, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 10.3% over the last 60 days.

Copart, Inc. Price and Consensus

Copart, Inc. price-consensus-chart | Copart, Inc. Quote

Copart has a PEG ratio of 3.14, compared with 3.35 for the industry. The company possesses a Growth Score of B.

Copart, Inc. PEG Ratio (TTM)

Copart, Inc. peg-ratio-ttm | Copart, Inc. Quote

Meritage Homes Corporation (MTH): This designer and builder of single-family homes in the United States which carries a Zacks Rank #1, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 1.9% over the last 60 days.

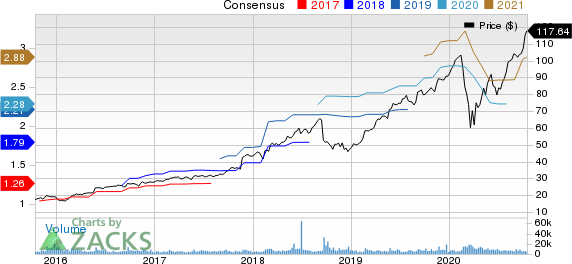

Meritage Homes Corporation Price and Consensus

Meritage Homes Corporation price-consensus-chart | Meritage Homes Corporation Quote

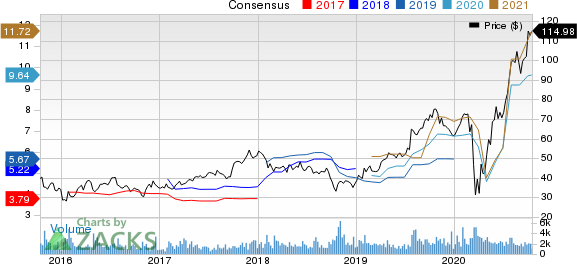

Meritage Homes has a PEG ratio of 0.53, compared with 1.06 for the industry. The company possesses a Growth Score of A.

Meritage Homes Corporation PEG Ratio (TTM)

Meritage Homes Corporation peg-ratio-ttm | Meritage Homes Corporation Quote

See the full list of top ranked stocks here

Learn more about the Growth score and how it is calculated here.

Legal Marijuana: An Investor’s Dream

Imagine getting in early on a young industry primed to skyrocket from $17.7 billion in 2019 to an expected $73.6 billion by 2027.

Although marijuana stocks did better as the pandemic took hold than the market as a whole, they’ve been pushed down. This is exactly the right time to get in on selected strong companies at a fraction of their value before COVID struck. Zacks’ Special Report, Marijuana Moneymakers, reveals 10 exciting tickers for urgent consideration.

Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report

M.D.C. Holdings, Inc. (MDC) : Free Stock Analysis Report

Copart, Inc. (CPRT) : Free Stock Analysis Report

Avnet, Inc. (AVT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research