Top Ranked Growth Stocks to Buy for February 2nd

Here are four stocks with buy ranks and strong growth characteristics for investors to consider today, February 2nd:

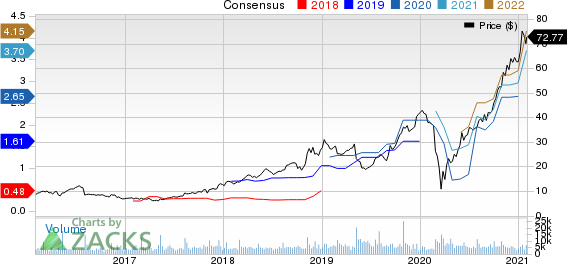

Texas Instruments Incorporated (TXN): This designer and manufacturer of semiconductors to electronics designers and manufacturers, which carries a Zacks Rank #1 (Strong Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 14.8% over the last 60 days.

Texas Instruments Incorporated Price and Consensus

Texas Instruments Incorporated price-consensus-chart | Texas Instruments Incorporated Quote

Texas Instruments has a PEG ratio of 2.65, compared with 14.37 for the industry. The company possesses a Growth Score of B.

Texas Instruments Incorporated PEG Ratio (TTM)

Texas Instruments Incorporated peg-ratio-ttm | Texas Instruments Incorporated Quote

Crocs, Inc. (CROX): This designer and developer of casual lifestyle footwear and accessories for men, women, and children, which carries a Zacks Rank #1, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 11.4% over the last 60 days.

Crocs, Inc. Price and Consensus

Crocs, Inc. price-consensus-chart | Crocs, Inc. Quote

Crocs has a PEG ratio of 1.26, compared with 1.80 for the industry. The company possesses a Growth Score of A.

Crocs, Inc. PEG Ratio (TTM)

Crocs, Inc. peg-ratio-ttm | Crocs, Inc. Quote

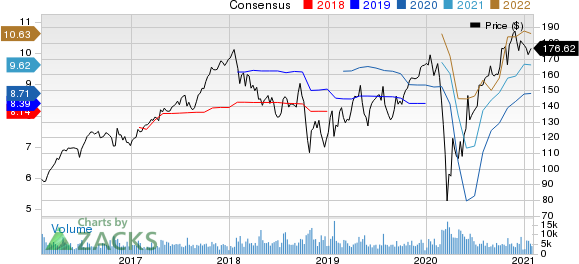

Stanley Black & Decker, Inc. (SWK): This company that is engaged in tools and storage, industrial, and security businesses, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 6% over the last 60 days.

Stanley Black & Decker, Inc. Price and Consensus

Stanley Black & Decker, Inc. price-consensus-chart | Stanley Black & Decker, Inc. Quote

Stanley Black & Decker’s has a PEG ratio of 2.65, compared with 3.46 for the industry. The company possesses a Growth Score of A.

Stanley Black & Decker, Inc. PEG Ratio (TTM)

Stanley Black & Decker, Inc. peg-ratio-ttm | Stanley Black & Decker, Inc. Quote

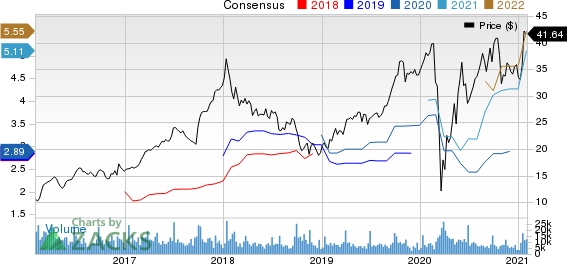

KB Home (KBH): This homebuilding company, which carries a Zacks Rank #1, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 19.7% over the last 60 days.

KB Home Price and Consensus

KB Home price-consensus-chart | KB Home Quote

KB Home’s has a PEG ratio of 0.39, compared with 0.81 for the industry. The company possesses a Growth Score of B.

KB Home PEG Ratio (TTM)

KB Home peg-ratio-ttm | KB Home Quote

See the full list of top ranked stocks here

Learn more about the Growth score and how it is calculated here.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Texas Instruments Incorporated (TXN) : Free Stock Analysis Report

Stanley Black & Decker, Inc. (SWK) : Free Stock Analysis Report

KB Home (KBH) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research