Top Ranked Income Stocks to Buy for January 11th

Here are four stocks with buy rank and strong income characteristics for investors to consider today, January 11th:

Flowers Foods, Inc. (FLO): This producer of bakery products has witnessed the Zacks Consensus Estimate for its current year earnings increasing 1.2% over the last 60 days.

Flowers Foods, Inc. Price and Consensus

Flowers Foods, Inc. price-consensus-chart | Flowers Foods, Inc. Quote

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 3.53%, compared with the industry average of 0.00%. Its five-year average dividend yield is 2.77%.

Flowers Foods, Inc. Dividend Yield (TTM)

Flowers Foods, Inc. dividend-yield-ttm | Flowers Foods, Inc. Quote

Macy's, Inc. (M): This stores operator has witnessed the Zacks Consensus Estimate for its current year earnings rising 6.8% over the last 60 days.

Macy's Inc Price and Consensus

Macy's Inc price-consensus-chart | Macy's Inc Quote

This Zacks Rank #2 (Buy) company has a dividend yield of 6.12%, compared with the industry average of 0.69%. Its five-year average dividend yield is 3.29%.

Macy's Inc Dividend Yield (TTM)

Macy's Inc dividend-yield-ttm | Macy's Inc Quote

BRT Apartments Corp. (BRT): This real estate investment trust has witnessed the Zacks Consensus Estimate for its current year earnings increasing 11.8% over the last 60 days.

BRT Realty Trust Price and Consensus

BRT Realty Trust price-consensus-chart | BRT Realty Trust Quote

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 5.50%, compared with the industry average of 4.04%. Its five-year average dividend yield is 0.44%.

BRT Realty Trust Dividend Yield (TTM)

BRT Realty Trust dividend-yield-ttm | BRT Realty Trust Quote

Tecnoglass Inc. (TGLS): This manufacturer of architectural glass has witnessed the Zacks Consensus Estimate for its current year earnings rising 4.9% over the last 60 days.

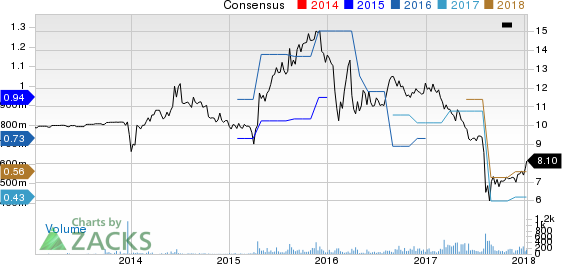

Tecnoglass Inc. Price and Consensus

Tecnoglass Inc. price-consensus-chart | Tecnoglass Inc. Quote

This Zacks Rank #2 (Buy) company has a dividend yield of 7.04%, compared with the industry average of 0.00%. Its five-year average dividend yield is 1.34%.

Tecnoglass Inc. Dividend Yield (TTM)

Tecnoglass Inc. dividend-yield-ttm | Tecnoglass Inc. Quote

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tecnoglass Inc. (TGLS) : Free Stock Analysis Report

Macy's Inc (M) : Free Stock Analysis Report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

BRT Realty Trust (BRT) : Free Stock Analysis Report

To read this article on Zacks.com click here.