Top Ranked Income Stocks to Buy for June 14th

Here are four stocks with buy rank and strong income characteristics for investors to consider today, June 14th:

Lakeland Bancorp, Inc. (LBAI): This bank holding company for Lakeland Bank has witnessed the Zacks Consensus Estimate for its current year earnings increasing 5.9% over the last 60 days.

Lakeland Bancorp, Inc. Price and Consensus

Lakeland Bancorp, Inc. price-consensus-chart | Lakeland Bancorp, Inc. Quote

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 3.2%, compared with the industry average of 1.9%. Its five-year average dividend yield is 2.6%.

Lakeland Bancorp, Inc. Dividend Yield (TTM)

Lakeland Bancorp, Inc. dividend-yield-ttm | Lakeland Bancorp, Inc. Quote

First American Financial Corporation (FAF): This financial services provider has witnessed the Zacks Consensus Estimate for its current year earnings increasing 2.4% over the last 60 days.

First American Financial Corporation Price and Consensus

First American Financial Corporation price-consensus-chart | First American Financial Corporation Quote

This Zacks Rank #2 (Buy) company has a dividend yield of 3.2%, compared with the industry average of 1.4%. Its five-year average dividend yield is 3%.

First American Financial Corporation Dividend Yield (TTM)

First American Financial Corporation dividend-yield-ttm | First American Financial Corporation Quote

MetLife, Inc. (MET): This life insurance company has witnessed the Zacks Consensus Estimate for its current year earnings increasing 2.4% over the last 60 days.

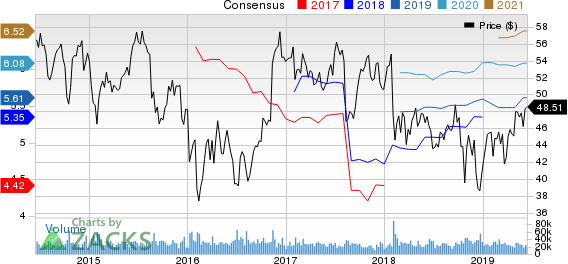

MetLife, Inc. Price and Consensus

MetLife, Inc. price-consensus-chart | MetLife, Inc. Quote

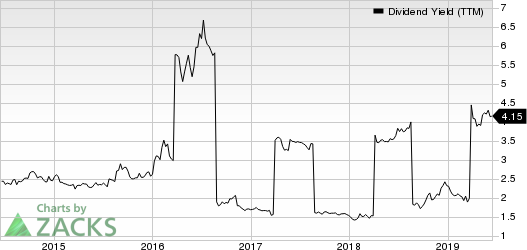

This Zacks Rank #2 company has a dividend yield of 3.6%, compared with the industry average of 2.4%. Its five-year average dividend yield is 3.2%.

MetLife, Inc. Dividend Yield (TTM)

MetLife, Inc. dividend-yield-ttm | MetLife, Inc. Quote

Prudential plc (PUK): This retail financial products and services provider has witnessed the Zacks Consensus Estimate for its current year earnings increasing 3.4% over the last 60 days.

Prudential Public Limited Company Price and Consensus

Prudential Public Limited Company price-consensus-chart | Prudential Public Limited Company Quote

This Zacks Rank #2 company has a dividend yield of 4.2%, compared with the industry average of 2.4%. Its five-year average dividend yield is 2.7%.

Prudential Public Limited Company Dividend Yield (TTM)

Prudential Public Limited Company dividend-yield-ttm | Prudential Public Limited Company Quote

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens.

Will you retire a millionaire?

One out of every six people retires a multimillionaire. Get smart tips you can do today to become one of them in a new Special Report, “7 Things You Can Do Now to Retire a Multimillionaire.”

Click to get it free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Prudential Public Limited Company (PUK) : Free Stock Analysis Report

MetLife, Inc. (MET) : Free Stock Analysis Report

Lakeland Bancorp, Inc. (LBAI) : Free Stock Analysis Report

First American Financial Corporation (FAF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research