How to Find Top-Ranked Stocks to Buy that are Generating Profits Efficiently

Wall Street has cooled down to start the final week of March. The selling has been mild and a bit more of a pullback might be welcome heading into the second quarter following the impressive Q1 rally.

The market could be overheated, especially in areas such as AI. Wall Street might now be waiting on the start of quarterly earnings season in a few weeks before it makes its next decisive move.

Despite the possibility of near-term selling or stagnation, the Fed gave Wall Street bulls most of the ammo they needed to continue leading the charge higher when it signaled that three rate cuts were still on the table in 2024.

Investors likely want to keep adding to their portfolios heading into the second quarter. Today we explore how to find Zacks Rank #1 (Strong Buy) stocks with proven track records of efficiently generating profits that investors might want to buy in April and beyond.

ROE

Return on Equity or ROE helps investors understand if a firm’s executives are creating assets with investors’ cash or burning it. ROE shows a company’s ability to turn assets into profits. Put another way, this vital metric measures the profits made for each dollar of shareholder equity.

ROE is calculated as net income / shareholder's equity. For example: if $0.10 of assets are created for each $1 of shareholder equity that would equal a ROE of 10%.

Overall, Return on Equity is a great item to use regardless of what type of investor you are since it provides insight into management’s ability to create value and keep costs under control. Plus, if ROE slips, it can alert us to potential problems.

With all that said, let’s take a look at this screen’s parameters and see the companies proving they can return value to shareholders instead of churning through their cash…

• Zacks Rank equal to 1

The Zacks Rank looks at upward earnings estimate revisions, among other metrics, in order to find companies that are projected to see their earnings get stronger. In fact, beginning with a Zacks Rank #1 can be a great starting point because it boasts an average annual return of over 25% per year during the last 30 years.

• Price greater than or equal to 5

Today we ruled out any stocks that are trading for less than $5 a share because they can be more volatile and speculative.

• Price/Sales Ratio less than or equal to 1

On top of that, we are looking for a low price to sales ratio. Today we went with 1 or below as this range is usually thought to provide better value since investors pay less for each unit of sales.

• % (Broker) Rating Strong Buy equal to 100 (%)

In this screen, we decided to go with companies that brokers are fully on board with since ratings are typically skewed strongly toward ‘buy’ and ‘strong buy.’

• ROE greater than or equal to 10

Lastly, but most importantly for today’s screen, we got rid of any companies with Return on Equity of less than 10 because the median ROE value for all of the stocks in the Zacks Universe is under 10.

Here is one of the four stocks that made it through today’s screen…

EZCORP (EZPW)

EZCORP (EZPW) is a leading provider of pawn loans in the U.S. and Latin America. The firm is focused on meeting the short-term cash needs of consumers who are both cash and credit constrained. EZCORP also sells merchandise, which is “primarily collateral forfeited from pawn lending operations and used merchandise purchased from customers.”

EZCORP is gaining momentum, with revenue up 19% in fiscal 2023 and 22% higher in FY22. EZCORP topped our Q1 fiscal 2024 EPS by 24% on estimate on January 31, marking its fourth straight double-digit bottom-line beat.

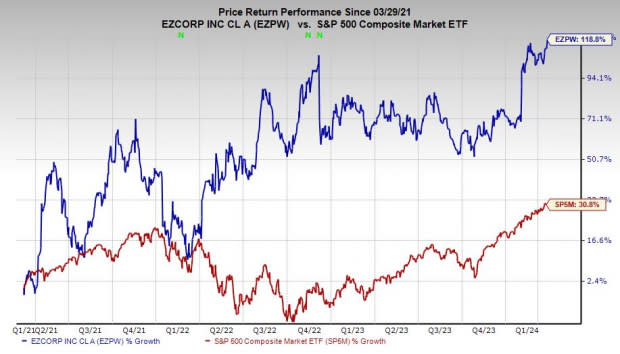

Image Source: Zacks Investment Research

EZCORP’s upbeat earnings guidance helps it land a Zacks Rank #1 (Strong Buy) right now. Zacks estimates call for its revenue to climb 11% in FY24 and 8% higher next year to help boost its adjusted earnings by 14% and 6%, respectively.

EZCORP shares have climbed by 120% in the last three years to blow away the S&P 500’s 30% and Finance sector’s 18%. EZCORP’s run includes a 27% YTD surge, boosted by its impressive beat-and-raise quarter.

Despite the climb, EZCORP trades 35% below its average Zacks price target at around $11 per share. The stock trades at a 36% discount to the Finance sector at 9.9X forward 12-month earnings.

Get the rest of the stocks on this list and start looking for the newest companies that fit these criteria. It's easy to do. And it could help you find your next big winner. Start screening for these companies today with a free trial to the Research Wizard. You can do it.

Click here to sign up for a free trial to the Research Wizard today.

Want more articles from this author? Scroll up to the top of this article and click the FOLLOW AUTHOR button to get an email each time a new article is published.

Disclosure: Officers, directors and/or employees of Zacks Investment Research may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material. An affiliated investment advisory firm may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material.

Disclosure: Performance information for Zacks’ portfolios and strategies are available at: www.zacks.com/performance_disclosure

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EZCORP, Inc. (EZPW) : Free Stock Analysis Report