Top Ranked Value Stocks to Buy for August 25th

Here are four stocks with buy rank and strong value characteristics for investors to consider today, August 25th:

Meritage Homes Corporation MTH: This designer and builder of single-family homes has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 28% over the last 60 days.

Meritage Homes Corporation Price and Consensus

Meritage Homes Corporation price-consensus-chart | Meritage Homes Corporation Quote

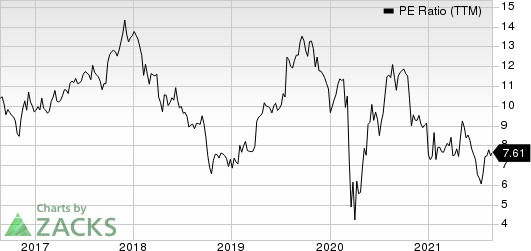

Meritage Homes has a price-to-earnings ratio (P/E) of 5.86, compared with 8.80 for the industry. The company possesses a Value Score of B.

Meritage Homes Corporation PE Ratio (TTM)

Meritage Homes Corporation pe-ratio-ttm | Meritage Homes Corporation Quote

Lincoln National Corporation LNC: This multiple insurance and retirement business operator has a Zacks Rank #1, and seen the Zacks Consensus Estimate for its current year earnings rising 12.8% over the last 60 days.

Lincoln National Corporation Price and Consensus

Lincoln National Corporation price-consensus-chart | Lincoln National Corporation Quote

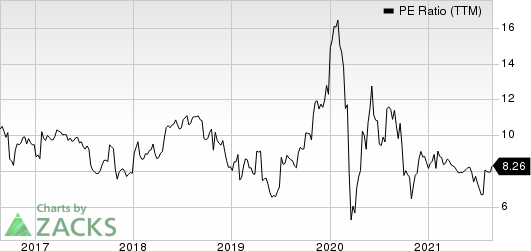

Lincoln National has a price-to-earnings ratio (P/E) of 6.68, compared with 11.20 for the industry. The company possesses a Value Score of B.

Lincoln National Corporation PE Ratio (TTM)

Lincoln National Corporation pe-ratio-ttm | Lincoln National Corporation Quote

Haverty Furniture Companies, Inc. HVT: This specialty retailer of residential furniture and accessories has a Zacks Rank #1, and seen the Zacks Consensus Estimate for its current year earnings rising 23.1% over the last 60 days.

Haverty Furniture Companies, Inc. Price and Consensus

Haverty Furniture Companies, Inc. price-consensus-chart | Haverty Furniture Companies, Inc. Quote

Haverty Furniture has a price-to-earnings ratio (P/E) of 7.24, compared with 22.20 for the industry. The company possesses a Value Score of A.

Haverty Furniture Companies, Inc. PE Ratio (TTM)

Haverty Furniture Companies, Inc. pe-ratio-ttm | Haverty Furniture Companies, Inc. Quote

Celestica Inc. CLS: This provider of hardware platform and supply chain solutions has a Zacks Rank #1, and seen the Zacks Consensus Estimate for its current year earnings rising 13.7% over the last 60 days.

Celestica, Inc. Price and Consensus

Celestica, Inc. price-consensus-chart | Celestica, Inc. Quote

Celestica has a price-to-earnings ratio (P/E) of 7.84, compared with 11.80 for the industry. The company possesses a Value Score of A.

Celestica, Inc. PE Ratio (TTM)

Celestica, Inc. pe-ratio-ttm | Celestica, Inc. Quote

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lincoln National Corporation (LNC) : Free Stock Analysis Report

Celestica, Inc. (CLS) : Free Stock Analysis Report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report

Haverty Furniture Companies, Inc. (HVT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research