Top-Rated Stocks to Watch as Earnings Approach

Glancing at tomorrow’s earnings calendar a number of top-rated stocks are set to release their quarterly reports.

Most eyes will be on the energy sector with big oil titans Chevron (CVX) and Exxon Mobil (XOM) rounding out this week’s earnings lineup. Notably, their stocks currently land a Zacks Rank #3 (Hold).

However, Friday’s lineup will feature a number of intriguing stocks from various industries with the Zacks consumer staples and broader Auto, Tires & Trucks sectors standing out.

Auto, Tires & Trucks

CNH Industrial (CNHI) and Gentex (GNTX) are appealing among the broader auto sector with both sporting a Zacks Rank #2 (Buy) ahead of their Q2 reports tomorrow. It's noteworthy that CNH Industrial’s Automotive-Foreign Industry is in the top 7% of over 250 Zacks industries.

CNH Industrial: CNH Industrial should benefit from its strong business environment as one of the leading equipment and services companies for agricultural and construction equipment including two-wheel and four-wheel tractors.

Second-quarter earnings are expected to rise 11% year over year at $0.48 per share with sales forecasted to rise 11% as well to $6.78 billion. At the moment CNHI shares are very attractive for their price-to-earnings valuation and have an “A” Zacks Style Scores grade for Value.

Image Source: Zacks Investment Research

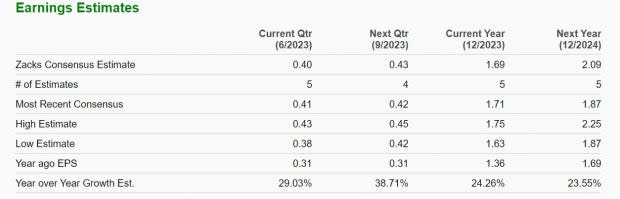

Gentex: Expecting strong quarterly growth Gentex has carved out a niche as a supplier of automatic dimming, rear-view mirrors, and electronics to the automotive industry.

It's noteworthy that Gentex stock has an “A” Zacks Style Scores grade for Growth and an overall “A” VGM Style Scores grade for the combination of Value, Growth, and Momentum. Second quarter earnings are projected to climb 29% YoY at $0.40 per share compared to EPS of $0.31 in Q2 2022. Sales for Q2 are projected to be up 16% to $539.04 million.

Image Source: Zacks Investment Research

Consumer Staples

Among the consumer staples sector, the Zacks Soap and Cleaning Materials Industry is standing out and is currently in the top 14% of Zacks industries. Among the space Colgate-Palmolive (CL) and Church & Dwight Co (CHD) have a Zacks Rank #2 (Buy) ahead of their Q2 reports.

Church & Dwight: Being a mainstay for many years as a provider of household, personal care, and specialty products usually makes Church & Dwight stock worthy of investors' consideration at some point. Notably, an earnings beat would be Church & Dwight’s 10th consecutive quarter of surpassing bottom-line expectations.

Now looks like a good time to buy with Q2 earnings expected to rise 4% YoY at $0.79 per share and sales anticipated at $1.42 billion, up 7%. Church & Dwight was founded in 1846 and despite the company's maturity it intriguingly has a “B” Style Scores grade for Growth.

Image Source: Zacks Investment Research

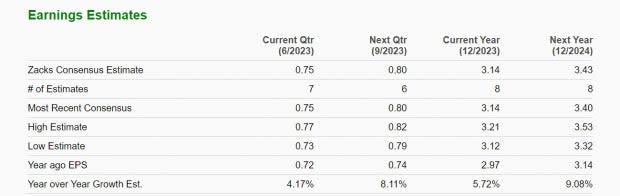

Colgate-Palmolive: Of course, Colgate is another popular name among consumer goods with its iconic toothpaste brand and home care products. The outlook for Colgate is strengthening with an “A” Style Scores grade for Growth.

To that point, Colgate’s Q2 EPS is expected at $0.75 per share up 4% from a year ago with sales also forecasted to be up 4% to $4.67 billion.

Image Source: Zacks Investment Research

Bottom Line

Investors should pay attention to other sectors outside of energy on Friday as there appears to be opportunity in these consumer staples and auto sector stocks. With solid quarterly growth expected these companies are shaping up to be viable investments as we progress through 2023.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Colgate-Palmolive Company (CL) : Free Stock Analysis Report

Church & Dwight Co., Inc. (CHD) : Free Stock Analysis Report

Gentex Corporation (GNTX) : Free Stock Analysis Report

CNH Industrial N.V. (CNHI) : Free Stock Analysis Report

Chevron Corporation (CVX) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report