Top-Rated Tech Stocks to Buy After Earnings

There are quite a few tech stocks that helped reconfirm investors' high sentiment toward the broader technology sector after posting impressive quarterly results.

To be more concise, let’s break these top-rated tech stocks down by their Zacks Industry and take a look at why now is an ideal time to buy.

Internet-Software and Services

There are over 250 Zacks industries and the Internet-Software and Services Industry is currently in the top 23 percentile indicating companies in the space should benefit from a strengthening business environment.

One standout is NetEase NTES a Chinese internet technology company that develops apps, and online gaming services that include multi-player options and licensed titles.

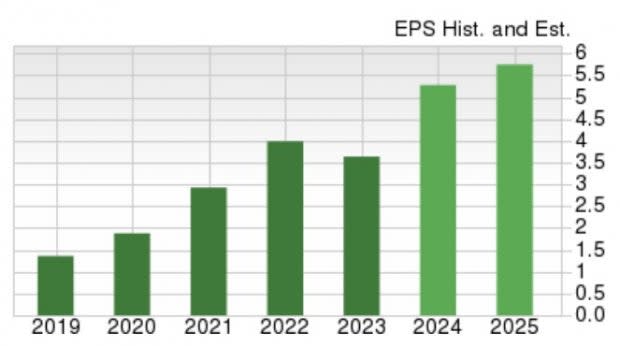

NetEase easily surpassed its second-quarter earnings expectations last Thursday with EPS at $1.91 compared to estimates of $1.33 a share. Crushing Q2 bottom-line estimates by 43%, NetEase stock currently boasts a Zacks Rank #1 (Strong Buy) with annual earnings now forecasted to climb 30% this year to $6.54 per share and jump another 9% in FY24.

Image Source: Zacks Investment Research

Internet-Software

The Zacks Internet-Software Industry is in the top 36% of all Zacks industires with Workday WDAY and Domo Inc’s DOMO stock very appealing after beating Q2 top and bottom line expectations last week.

Workday may be a familiar name as a provider of enterprise-level software solutions for financial management and human resource domains. Sporting a Zacks Rank #1 (Strong Buy), Workday's Q2 EPS of $1.43 beat estimates by 14% with sales of $1.78 billion topping expectations by roughly 1%.

Intriguingly, Workday’s bottom line is forecasted to expand 47% in its current fiscal 2024 to $5.34 per share versus EPS of $3.64 last year. Plus, FY25 earnings are projected to pop another 18%.

Image Source: Zacks Investment Research

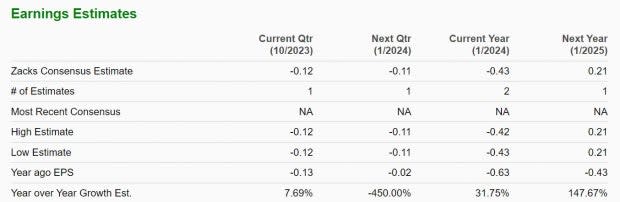

As for Domo, the company offers a cloud-based executive management platform and is steadily expanding and approaching profitability.

Domo’s stock sports a Zacks Rank #2 (Buy) with a Q2 adjusted loss of -$0.02 per share surpassing EPS estimates of -0.08. Notably, this soared from an adjusted loss of -$0.26 a share in the prior-year quarter. Sales of $79.67 million topped Q2 estimates by 1% and rose 5% YoY.

A loss of -$0.43 a share is now expected in Domo’s current FY24 but earnings are expected to leap into the black at $0.21 per share in FY25. With shares of DOMO trading at $10, the risk to reward is still favorable considering the company’s growth potential.

Image Source: Zacks Investment Research

Computer-Software

Among the top 40% of Zacks industries, Salesforce CRM is attractive in the Computer-Software Industry. Salesforce more recently beat its top and bottom line expectations on Wednesday with CRM shares popping +3% today.

The leading provider of on-demand customer relationship management software topped the Zacks EPS Consensus by 11% with Q2 earnings at $2.12 per share. Second-quarter sales of $8.6 billion came in 1% above expectations. Furthermore, Salesforce's streak of beating earnings expectations is now at 26 consecutive quarters.

Annual earnings are anticipated to soar 42% in Salesforce’s current FY24 to $7.44 per share compared to EPS of $5.24 last year. Even better, FY25 earnings are forecasted to leap another 21%.

Image Source: Zacks Investment Research

Bottom Line

The bottom line expansion of these tech companies is very attractive right now and they give investors plenty of options for growth in the portfolio. After impressively surpassing quarterly EPS expectations, earnings estimates should go up making now a good time to buy these top-rated tech stocks.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

NetEase, Inc. (NTES) : Free Stock Analysis Report

Workday, Inc. (WDAY) : Free Stock Analysis Report

Domo, Inc. (DOMO) : Free Stock Analysis Report