Top Stocks to Buy for a Rebound Among Chinese Equities

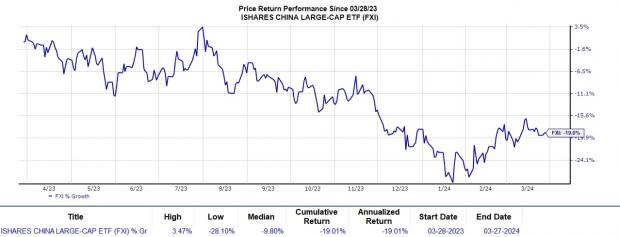

While the iShares China Large-Cap ETF FXI has fallen -19% over the last year, several Chinese ADRs (American Depository Receipts) look poised for a sharp rebound.

To that point, many Chinese stocks are starting to look oversold due to concerns of slower economic growth in China. Still, there are internet-commerce leaders in China that have been able to sustain their attractive growth trajectories among other companies benefiting from strong business industries.

More enticing is that their stocks are now trading at more reasonable valuations while offering exposure to the massive number of consumers in China. Furthermore, China is still considered the second-largest economy in the world by nominal GDP and the largest based on purchasing power.

Surely, investors may be eyeing opportunities among Chinese equities and here are a few top-rated stocks to choose from.

Image Source: Zacks Investment Research

Internet-Commerce Leaders

Notably, the Zacks Internet-Commerce Industry is in the top 26% of over 250 Zacks industries and among the space JD.com JD and PDD Holdings PDD both sport a Zacks Rank #1 (Strong Buy).

Like Amazon AMZN in the United States, Alibaba BABA is known as the premier e-commerce giant in China but the top and bottom line expansion of JD.com and PDD Holdings indicates they are taking market share and worth keeping in the portfolio at their current levels.

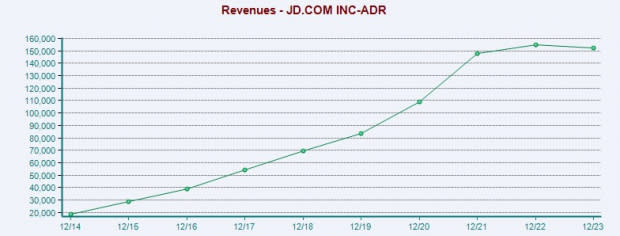

Offering a full-scale of authentic consumer products, JD.com’s total sales are projected to rise 5% in both fiscal 2024 and FY25 with projections now over $160 billion. More importantly, JD.com’s annual earnings are expected to slightly increase this year and jump 12% in FY25 to $3.53 per share.

Image Source: Zacks Investment Research

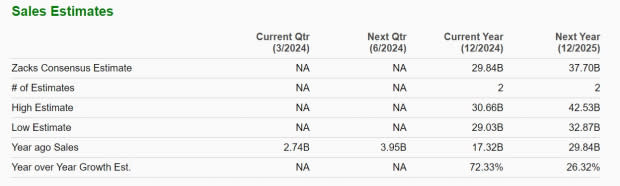

Turning to PDD Holdings, its Pinduoduo platform allows users to participate in group buying deals for consumer goods and is seeing experiential growth. Fiscal 2024 sales are forecasted to climb 50% to $51.89 billion versus $34.64 billion in 2023. More compelling, FY25 sales are projected to leap another 35% to $70.2 billion with PDD Holdings’ EPS expected to expand 29% this year and soar another 26% next year to $10.66 per share. Even better, over the last 30 days, EPS estimates have soared 18% for FY24 and 19% for FY25.

Image Source: Zacks Investment Research

Furthermore, JD and PDD are still 39% and 24% below their 52-week highs respectively but trade at P/E multiples well under 20X which are pleasant discounts to the industry average of 27.4X and the S&P 500’s 22.1X.

Image Source: Zacks Investment Research

Li Auto LI

Along with electrified vehicles, the push for autonomous driving features is at the center of the auto evolution and Li Auto has a commanding presence in China’s smart energy vehicle market.

Sporting a Zacks Rank #2 (Buy), it's noteworthy that Li Auto’s Automotive-Foreign Industry is in the top 36% of all Zacks industries. Li Auto’s stock is still up +21% over the last year but has dipped -19% year to date and the drop is starting to look like a buying opportunity.

Correlating with the notion that corrections can be healthy regarding long-term performance, LI now trades at a more reasonable 15.7X forward earnings multiple with EPS anticipated to soar 22% in FY24 and skyrocket another 54% in FY25 to $3.05 per share. Furthermore, Li Auto’s increased profitability is accompanied by high double-digit percentage growth estimates on its top line as well.

Image Source: Zacks Investment Research

iQIYI IQ

Rounding out the list is Iqiyi which also sports a Zacks Rank #2 (Buy) and has previously been referred to as the Netflix NFLX of China. While the Netflix comparison has been too lofty, the risk to reward has become more appealing to invest in Iqiyi‘s stock with its Zacks Film and Television Production and Distribution Industry in the top 16 percentile.

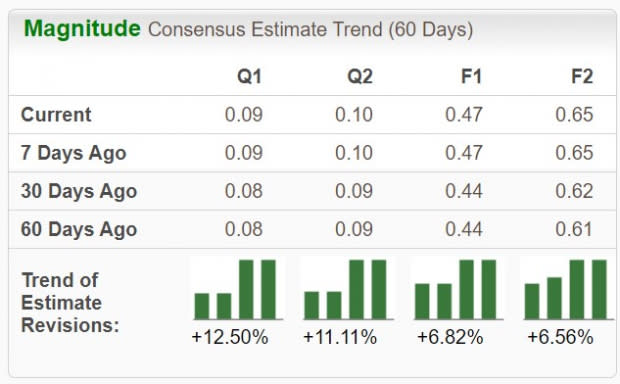

Crossing the profitability line last year, Iqiyi’s stock trades at just $4 and 8.7X forward earnings. Reassuringly, annual earnings are projected to pop 14% in FY24 and jump another 38% in FY25 to $0.65 a share. Iqiyi’s top line growth has been steady as well with sales forecasted to be up 7% this year and expected to rise another 5% in FY25 to $4.91 billion. Plus, earnings estimate revisions are modestly higher over the last 60 days for both FY24 and FY25.

Image Source: Zacks Investment Research

Bottom Line

Given their attractive outlooks, these Chinese stocks looked poised for a sharp rebound and more importantly, they are shaping up to be viable investments for 2024 and beyond. Now may be a good time to start building positions as market sentiment is bound to be higher for Chinese equities at some point especially if China can put fears of its slowing economy behind it.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JD.com, Inc. (JD) : Free Stock Analysis Report

iQIYI, Inc. Sponsored ADR (IQ) : Free Stock Analysis Report

PDD Holdings Inc. (PDD) : Free Stock Analysis Report

Li Auto Inc. Sponsored ADR (LI) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

iShares China Large-Cap ETF (FXI): ETF Research Reports

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report