Top Transport Dividend Picks For The Day

Transport and automobile names generally suffer from deep cyclicality which can affect companies operating in areas ranging from airfreight and logistics to infrastructure. Hence, considering economic volatility crucial when thinking about these companies’ profitability. Cash flow availability also drives dividend payout, so in times of growth, these transport companies could provide hefty dividend income for your portfolio. Today I will share with you my list of high-dividend transport and automobile stocks you should consider for your portfolio.

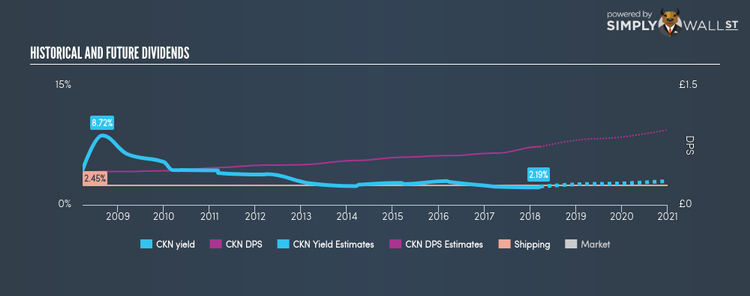

Clarkson PLC (LSE:CKN)

CKN has a sizeable dividend yield of 2.31% and the company has a payout ratio of 69.98% . The company’s dividends per share have risen from UK£0.40 to UK£0.73 over the last 10 years. During this period, the company has not missed a dividend payment – as you would expect from a company increasing their dividend. Clarkson’s future earnings growth looks strong, with analysts expecting 53.34% EPS growth in the next three years. Interested in Clarkson? Find out more here.

Royal Mail plc (LSE:RMG)

RMG has a large dividend yield of 4.38% and is currently distributing 64.68% of profits to shareholders . RMG’s dividend alone will put you better off than your bank interest, but the company’s yield isn’t only higher than the low risk savings rate. It’s also amongst the market’s top dividend payers. Interested in Royal Mail? Find out more here.

International Consolidated Airlines Group, S.A. (LSE:IAG)

IAG has a enticing dividend yield of 4.11% and has a payout ratio of 28.18% , and analysts are expecting the payout ratio in three years to hit 28.24%. Besides capital gain prospects, just the yield is higher than the low risk savings rate – enticing for investors with goals of beating their bank accounts. Plus, a 4.11% yield places it amidst the market’s top dividend payers. Dig deeper into International Consolidated Airlines Group here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.