Top Undervalued Companies Owned by Activist Investors, Part 2

In a previous article, I discussed Jeff Ubben (Trades, Portfolio)'s investment in Alliance Data Systems Corp. (NYSE:ADS) and Daniel Loeb (Trades, Portfolio)'s investment in Centene Corp. (NYSE:CNC). Due to factors such as the loosening of monetary policy in a strengthening economy and a federal court ruling, respectively, those two holdings of activist investors became undervalued according to measures such as the discounted cash flow model and the Peter Lynch fair value.

Activist investors typically take large stakes in underperforming stocks that have high potential to show improvement in their stock prices due to upcoming events. Many activist investors, such as Bill Ackman (Trades, Portfolio), take large enough stakes in companies to influence their decisions by making phone calls or even becoming part of the board of directors.

As there is overlap between activist investing and value investing, the following stocks owned by activist investors may be worth keeping an eye on since they have qualities that make them attractive from a value investing standpoint.

David Einhorn and The Chemours Co.

David Einhorn (Trades, Portfolio) is the founder and president of Greenlight Capital, an activist hedge fund that that he describes as "long-short value-oriented." His most famous successful short was Lehman Brothers, which he made before its collapse in the 2008 financial crisis. Although more growth-oriented investors blame Einhorn's value-oriented stance as having contributed to his firm's underperformance in 2018-19, that same value approach is what propelled Greenlight to profitability and fame during the dotcom era and the financial crisis. Greenlight Capital's equity portfolio was valued at $1.39 billion as of Dec. 16 and consisted of holdings in 19 stocks.

According to factors such as the Peter Lynch fair value, median price-sales ratio and rate of return, Greenlight's most undervalued holding is The Chemours Co. (NYSE:CC). After making a tidy profit off the DuPont spinoff in its early days, Einhorn established a new holding in the company in the fourth quarter of 2018 and has increased his stake to 6,483,341 shares as its price has decreased, making up 3.8% of total shares outstanding.

Chemours is the result of the 2015 spinoff of the performance chemicals sector of DuPont de Nemours Inc. (NYSE:DD). The company focuses on environmentally responsible chemistry with products such as pigments, refrigerants and solvents.

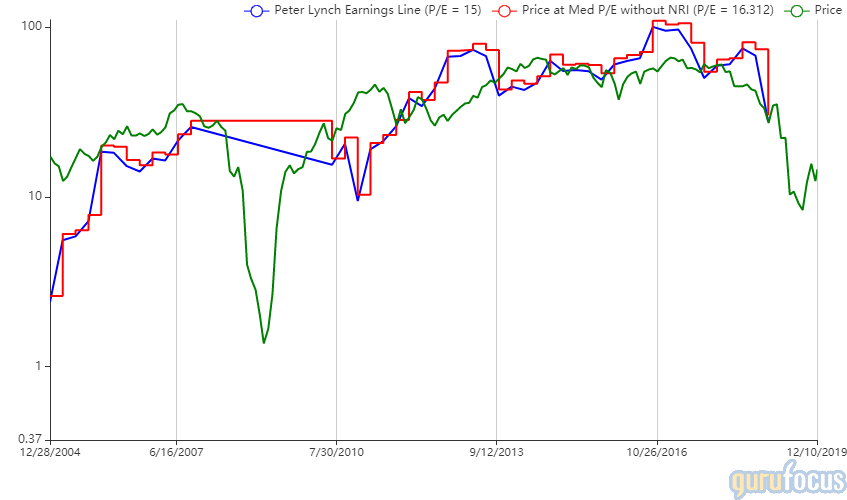

As of Dec. 16, shares of Chemours are trading at around $17.90, which is less than half of the Peter Lynch fair value of $48.92. According to the Peter Lynch chart below, the company has been trading lower than its earnings since 2017.

The reason for Chemours' undervaluation is primarily related to Teflon. When DuPont spun off Chemours, it sent a good chunk of its legal liabilities and $4 billion worth of debt with it. One of those legal liabilities was Teflon, the non-stick cookware coating that was produced using the chemical PFOA. After researchers discovered that PFOA increases the risk of cancer in those who consume even a trace amount of it, the large-scale class-action lawsuits were inevitable; not even a chemicals giant like DuPont could avoid legal action.

In February 2017, Chemours settled the first round of Teflon production lawsuits, which included 3,550 personal injury claims from cancer cases linked to PFOA-contaminated drinking water from the Teflon plant in Parkersburg, West Virginia. The company split the $671 million cash settlement with DuPont.

More recently, Chemours has suffered from revenue and net income loss, which it contributes largely to illegal imports of competing products. President and CEO Mark Newman said the following in the company's third-quarter 2019 earnings call:

"Headwinds from illegal imports continue to weigh on results in fluoroproducts. We are accelerating our corrective actions from a regulatory environmental trade and public-awareness perspective. While there have been a number of high-profile seizures of illegal refrigerants in 2019 we have not yet reached a tipping point where we believe illegal activity is fully under control."

While the biggest headwind in terms of revenue is illegal imports, the biggest headwind in terms of share price is still legal liabilities. In 2018, a nationwide class-action lawsuit was filed in the U.S. against 3M (MMM), DuPont and Chemours due to their production of cancer-causing PFAS chemicals, while 2019 has seen Chemours both being sued over the environmental effects of its chemicals and counter-suing DuPont.

In short, the chemicals sector continues to face legal action for chemicals created and sold for profit before their effects on humans and the environment have been fully researched. Einhorn's position in Chemours is a bet that the market is overestimating the company's legal liabilities, just like in did in the past. Mr. Market expected the Teflon lawsuits to ruin the company, but instead, Chemours took no significant hit to its profitability or operations. The future resolutions of lawsuits will likely see increases in Chemours' share price.

Carl Icahn and Tenneco Inc.

Carl Icahn (Trades, Portfolio) is a successful businessman and investor who is the founder of and largest shareholder in Icahn Capital Management. His activist investing strategy focuses on taking significant positions in companies that are facing negative investor sentiment, aiming to capitalize on the sensationalism of markets. As of Dec. 16, Icahn Capital Management's equity portfolio consisted of positions in 18 stocks valued at a total of $25.69 billion.

Icahn's most undervalued holding is Tenneco Inc. (NYSE:TEN), according to the Peter Lynch chart and median price-sales ratio. Icahn first established a position of 5,651,177 shares of the company in the fourth quarter of 2018, making it the largest institutional shareholder at 6.98% of shares outstanding, and has held the shares since then, even as the price has dropped from around $33.20 to around $13.85.

Tenneco designs, manufactures and sells various ride performance and clean air products in the aftermarket autos industry. In October 2018, Tenneco completed its acquisition of powertrain company Federal Mogul, which it bought from Carl Icahn (Trades, Portfolio) himself for $3.7 billion in cash and the assumption of $3 billion in debt.

As you can see in the chart below, Tenneco's stock price plummeted further after the acquisition was completed, creating the unusual sight of revenue and share price moving in the opposite direction. The negative sentiment comes from a variety of factors, including Tenneco's earnings missing analyst expectations several quarters in a row. This has been compounded by an overall slowdown in the automobile industry and the fact that the merger was made with the intent to split the company again soon, causing investors to question the necessity of Tenneco taking debt in the first place.

The new debt dropped Tenneco's cash-debt ratio to 0.07 and upped its debt-equity ratio to 3.37. With an Altman Z-Score of 1.46, debt is undeniably a large driver of negative investor sentiment for the company, driving its valuation down more than 70% over the past 12 months and making the company undervalued according to the Peter Lynch chart.

Tenneco plans to split into two separate companies, aftermarket and engine performance (powertrain), after realigning and streamlining their resources. However, the split has had to be postponed to 2020 as Tenneco struggles with debt and reduced sales income. A merger-split company engineering project such as this typically requires precise timing, and Tenneco has been left with the metaphorical hot potato after missing the tail end of the last automobile boom.

The rush of negative investor sentiment in this case has factored in hypothetical recession and bankruptcy. As long as Tenneco can stave off bankruptcy, there is little doubt that its share prices will recover significantly from the September low of $8.18 and even more once the split happens.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful analysis or consult registered investment advisors before taking action in the stock market.

Read more here:

Top Undervalued Companies Owned by Activist Investors, Part 1

Bruce Berkowitz's 3rd-Quarter Update

Al Gore Buys 2 Stocks, Cuts Nvidia in 3rd Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.