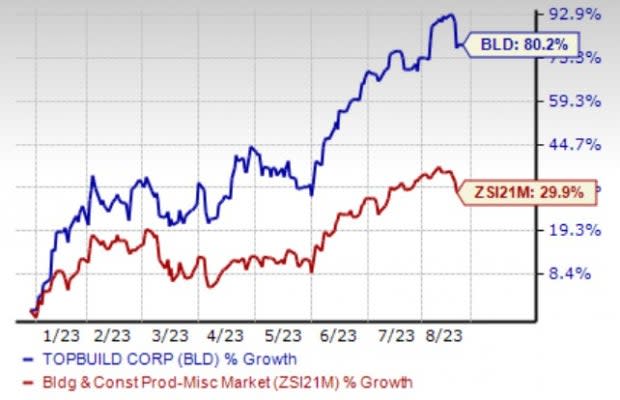

TopBuild (BLD) Rallies 80% Year to Date: More Room to Run?

TopBuild Corp. BLD stock jumped 80.2% in the year-to-date period, strongly outperforming the Zacks Building Products - Miscellaneous industry’s rise of 29.9%.

This Florida-based installer and distributor of insulation and other building products has been benefiting from robust installation business and strategic acquisitions. Also, enhancements in operational efficiencies, fixed cost leverage and inflation mitigation initiatives are heling it to boost margins.

Earnings estimates for 2023 have moved north to $17.90 per share from $16.46 per share in the past 30 days. This reflects 4.6% year-over-year growth on 3.4% rise in net sales and depicts analysts' optimism over the company’s growth potential.

It also has a long-term earnings growth rate of 6.2% and currently holds a VGM Score of A, supported by Value and Growth score of B and Momentum Score of A.

Image Source: Zacks Investment Research

Let’s discuss the factors substantiating its Zacks Rank #1 (Strong Buy).

Strong Q2 Performance: TopBuild continues to report solid earnings and revenue growth over the last few quarters. The company reported impressive second-quarter 2023 results, with earnings and revenues beating the Zacks Consensus Estimate. The company’s sales increased 3.4%, adjusted earnings per share grew 18.5% and adjusted operating margin and adjusted EBITDA margin expanded 190 bps each from the prior-year period’s levels. The impressive performance was backed by a favorable mix of installation business and strong commercial performance.

Strength in Installation Business: Despite a slight decline in single-family work, BLD managed to outperform the single-family market. During the quarter, the company's commercial revenue increased 22.6% year over year. The upside was backed by its new Lead App, which remained robust in identifying commercial opportunities. The company also showcased its operational efficiency by successfully executing these multifamily and commercial projects.

On the heavy commercial front, the company continues driving improvements, resulting in an improved win rate for various projects nationwide. BLD's installation segment is actively engaged in diverse projects, including the Nashville International Airport, UCI Medical Center in Irvine, California, and the revitalization of Two Penn Plaza in New York. Going forward, BLD's commercial backlog remains strong, with bids secured for projects extending into late 2024 and early 2025.

Strategic Acquisitions: Acquisitions remains BLD's primary focus for capital allocation and growth strategy. So far in 2023, BLD acquired three residential insulation businesses. The acquisitions include SRI Holdings, which strengthens its presence across Georgia, Michigan, Ohio, Florida, Alabama, and South Carolina; Best Insulation, expanding into high-growth areas in the Southeast and Southwest such as Florida, Texas and Arizona; and Colorado-based, Rocky Mountain Spray Foam. For 2023, the company expects these acquisitions to contribute approximately $170 million in revenues.

Furthermore, the company is set to acquire SPI, which will bring together two specialized distributors in mechanical insulation. The acquisition will enable BLD to reduce the cyclicality of its business, by increasing the recurring revenues from maintenance and repairs work. The company expects to achieve run rate cost synergies between $35 million to $40 million through this acquisition, by the end of the second year after the close.

Other Key Picks

Some better-ranked stocks from the Zacks Construction sector are:

Summit Materials, Inc. SUM sports a Zacks Rank #1. SUM has a trailing four-quarter earnings surprise of 13.1%, on average. Shares of SUM have gained 22.2% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for SUM’s 2023 sales and earnings per share (EPS) indicates rises of 7.1% and 23.6%, respectively, from the year-ago period’s levels.

EMCOR Group, Inc. EME flaunts a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 17.2%, on average. Shares of EME have risen 78.6% in the past year.

The Zacks Consensus Estimate for EME’s 2023 sales and EPS suggests growth of 11.5% and 35.9%, respectively, from the year-ago period’s levels.

AECOM ACM flaunts a Zacks Rank #2 (Buy). It has a trailing four-quarter earnings surprise of 3.6%, on average. Shares of ACM have surged 16.1% in the past year.

The Zacks Consensus Estimate for ACM’s 2023 sales and EPS indicates gains of 6.3% and 6.9%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AECOM (ACM) : Free Stock Analysis Report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

TopBuild Corp. (BLD) : Free Stock Analysis Report

Summit Materials, Inc. (SUM) : Free Stock Analysis Report