TopBuild Corp (BLD) Reports Steady Growth Amidst Market Challenges

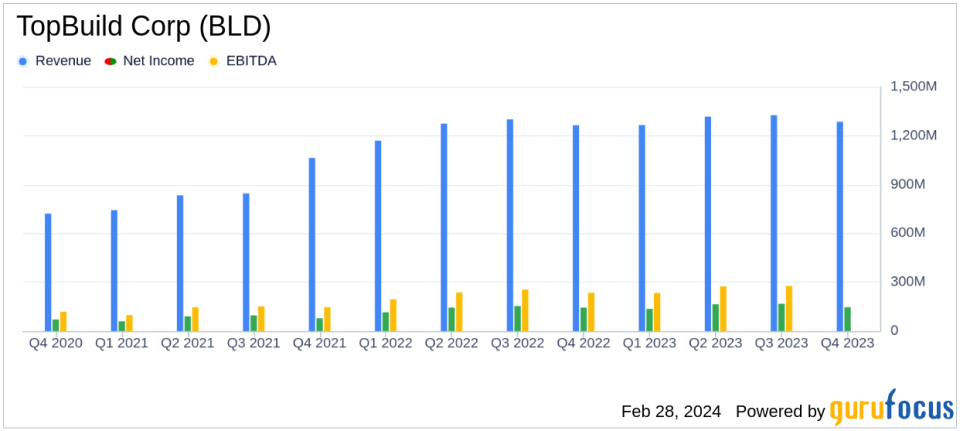

Revenue Growth: TopBuild Corp (NYSE:BLD) reported a 3.7% increase in annual sales, reaching $5.19 billion.

Net Income Rise: Net income saw a 10.5% year-over-year increase, with a notable 12.8% rise in diluted earnings per share.

Margin Expansion: Gross margin expanded by 120 basis points to 30.9%, reflecting operational efficiencies.

Acquisitions: The company acquired four residential insulation installation companies, expected to contribute over $172 million in annual revenue.

2024 Outlook: TopBuild provides sales and adjusted EBITDA guidance, excluding potential future acquisitions or divestitures.

On February 28, 2024, TopBuild Corp (NYSE:BLD) released its 8-K filing, detailing its financial results for the fourth quarter and full year of 2023. The company, a leading installer and specialty distributor of insulation and related building material products, demonstrated resilience and strategic growth despite market challenges.

Company Overview

TopBuild Corp operates through two main segments: Installation, which provides insulation installation services nationwide, and Specialty Distribution, which distributes building and mechanical insulation, insulation accessories, and other building product materials. The Installation segment is the primary revenue generator, serving contractors across residential, commercial, and industrial markets in the United States.

Financial Performance and Challenges

The company's performance in 2023 reflects continuous improvement and profitable growth, particularly in the commercial and industrial end markets, which saw a 4.9% growth in the fourth quarter and 6.2% for the full year. President and CEO Robert Buck expressed satisfaction with the company's ability to drive operational efficiencies and improve sales and labor productivity, which contributed to solid revenue growth and margin expansion.

"2023 was another year of consistent performance and solid execution for TopBuild, demonstrating the strength of our unique operating model and our ability to adapt to changing environments." - Robert Buck, President & CEO, TopBuild

Despite these achievements, the company faced challenges such as volume declines in the Installation segment by 3.0% in the fourth quarter. However, this was offset by price increases and mergers and acquisitions activity, leading to a total change of 3.8% in the segment for the quarter.

Financial Achievements and Industry Significance

TopBuild's financial achievements are particularly important in the construction industry, which often faces cyclical challenges and cost pressures. The company's ability to expand its gross margin by 120 basis points to 30.9% is a testament to its operational efficiency and pricing strategy. Furthermore, the 10.2% increase in operating profit and the 100 basis points improvement in operating margin underscore the company's effective cost management and growth strategy.

Key Financial Metrics

TopBuild's financial metrics for the year-end 2023 are indicative of its strong position in the market:

Sales increased by 3.7% to $5.19 billion.

Gross margin improved by 120 basis points to 30.9%.

Operating profit rose by 10.2% to $878.8 million.

Net income grew by 10.5% to $614.3 million.

Diluted earnings per share increased by 12.8% to $19.33.

Adjusted EBITDA increased by 11.5% to $1.05 billion.

These metrics are crucial for TopBuild as they reflect the company's profitability, efficiency, and overall financial health. The increase in net income and earnings per share is particularly important for investors as it indicates the company's ability to generate profit and return value to shareholders.

Analysis and Future Outlook

TopBuild's strategic acquisitions have bolstered its market position, with the four companies acquired in 2023 expected to generate over $172 million in annual revenue. Looking ahead to 2024, the company has already made moves to acquire additional businesses, which are projected to bring in approximately $33 million of annual revenue.

The company's guidance for 2024, which includes sales and adjusted EBITDA projections, reflects management's confidence in the company's market strategy and operational model. However, these targets do not account for any potential acquisitions or divestitures that may occur after the date of the press release.

TopBuild's solid financial results and strategic growth initiatives position it well for continued success in the construction industry. Value investors and potential GuruFocus.com members may find the company's consistent performance and proactive approach to market opportunities appealing for long-term investment considerations.

For more detailed information and to access the full earnings report, please visit TopBuild's website or refer to the official 8-K filing.

Explore the complete 8-K earnings release (here) from TopBuild Corp for further details.

This article first appeared on GuruFocus.