Topgolf Callaway Brands Corp (MODG) Reports Revenue Growth and Positive Free Cash Flow in ...

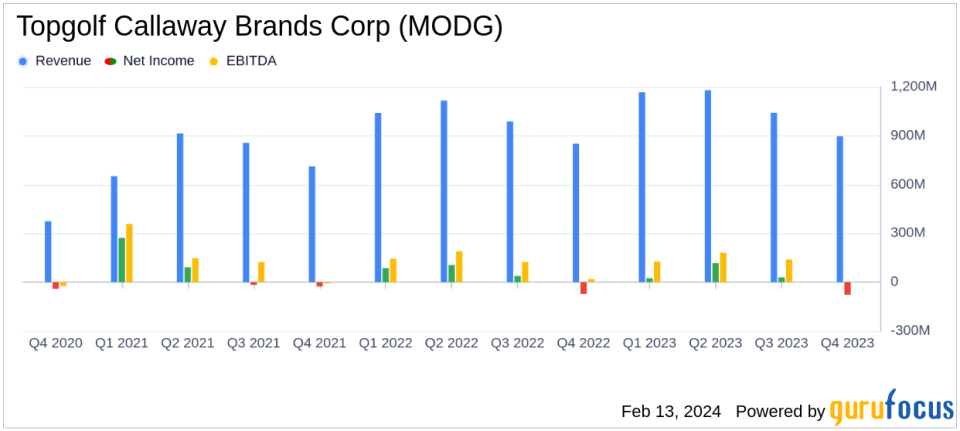

Consolidated Revenue: Increased by 7% year-over-year to $4,284.8 million.

Net Income: Decreased by 39.8% to $95.0 million compared to the previous year.

Adjusted EBITDA: Grew by 6.9% to $596.6 million for the full year.

Free Cash Flow: Reported at $160 million, with Embedded Cash Flow at $221 million.

Topgolf Segment: Delivered 1% Same Venue Sales growth and opened 11 new venues.

Active Lifestyle Segment: Achieved over 9% revenue growth, with TravisMathew brand experiencing double-digit growth.

Golf Equipment Segment: Maintained strong U.S. market share, with Paradym as the #1 model in Drivers and Fairway Woods.

On February 13, 2024, Topgolf Callaway Brands Corp (NYSE:MODG) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its modern golf and active lifestyle offerings, including premium golf equipment and apparel brands such as Odyssey, OGIO, TravisMathew, and Jack Wolfskin, reported a consolidated full-year revenue growth of 7%. The majority of the company's revenue is generated in the United States, with additional segments in Europe, Japan, and the Rest of the World.

Fiscal Summary and Performance Insights

Topgolf Callaway Brands Corp's performance in 2023 reflects a resilient travel and leisure industry, with the company achieving significant milestones. The consolidated revenue growth is a testament to the company's diverse portfolio and its ability to appeal to a broad consumer base. The 1% Same Venue Sales growth in the Topgolf business and the positive Free Cash Flow are particularly noteworthy, indicating operational efficiency and a strong consumer response to the company's entertainment experiences.

The Golf Equipment segment's sustained market share leadership in the U.S., especially with the success of the Paradym model, underscores the company's innovation and brand strength in a competitive market. Meanwhile, the Active Lifestyle segment's 9% revenue growth, led by the TravisMathew brand, highlights the increasing consumer demand for golf and active lifestyle apparel.

Challenges and Financial Achievements

Despite the positive outcomes, Topgolf Callaway Brands Corp faced challenges, including a potentially softer consumer environment and foreign currency headwinds estimated at approximately $20 million in pre-tax income. The company's ability to navigate these challenges while still projecting growth in revenue, Adjusted EBITDA, and Embedded Cash Flow for 2024 speaks to the robustness of its business model and the strength of its operating segments.

The financial achievements of Topgolf Callaway Brands Corp, particularly in generating positive Free Cash Flow and reducing inventory levels significantly, are crucial for maintaining liquidity and investing in future growth. The company's proactive management of its balance sheet and cash flows positions it well to capitalize on market opportunities and to continue delivering value to its stakeholders.

Key Financial Metrics and Outlook

Topgolf Callaway Brands Corp's financial health can be further assessed through key metrics such as net revenues, which grew to $897.1 million in Q4 2023, a 5.4% increase compared to the same period in the previous year. The company's net income, however, saw a decrease to $95.0 million for the full year, a 39.8% drop from the previous year. Adjusted EBITDA showed a healthy increase of 6.9% to $596.6 million for the full year, indicating strong underlying operational performance.

Looking ahead to 2024, the company expects to continue its growth trajectory, with projected full-year consolidated net revenues between $4,515 million and $4,555 million, and Adjusted EBITDA between $620 million and $640 million. This outlook reflects the company's confidence in its business strategy and the ongoing demand for its products and services within the modern golf ecosystem.

In conclusion, Topgolf Callaway Brands Corp's 2023 financial results demonstrate a solid performance amidst a challenging environment. The company's strategic focus on innovation, brand strength, and operational efficiency has yielded positive results, setting the stage for continued success in the year ahead.

For a detailed analysis of Topgolf Callaway Brands Corp's financial results and further insights into the company's performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Topgolf Callaway Brands Corp for further details.

This article first appeared on GuruFocus.