Torrid Holdings Inc (CURV) Earnings: A Mixed Bag Against Analyst Estimates

Net Sales: Q4 net sales slightly missed analyst expectations, decreasing 2.6% to $293.5 million against an estimated $296.4397 million.

Net Loss: Q4 reported a net loss of $4.1 million, contrasting with an estimated net income of $15 million.

Earnings Per Share (EPS): Q4 EPS stood at ($0.04), diverging from the estimated EPS of $0.146.

Gross Profit Margin: Q4 saw a gross profit margin improvement to 34.5%, up from 31.9% in the same quarter last year.

Adjusted EBITDA: Q4 Adjusted EBITDA aligned with the guidance at $16.4 million, representing 5.6% of net sales.

Store Count: The fiscal year ended with a total of 655 stores after opening 36 new stores and closing 20.

Full Year Net Income: Annual net income significantly decreased to $11.6 million from $50.2 million in the previous fiscal year.

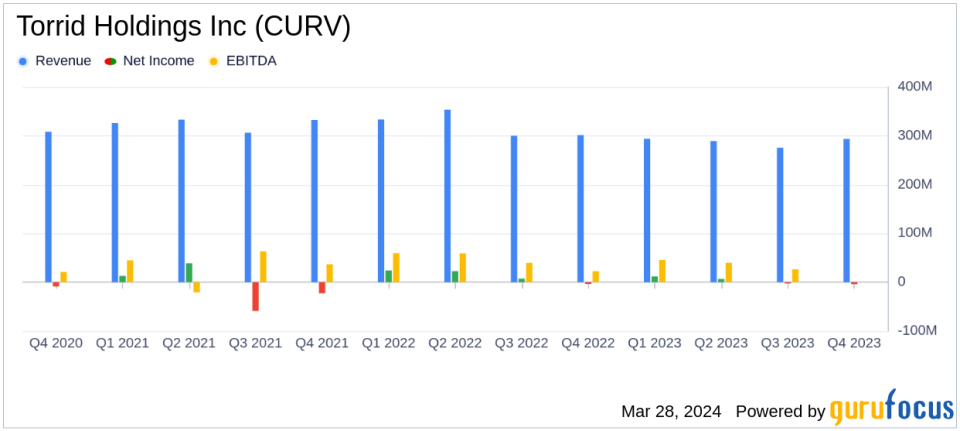

Torrid Holdings Inc (NYSE:CURV) released its 8-K filing on March 28, 2024, revealing a mixed set of financial results for the fourth quarter and full fiscal year 2023. The company, a leading direct-to-consumer apparel, intimates, and accessories brand in North America for women sizes 10 to 30, reported a net loss for the quarter, which contrasts with the analyst's expectations for net income.

Financial Performance and Challenges

The company's net sales for the fourth quarter decreased by 2.6% to $293.5 million compared to the same period last year, falling short of the analyst's revenue estimate. The comparable sales also saw a decrease of 9%. Despite this, Torrid managed to improve its gross profit margin to 34.5%, a notable increase from 31.9% in the prior-year quarter, driven primarily by improved product margins.

However, Torrid reported a net loss of $4.1 million, or ($0.04) per share, which did not meet the positive net income estimate. This was slightly worse than the net loss of $3.8 million, or ($0.04) per share, in the fourth quarter of last year. The full-year net income also saw a significant decrease to $11.6 million from $50.2 million in the previous fiscal year, reflecting a 77% decline.

Strategic Initiatives and Financial Achievements

CEO Lisa Harper highlighted the company's strategic initiatives, including enhancing assortments, reducing inventory levels, and optimizing marketing investments. She noted the positive customer response to new merchandise collections and the company's ability to exceed its fourth-quarter Adjusted EBITDA guidance. These achievements are critical for a company in the retail-cyclical industry, as they demonstrate the ability to navigate market fluctuations and maintain profitability.

Operational Metrics and Outlook

Torrid ended the year with a total of 655 stores after a net increase of 16 stores. The Adjusted EBITDA for the full year was $106.2 million, or 9.2% of net sales, which is a decrease from 11.8% last year. The company has initiated its fiscal 2024 guidance, expecting net sales between $1.135 billion and $1.155 billion and Adjusted EBITDA between $106 million and $116 million.

Cash and cash equivalents at the end of fiscal 2023 totaled $12.1 million. Total liquidity, including available borrowing capacity under the revolving credit agreement, was $114.8 million. Cash flow from operations for the twelve-month period was $42.8 million, compared to $53.3 million for the previous twelve-month period.

While Torrid faces challenges, including a decrease in net sales and net income, the company's improved gross profit margin and strategic initiatives suggest potential for future growth. The company's performance must be viewed in light of the broader macroeconomic challenges and higher labor costs that are affecting the industry.

For investors, Torrid's financial results offer a nuanced picture: while the company faces headwinds with net sales and net income, its strategic initiatives and improvements in gross profit margin may position it for recovery in the challenging retail landscape.

For further details on Torrid Holdings Inc (NYSE:CURV)'s financial performance, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Torrid Holdings Inc for further details.

This article first appeared on GuruFocus.