Torrid's (NYSE:CURV) Q4 Sales Beat Estimates, Stock Jumps 22.4%

Women’s plus-size apparel retailer Torrid Holdings (NYSE:CURV) reported Q4 CY2023 results topping analysts' expectations , with revenue down 2.6% year on year to $293.5 million. On the other hand, next quarter's revenue guidance of $279.5 million was less impressive, coming in 5.7% below analysts' estimates. It made a GAAP loss of $0.04 per share, improving from its loss of $0.04 per share in the same quarter last year.

Is now the time to buy Torrid? Find out by accessing our full research report, it's free.

Torrid (CURV) Q4 CY2023 Highlights:

Revenue: $293.5 million vs analyst estimates of $276.2 million (6.3% beat)

Adjusted EBITDA: $16.4 million vs analyst estimates of $10.8 million (52% beat)

EPS: -$0.04 vs analyst estimates of -$0.07 (40% beat)

Revenue Guidance for Q1 CY2024 is $279.5 million at the midpoint, below analyst estimates of $296.5 million

Management's revenue guidance for the upcoming financial year 2024 is $1.15 billion at the midpoint, missing analyst estimates by 2.1% and implying -0.6% growth (vs -10.2% in FY2023) (adjusted EBITDA guidance for the period also missed expectations)

Gross Margin (GAAP): 34.5%, up from 31.9% in the same quarter last year

Free Cash Flow was -$1.73 million compared to -$6.88 million in the same quarter last year

Same-Store Sales were down 9% year on year (miss vs. estimates of own 7% year on year)

Store Locations: 655 at quarter end, increasing by 16 over the last 12 months

Market Capitalization: $477.8 million

Lisa Harper, Chief Executive Officer, stated, “In fiscal 2023 we improved the fundamentals of our business by enhancing our assortment while reducing overall inventory levels, improving product costs, and optimizing our marketing investments. We are encouraged by the improving trends in sales and margins as customers responded to our new merchandise collections. For the fourth quarter we delivered results that exceeded our guidance, providing a strong foundation for the future. As we move into fiscal 2024, we will continue to build on our core strategic initiatives, which we believe will position us to deliver consistent results and generate meaningful cash flow.”

Promoting a message of body positivity and inclusiveness, Torrid Holdings (NYSE:CURV) is a plus-size women’s apparel and accessories retailer.

Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

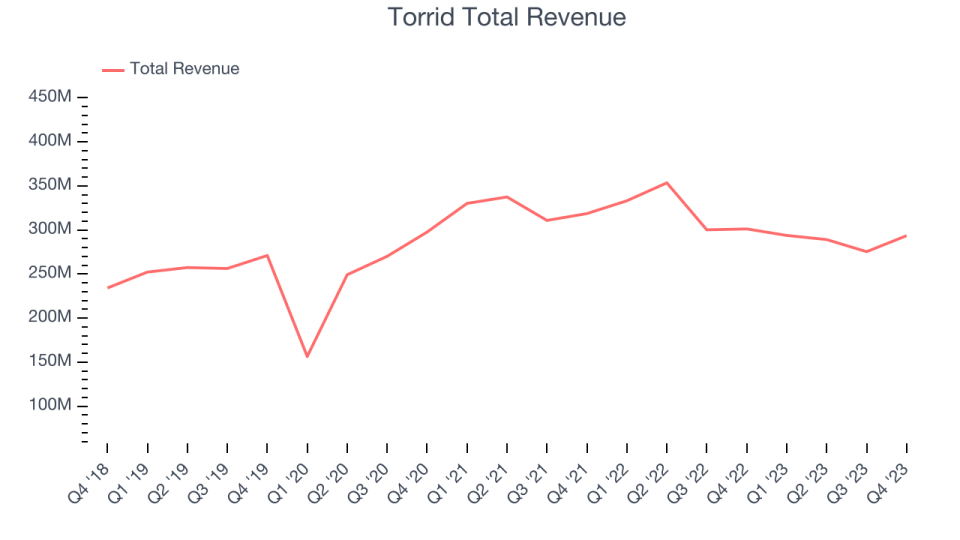

Sales Growth

Torrid is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

As you can see below, the company's annualized revenue growth rate of 2.7% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was weak , but to its credit, it opened new stores and expanded its reach.

This quarter, Torrid's revenue fell 2.6% year on year to $293.5 million but beat Wall Street's estimates by 6.3%. The company is guiding for a 4.9% year-on-year revenue decline next quarter to $279.5 million, an improvement from the 11.8% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 2.5% over the next 12 months, an acceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

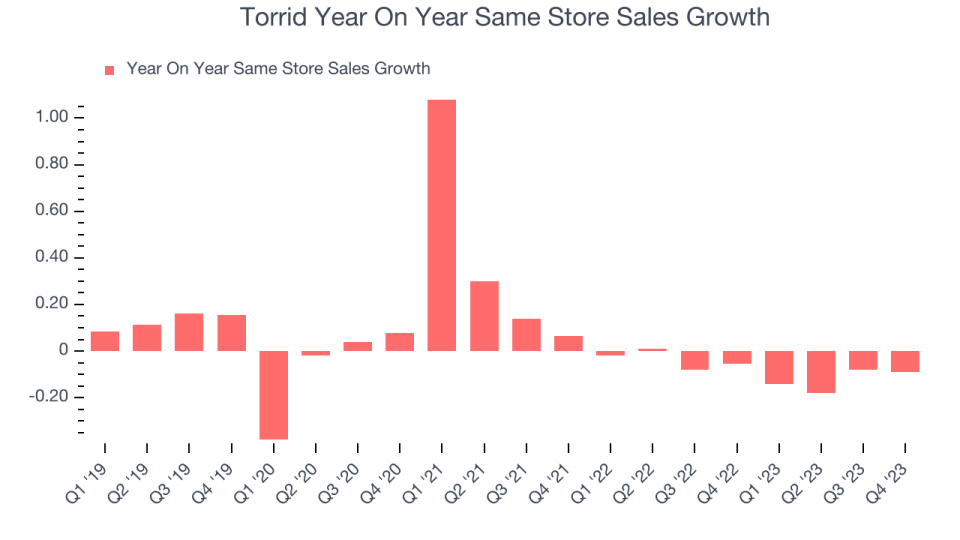

Same-Store Sales

Torrid's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 7.9% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Torrid's same-store sales fell 9% year on year. This decrease was a further deceleration from the 5.4% year-on-year decline it posted 12 months ago. We hope the business can get back on track.

Key Takeaways from Torrid's Q4 Results

We were impressed by how significantly Torrid blew past analysts' adjusted EBITDA and EPS expectations this quarter. On the other hand, its revenue guidance for next quarter and the full year missed analysts' expectations. Overall, we think this was a really good quarter with tepid guidance. However, it seems that the guidance was better than feared considering that some small retailers have been struggling with choppy demand this earnings season. Finally, management struck an optimistic tone, calling out efforts at "enhancing our assortment while reducing overall inventory levels, improving product costs, and optimizing our marketing investments." The result is that the company is seeing "improving trends in sales and margins as customers responded to our new merchandise collections." The stock is up 22.4% after reporting and currently trades at $6 per share.

Torrid may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.