TotalEnergies (TTE), Adani Green Ink JV to Fund 1.1GWac Project

TotalEnergies TTE recently announced that it has signed a new clean energy joint venture (JV) with Adani Green Energy Limited (“AGEL”). Under this agreement, TotalEnergies will invest $300 million and hold a 50% stake in the new JV, with AGEL holding the rest.

The JV will hold a portfolio of 1,050 megawatts alternating current (MWac) - 300 MW of operational capacity, 500 MWac under-construction projects and 250 MWac under-development assets, including solar and wind power.

TTE’s Clean Energy Focus

TotalEnergies, which aims to achieve net zero emissions by 2050, had a gross renewable power generation installed capacity of 19 gigawatts (GWs) as of July 2023. The company plans to expand its business to reach 35 GWs of gross production capacity from renewable sources and storage by 2025 and 100 GWs by 2030.

Notably, its recent achievements in the renewable sector include the plan to build a new mechanical recycling unit for plastic waste at its Grandpuits site southeast of Paris and its partnership with European Energy to build and operate in a 65/35 JV with at least 4 GWs of onshore renewable projects in multiple regions.

With industries across the board rapidly adopting renewables as their preferred choice of energy source, TotalEnergies' efforts to expand its renewable portfolio, including the latest JV signed with AGEL, can be expected to bolster its position in the expanding renewables market.

TTE’s Prospects in India

While China and the United States continue to be the forerunners in the global renewable space, India holds a significant position when it comes to emerging nations’ contribution to promoting clean energy. Impressively, India is one of the biggest emerging economies offering high growth prospects for renewable energy generation.

Per India Brand Equity Foundation’s Report, India had a fully renewable energy capacity of 168.9 GW, including 67.82 GW of solar power and 43.20 of wind power as of May 30, 2023. The country is targeting about 450 GW of installed renewable energy capacity by 2030, with more than 60% expected from solar.

TotalEnergies has been actively making developments to expand its presence in India’s renewable power market. The recent announcement will enable it to speed up its development in the country.

Apart from this, TotalEnergies already has a 19.7% stake in AGEL. The company also has an equal JV with AGEL, called Adani Green Energy Twenty Three Limited (AGE23L), which holds a portfolio of 2,353 MW.

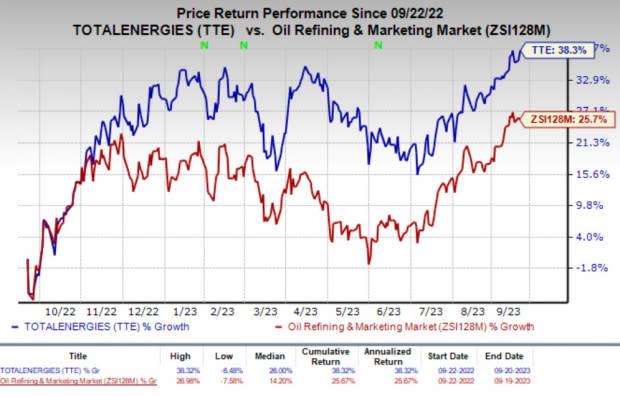

Price Performance

Over the past year, shares of TTE have surged 38.3% compared with the industry’s growth of 25.7%.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

TotalEnergies currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same sector are Constellation Energy Corp. CEG, Archrock Inc. AROC and Texas Pacific Land Corp. TPL. CEG sports a Zacks Rank #1 (Strong Buy) while AROC and TPL each carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Constellation Energy’s long-term earnings growth rate is pegged at 23.3%. The Zacks Consensus Estimate for 2023 earnings per share (EPS) has moved up by 26.9% in the past 60 days.

Archrock’s long-term (three- to five-year) earnings growth rate is pegged at 7%. The Zacks Consensus Estimate for 2023 sales indicates an improvement of 16.6% from that reported in 2022.

The Zacks Consensus Estimate for Texas Pacific Land’s 2023 EPS has moved up by 0.6% in the past 60 days. The stock boasts a four-quarter average earnings surprise of 1.25%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Constellation Energy Corporation (CEG) : Free Stock Analysis Report

Archrock, Inc. (AROC) : Free Stock Analysis Report

Texas Pacific Land Corporation (TPL) : Free Stock Analysis Report

TotalEnergies SE Sponsored ADR (TTE) : Free Stock Analysis Report