ToughBuilt's (TBLT) Gross Sales Via Amazon.com In line Y/Y

Despite operating in a challenging macroeconomic environment, ToughBuilt Industries, Inc. TBLT maintains sales pace, which serve as a positive indicator of its growth trajectory. During second-quarter fiscal 2023, the company recorded gross sales of $3.61 million through Amazon.com compared with $3.56 million in second-quarter fiscal 2022.

Sales for the first half of 2023 have increased by 5.3% to approximately $7.41 million compared with $7.01 million reported in the last year. The company intends to further expand its distribution network in new and existing global markets and implement measures to keep expenses and cost of operations reduced.

Focus on Expansion Bodes Well

The company continues to expand its global presence by opening new storefronts in Europe and extending its distribution agreement with Sodimac, the largest supplier in South America, encompassing Chile, Peru, Argentina, Colombia, Brazil, Uruguay and Sodimac's online marketplace.

In first-quarter fiscal 2023, TBLT launched new product lines in the Pliers and Clamps, Handheld Wrenches and Handheld Screwdrivers categories, introducing over 100 SKUs (stock-keeping units) across these segments. These innovative offerings are available through major U.S. and global home improvement retailers, catering to a network of over 18,900 storefronts and online portals worldwide.

The company's revenues increased by 17.4% to $20.2 million in first-quarter fiscal 2023 compared with $17.2 million reported previous quarter. The upside was primarily backed by wide acceptance of products in the tools industry and receipt of recurring sales orders for metal goods and soft goods from the existing and new customers, driven by an increase in the sales through Amazon.

Backed by its cost reduction efforts and strengthening global brand presence and the introduction of more than 100 new SKUs in the first quarter, the company is optimistic about its growth potential throughout fiscal 2023.

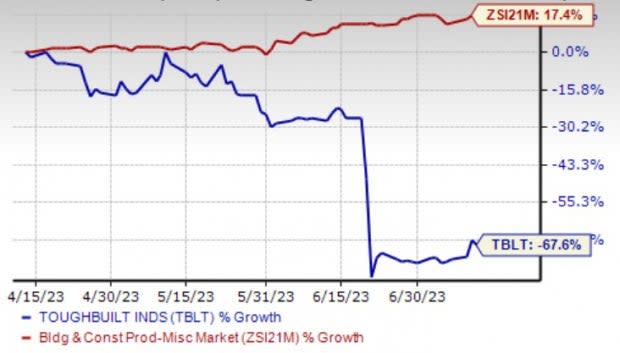

Image Source: Zacks Investment Research

In the past three months, shares of have ToughBuilt declined 67.6% compared with the industry’s 17.4% rise. Investors sentiment might have hurt from the announcement of the pricing of a public offering of 10,975,611 shares of its common stock (or pre-funded warrants in lieu thereof).

Nonetheless, the recent move and strategic initiatives are likely to boost share price in future.

Zacks Rank & Key Picks

ToughBuilt currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Zacks Construction sector are:

Dycom Industries, Inc. DY sports a Zacks Rank #1 (Strong Buy). DY has a trailing four-quarter earnings surprise of 153.7%, on average. Shares of DY have gained 18.3% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for DY’s 2024 sales and earnings per share (EPS) indicates a rise of 8.3% and 41%, respectively, from the year-ago period’s levels.

Eagle Materials Inc. EXP sports a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 6.5%, on average. Shares of EXP have increased 62.2% in the past year.

The Zacks Consensus Estimate for EXP’s 2024 sales and EPS indicates a rise of 2% and 8.3%, respectively, from the year-ago period’s levels.

Martin Marietta Materials, Inc. MLM flaunts a Zacks Rank #2 (Buy). The company has a trailing four-quarter earnings surprise of 31%, on average. Shares of MLM have increased 44.5% in the past year.

The Zacks Consensus Estimate for MLM’s 2023 sales and EPS indicates a rise of 18.4% and 31.7%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Martin Marietta Materials, Inc. (MLM) : Free Stock Analysis Report

Eagle Materials Inc (EXP) : Free Stock Analysis Report

Dycom Industries, Inc. (DY) : Free Stock Analysis Report

ToughBuilt Industries, Inc. (TBLT) : Free Stock Analysis Report