TPG GP A, LLC Reduces Stake in Progyny Inc

On August 7, 2023, TPG GP A, LLC (Trades, Portfolio), a Fort Worth-based investment firm, executed a significant transaction involving Progyny Inc (NASDAQ:PGNY). The firm reduced its stake in the company, a move that holds considerable importance for value investors. This article provides a detailed analysis of the transaction, the profiles of the firm and the traded stock, and the performance and financial health of the stock.

Details of the Transaction

TPG GP A, LLC (Trades, Portfolio) reduced its stake in Progyny Inc by 31.35%, selling 2,900,000 shares at a trade price of $41.08. This transaction impacted the firm's portfolio by -1.95%. After the trade, TPG GP A, LLC (Trades, Portfolio) held a total of 6,350,000 shares in Progyny Inc, representing 4.36% of its portfolio and 6.66% of Progyny Inc's total shares.

Profile of the Firm

TPG GP A, LLC (Trades, Portfolio) is an investment firm located at 301 Commerce Street, Fort Worth, TX. The firm holds 38 stocks in its portfolio, with a total equity of $6.11 billion. Its top holdings include Cushman & Wakefield PLC (NYSE:CWK), Progyny Inc (NASDAQ:PGNY), LifeStance Health Group Inc (NASDAQ:LFST), Life Time Group Holdings Inc (NYSE:LTH), and NEXTracker Inc (NASDAQ:NXT). The firm's top sectors are Healthcare and Technology.

Overview of the Traded Stock

Progyny Inc, a US-based company, specializes in fertility and family building benefits solutions. The company's services include treatment services (Smart Cycles), access to a network of high-quality fertility specialists, and active management of a selective network of high-quality provider clinics. The company's segments include Fertility benefit services revenue and Pharmacy benefit services revenue. As of August 10, 2023, the company's market cap stands at $3.72 billion, with a stock price of $39.04 and a PE percentage of 79.67. According to GuruFocus, the stock is significantly undervalued, with a GF Value of 81.41 and a Price to GF Value ratio of 0.48.

Performance of the Stock

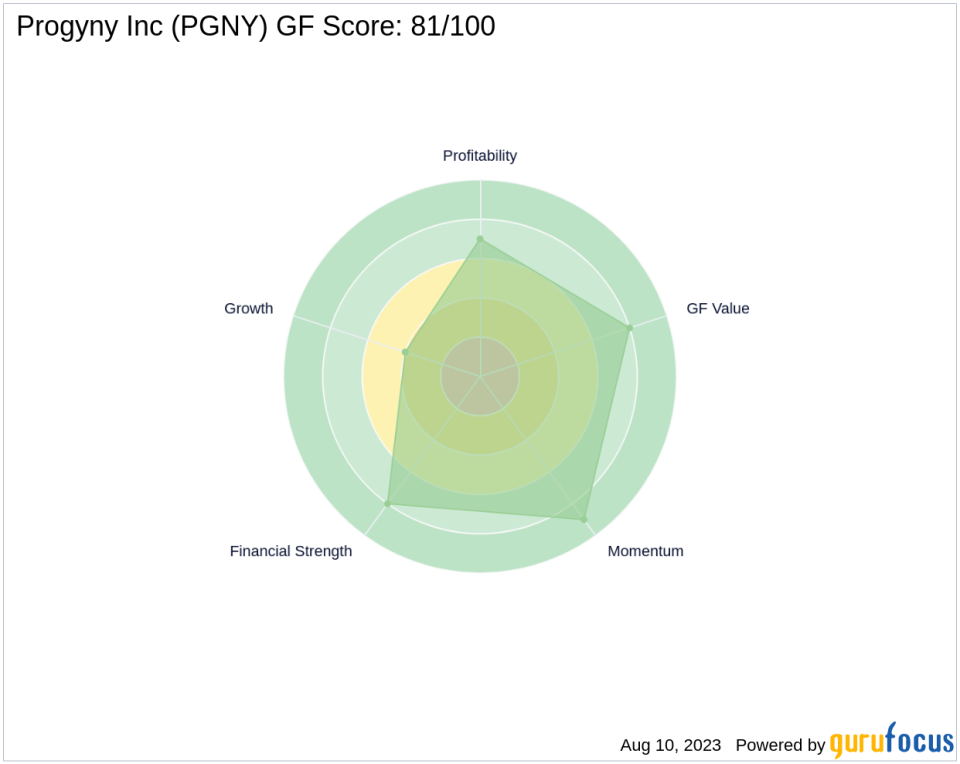

Since its IPO on October 25, 2019, Progyny Inc's stock has gained 189.19%. The year-to-date price change ratio stands at 27.62%. The stock's GF Score is 81/100, indicating good outperformance potential. The stock's Balance Sheet Rank is 8/10, its Profitability Rank is 7/10, and its Growth Rank is 4/10.

Financial Health of the Stock

Progyny Inc's financial health is reflected in its Piotroski F-Score of 6 and its Altman Z score of 13.15. The company's cash to debt ratio is 15.58, and its interest coverage is not applicable due to no interest expense data. The company's ROE is 12.78, and its ROA is 8.65.

Momentum and Predictability of the Stock

The stock's RSI 5 Day is 34.34, its RSI 9 Day is 42.10, and its RSI 14 Day is 46.20. The stock's Momentum Index 6 - 1 Month is 19.09, and its Momentum Index 12 - 1 Month is -8.67.

Other Gurus' Involvement in the Stock

Leucadia National is the largest guru holding Progyny Inc's stock. Other gurus holding the stock include Ken Fisher (Trades, Portfolio).

In conclusion, TPG GP A, LLC (Trades, Portfolio)'s recent transaction has significantly influenced its portfolio and Progyny Inc's stock. The transaction, along with the stock's performance and financial health, provides valuable insights for value investors.

This article first appeared on GuruFocus.