TPI Composites Inc (TPIC) Reports Mixed 2023 Financial Results Amidst Industry Challenges

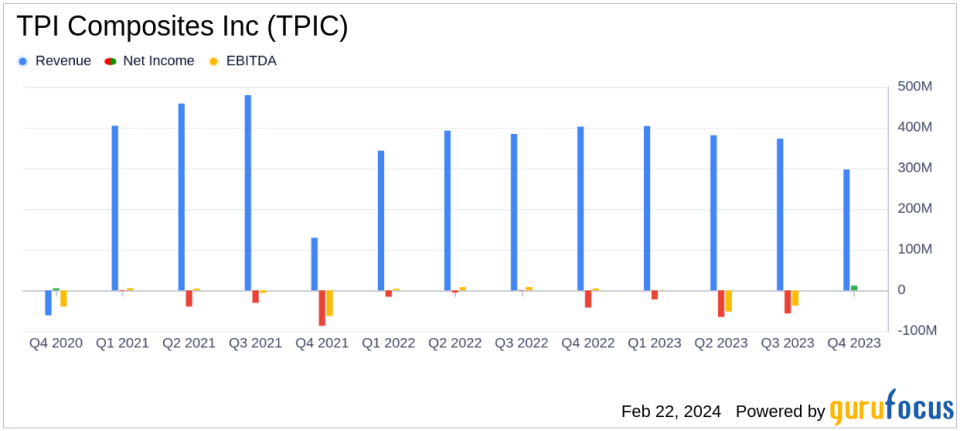

Net Sales: Decreased by 26.2% in Q4 2023 compared to the same period last year.

Net Income: Reported a net income of $11.6 million in Q4 2023, a significant improvement from a loss of $41.9 million in Q4 2022.

Adjusted EBITDA: Experienced a loss of $28.1 million in Q4 2023 versus a gain of $21.2 million in Q4 2022.

Liquidity: Ended 2023 with $161.1 million in unrestricted cash and cash equivalents.

2024 Guidance: Projects net sales from continuing operations between $1.3 billion and $1.4 billion with an adjusted EBITDA margin of 1% to 3%.

Capital Expenditures: Increased to $36.1 million for the year ended December 31, 2023, from $18.8 million in 2022.

On February 22, 2024, TPI Composites Inc (NASDAQ:TPIC) released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 31, 2023. The company, a leading manufacturer of composite wind blades, operates across various geographies, with a significant revenue stream from Mexico. Despite a challenging macro environment, TPI Composites managed to end the year with a strong liquidity position, thanks to working capital improvements and strategic refinancing efforts.

Financial Performance and Challenges

TPI Composites reported a decrease in net sales to $297.0 million in Q4 2023, down 26.2% from the same period in the previous year. The company's net income from continuing operations attributable to common stockholders showed a remarkable recovery, posting $11.6 million compared to a loss of $41.9 million in Q4 2022. However, the adjusted EBITDA was a loss of $28.1 million for Q4 2023, a significant decrease from a gain of $21.2 million in the same period last year.

For the full year 2023, net sales decreased by 4.4% to $1,455.2 million, and the company recorded a net loss attributable to common stockholders of $172.3 million. This annual loss included a $82.6 million gain associated with the refinancing of Series A Preferred Stock into a Senior Secured Term Loan. The adjusted EBITDA for the year was a loss of $85.9 million, compared to an income of $37.9 million in 2022.

The company faced several challenges throughout the year, including production slowdowns due to out-of-spec material from a supplier, the bankruptcy of Proterra affecting automotive sales, and increased costs related to quality initiatives and higher startup and transition costs.

Strategic Position and Liquidity Enhancement

President and CEO Bill Siwek highlighted the company's strategic positioning and liquidity enhancement, stating:

"Our recently announced refinancing of Oaktrees Series A Preferred Stock holdings provides TPI with approximately $190 million of improved liquidity through the life of the loan, permanently reduced future obligations by up to $90 million and gives us greater financial flexibility to execute on our strategic initiatives in 2024 and beyond."

This strategic move is important for TPI Composites as it allows the company to navigate through the transitional phase of 2024 with an eye on profitability improvements in the latter half of the year and positions it for a stronger performance in 2025.

2024 Outlook and Investor Relations

Looking ahead, TPI Composites anticipates 2024 to be a transitional year with improved financial performance expected in the second half. The company projects net sales from continuing operations to be between $1.3 billion and $1.4 billion, with an adjusted EBITDA margin percentage from continuing operations of 1% to 3%. Capital expenditures are forecasted to be between $25 million and $30 million.

TPI Composites will host an investor conference call to discuss these results and provide further insights into the company's strategies and outlook.

For more detailed information on TPI Composites Inc's financial results, investors and interested parties are encouraged to review the full 8-K filing.

Value investors and potential GuruFocus.com members seeking to understand the implications of TPI Composites Inc's financial performance can find comprehensive analysis and insights on GuruFocus.com.

Explore the complete 8-K earnings release (here) from TPI Composites Inc for further details.

This article first appeared on GuruFocus.