Tractor Supply Co (TSCO) Reports Mixed Fiscal Year 2023 Results; Provides Conservative 2024 Outlook

Net Sales: Fiscal year 2023 net sales increased by 2.5% to $14.56 billion.

Comparable Store Sales: Remained flat compared to the prior year.

Gross Profit and Margin: Gross profit rose 5.1% with a margin increase of 92 basis points to 35.9%.

Operating Income: Operating income for the fiscal year 2023 increased by 3.1%.

Net Income and EPS: Net income grew 1.7% with diluted EPS up 3.9% to $10.09.

Capital Return: Over $1.0 billion returned to shareholders in fiscal year 2023.

2024 Outlook: Diluted EPS projected between $9.85 to $10.50 with net sales expected to be $14.7 billion to $15.1 billion.

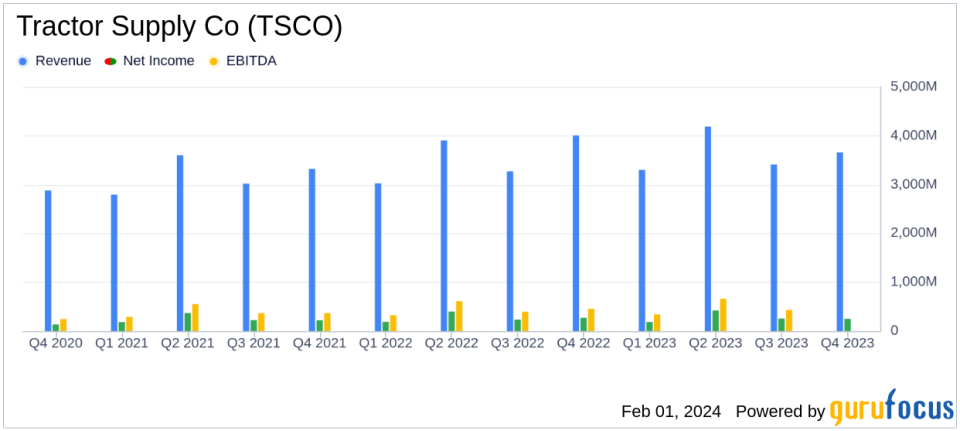

On February 1, 2024, Tractor Supply Co (NASDAQ:TSCO) released its 8-K filing, announcing its financial results for the fourth quarter and fiscal year ended December 30, 2023. Despite facing a challenging environment, the company reported a marginal increase in net sales for the fiscal year 2023, while comparable store sales remained even with the previous year. The company's diluted earnings per share (EPS) for the fiscal year also saw a modest increase.

Tractor Supply is the largest operator of retail farm and ranch stores in the United States, catering primarily to recreational farmers and ranchers. The company operates 2,216 Tractor Supply stores and 198 Petsense by Tractor Supply stores across 49 states, focusing on a mix of products including livestock and pet supplies, hardware, tools, truck items, and seasonal gifts and toys.

Fiscal Year 2023 Performance Highlights

For the fiscal year 2023, Tractor Supply Co reported net sales of $14.56 billion, a 2.5% increase from the previous year's $14.20 billion. The company's gross profit also improved, rising 5.1% to $5.23 billion, with a gross margin increase of 92 basis points to 35.9%. This margin expansion was attributed to lower transportation costs, disciplined product cost management, and the execution of an everyday low price strategy.

Operating income for the year increased by 3.1% to $1.48 billion, while net income saw a 1.7% increase to $1.11 billion. Diluted EPS for fiscal year 2023 was $10.09, up 3.9% from the previous year's $9.71. The company also returned over $1.0 billion to shareholders through share repurchases and dividends.

Challenges and Outlook for Fiscal Year 2024

Despite the financial achievements, Tractor Supply Co faced challenges in the fourth quarter with a comparable store sales decline of 4.2% and a net sales decrease of 8.6% to $3.66 billion. The company attributed the decline to a shorter quarter compared to the previous year and softness in certain product categories.

While our financial performance in 2023 did not meet our initial expectations, our team successfully navigated a highly dynamic environment with agility, operational resiliency and a focus on our strategic investments," said Hal Lawton, President and CEO of Tractor Supply.

For fiscal year 2024, Tractor Supply Co provides a conservative outlook, expecting net sales between $14.7 billion and $15.1 billion, with comparable store sales ranging from a 1.0% decrease to a 1.5% increase. The company also anticipates diluted EPS to be in the range of $9.85 to $10.50, reflecting ongoing investments and sale-leaseback transactions.

Tractor Supply Co's performance and strategic investments indicate a company adapting to a changing retail landscape while maintaining a commitment to shareholder returns. Value investors may find the company's steady performance, despite external challenges, and its focus on long-term value creation appealing.

For more detailed information, investors are encouraged to review the full 8-K filing and listen to the webcast of the earnings call.

Explore the complete 8-K earnings release (here) from Tractor Supply Co for further details.

This article first appeared on GuruFocus.