Tractor Supply (NASDAQ:TSCO) Reports Sales Below Analyst Estimates In Q3 Earnings, Stock Drops

Rural goods retailer Tractor Supply (NASDAQ:TSCO) missed analysts' expectations in Q3 FY2023, with revenue up 4.32% year on year to $3.41 billion. Turning to EPS, Tractor Supply made a GAAP profit of $2.33 per share, improving from its profit of $2.10 per share in the same quarter last year.

Is now the time to buy Tractor Supply? Find out by accessing our full research report, it's free.

Tractor Supply (TSCO) Q3 FY2023 Highlights:

Revenue: $3.41 billion vs analyst estimates of $3.47 billion (1.72% miss)

EPS: $2.33 vs analyst estimates of $2.29 (1.73% beat)

The company dropped its revenue guidance for the full year from $14.9 billion to $14.6 billion at the midpoint, a 2.02% decrease

Free Cash Flow was -$21.5 million compared to -$185 million in the same quarter last year

Gross Margin (GAAP): 36.6%, up from 35.6% in the same quarter last year

Same-Store Sales were down 0.4% year on year

Store Locations: 2,393 at quarter end, increasing by 186 over the last 12 months

“We delivered solid growth in both net sales and earnings in the third quarter, although our sales performance was softer than our expectations. Given this environment, we have updated our outlook for the year to reflect continued unfavorable seasonal category performance and discerning consumer spending. Our consistent market share expansion and positive customer trends underscore the enduring strength of our business. We are confident in our ability to navigate in the near-term and remain as excited as ever about our bright future. I would like to thank our team for their dedication to our Mission and Values, as this continues to be the key to our customers’ strong loyalty,” said Hal Lawton, President and Chief Executive Officer of Tractor Supply.

Started as a mail-order tractor parts business, Tractor Supply (NASDAQ:TSCO) is a retailer of general goods such as agricultural supplies, hardware, and pet food for the rural consumer.

Specialty Retail

Some retailers try to sell everything under the sun, while others—appropriately called Specialty Retailers—focus on selling a narrow category and aiming to be exceptional at it. Whether it’s eyeglasses, sporting goods, or beauty and cosmetics, these stores win with depth of product in their category as well as in-store expertise and guidance for shoppers who need it. E-commerce competition exists and waning retail foot traffic impacts these retailers, but the magnitude of the headwinds depends on what they sell and what extra value they provide in their stores.

Sales Growth

Tractor Supply is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

As you can see below, the company's annualized revenue growth rate of 15.8% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was excellent as it added more brick-and-mortar locations and increased sales at existing, established stores.

This quarter, Tractor Supply grew its revenue by 4.32% year on year, falling short of Wall Street's estimates. Looking ahead, the analysts covering the company expect sales to grow 2.8% over the next 12 months.

The pandemic fundamentally changed several consumer habits. There is a founder-led company that is massively benefiting from this shift. The business has grown astonishingly fast, with 40%+ free cash flow margins. Its fundamentals are undoubtedly best-in-class. Still, the total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

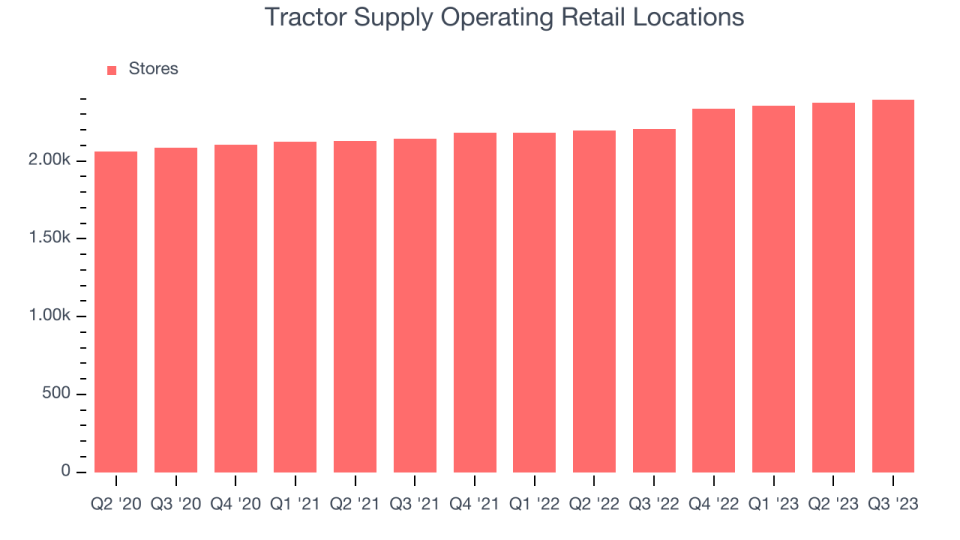

Number of Stores

A retailer's store count often determines on how much revenue it can generate.

When a retailer like Tractor Supply is opening new stores, it usually means it's investing for growth because demand is greater than supply. Since last year, Tractor Supply's store count increased by 186 locations, or 8.43%, to 2,393 total retail locations in the most recently reported quarter.

Over the last two years, the company has opened new stores quickly and averaged 5.48% annual growth in new locations, meaningfully higher than other consumer retail businesses. With an expanding store base and demand, revenue growth can come from multiple vectors: sales from new stores, sales from e-commerce, or increased foot traffic and higher sales per customer at existing stores.

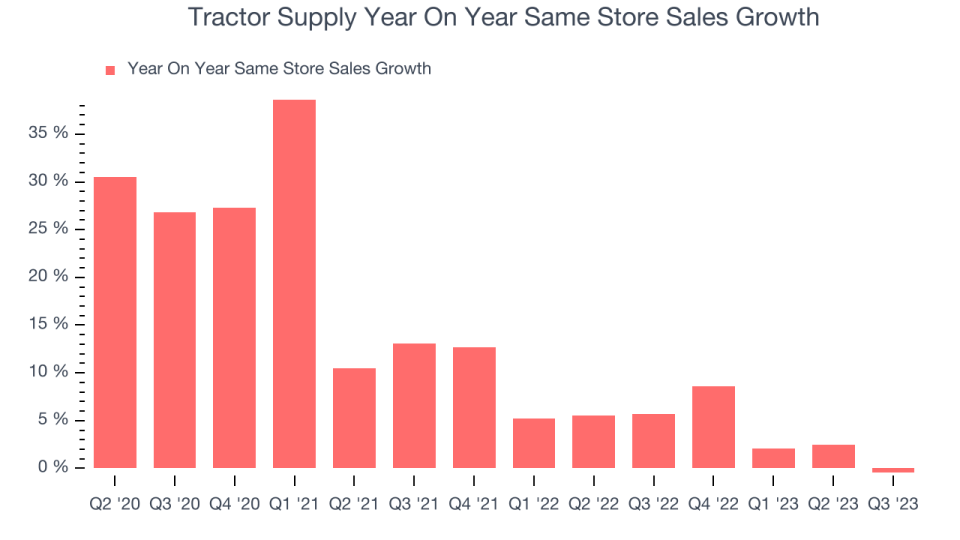

Same-Store Sales

Tractor Supply's demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company's same-store sales have grown by 5.24% year on year. With positive same-store sales growth amid an increasing physical footprint of stores, Tractor Supply is reaching more customers and growing sales.

In the latest quarter, Tractor Supply's year on year same-store sales were flat, or negative 0.4%. By the company's standards, this growth was a meaningful deceleration from the 5.7% year-on-year increase it posted 12 months ago. One quarter fluctuations aren't material for the long-term prospects of a business, but we'll watch Tractor Supply closely to see if it can reaccelerate growth.

Key Takeaways from Tractor Supply's Q3 Results

Sporting a market capitalization of $21.6 billion, more than $421.7 million in cash on hand, and positive free cash flow over the last 12 months, we believe that Tractor Supply is attractively positioned to invest in growth.

We struggled to find many strong positives in these results. The company lowered its full-year guidance for all reported metrics. Its gross margin and revenue also missed Wall Street's estimates. Overall, this was a mixed quarter for Tractor Supply. The company is down 6.16% on the results and currently trades at $185.8 per share.

Tractor Supply may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.