Can The Trade Desk Stock Continue Soaring for the Next 3 Years?

Share prices of The Trade Desk (NASDAQ: TTD) shot up an impressive 17% following its latest quarterly report. This wasn't surprising, as the company's outlook for the current quarter turned out to be significantly better than expectations.

The programmatic advertising platform provider released fourth-quarter 2023 results on Feb. 15. Its revenue increased 23% year over year to $606 million, exceeding the consensus estimate of $582 million by a comfortable margin. The Trade Desk's non-GAAP earnings of $0.41 per share, however, increased at a slower pace of 9% year over year to $0.41 per share, missing the Wall Street estimate of $0.43 per share.

However, investors looked past the bottom-line miss, as The Trade Desk management's guidance was solid and points toward an acceleration in growth. Let's take a closer look at what's going to drive the improvement in the company's growth, and check whether the stock can sustain its newly found momentum and deliver healthy gains to investors over the next three years.

The digital advertising market's growth will give The Trade Desk a nice boost

The Trade Desk finished 2023 with a total revenue of $1.95 billion, an increase of 23% over the previous year. That was a dip from the 32% revenue growth it recorded in 2022. However, the good thing to note here is that The Trade Desk grew at a faster pace than the 10.7% growth in digital ad spending last year. More importantly, digital ad spending is expected to grow at a faster pace of 13.2% in 2024.

This probably explains why The Trade Desk's first-quarter 2024 outlook turned out to be robust. The company has guided for $478 million in revenue for the current quarter, pointing toward 25% year-over-year growth. That's well ahead of the 18% year-over-year growth analysts were looking for. What's more, The Trade Desk's Q1 revenue guidance points toward an improvement over the 21% growth it recorded in the same period last year.

Even better, The Trade Desk has guided for adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $130 million for the current quarter, which would be a 19% jump over the prior-year period. This could lead to stronger growth in the company's bottom line, following a 21% increase in adjusted earnings last year to $1.26 per share.

A key reason why The Trade Desk's growth is on track to accelerate is because the company is winning a bigger share of the digital ad market. That's evident from its growth rate, which is much greater than the pace at which digital ad spending is increasing.

It is not surprising to see why more companies are gravitating toward The Trade Desk's programmatic ad platform and helping it win a bigger share of the industry it operates in. After all, the company's technology-driven, cloud-based, and data-driven ad platform allows ad buyers to create campaigns and optimize them in real-time. As a result, marketers can improve audience targeting and display their ads across multiple mediums such as connected television, computers, and smartphones.

The advantages of programmatic advertising explain why this niche is growing rapidly. Last year, the programmatic advertising market was worth an estimated $200 billion, and it is expected to hit $300 billion in revenue by 2026. Not surprisingly, The Trade Desk is anticipated to deliver robust growth over the next year, and beyond.

Investors can expect solid gains over the next three years

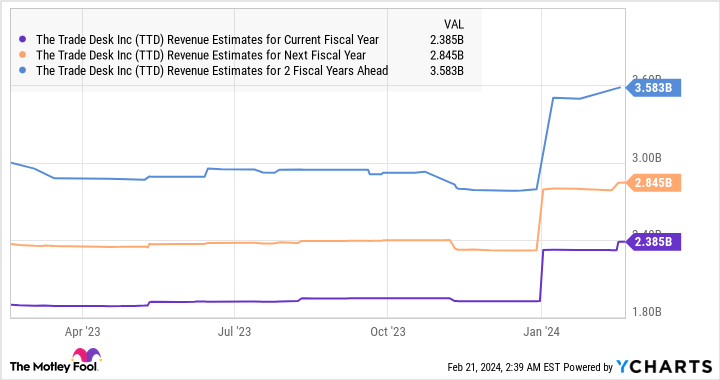

Analysts have significantly increased their revenue growth expectations for The Trade Desk in 2024, 2025, and 2026. This is evident from the chart below.

The Trade Desk currently trades at 21 times sales. While that's expensive, it is worth noting that the stock is currently cheaper than its five-year average sales multiple of 27. The company could justify its rich sales multiple by outpacing the digital ad market and accelerating its pace of growth.

So, if The Trade Desk does hit $3.6 billion in revenue in 2026 and trades at a slightly discounted 20 times sales at that time, its market cap could jump to $72 billion. That would be an 80% jump from current levels, which is why investors looking to buy a growth stock should consider buying The Trade Desk before it heads higher.

Should you invest $1,000 in The Trade Desk right now?

Before you buy stock in The Trade Desk, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and The Trade Desk wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 20, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends The Trade Desk. The Motley Fool has a disclosure policy.

Can The Trade Desk Stock Continue Soaring for the Next 3 Years? was originally published by The Motley Fool