TransAlta (TAC) Closes Acquisition of TransAlta Renewables

TransAlta Corporation TAC recently concluded its acquisition of TransAlta Renewables Inc. (“RNW”). RNW will now be a wholly owned subsidiary of TransAlta.

Benefits of the Transaction

TAC and RNW are expected to become a unified, large-scale clean electricity leader and one of Canada’s largest independent power producers with direct ownership in an extensive renewables platform. The combined company will have a diversified renewables platform with increased market capitalization, a robust balance sheet and enhanced ability to realize future growth.

The integrated portfolio of high-quality assets will have 6,246 megawatts (MW) of net capacity ownership interest.

TransAlta’s Clean Energy Focus

During second-quarter 2023, TransAlta energized 10 turbines at the Kent Hills wind facilities. In February 2023, the company acquired a 50% interest in the Tent Mountain Renewable Energy Complex, an early-stage 320 MW pumped hydro energy storage development project located in southwest Alberta.

TransAlta plans to achieve net-zero carbon emissions by 2045. The company’s current advanced-stage projects under development include 180 MW of battery storage and 100 MW wind, which are expected to be completed by 2024-25.

TAC’s latest efforts to expand its renewable portfolio, including RNW’s acquisition, should enable the company to duly achieve its clean energy goals.

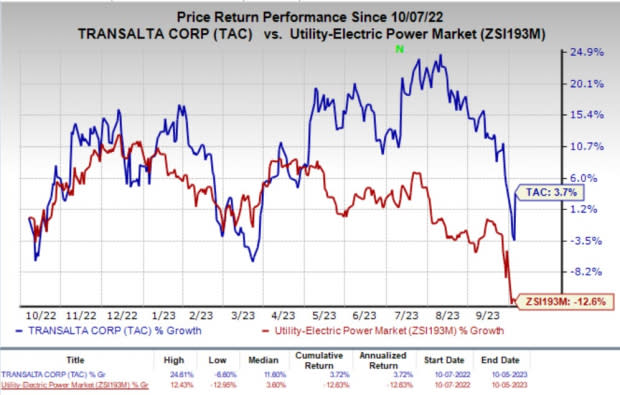

Price Performance

Over the past year, shares of TAC have rallied 3.7% against the industry’s decline of 12.6%.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

TransAlta currently has a Zacks Rank #1 (Strong Buy).

A few other top-ranked stocks in the same industry are Vistra Corp. VST, ALLETE Inc. ALE and PNM Resources Inc. PNM. VST sports a Zacks Rank #1 while ALE and PNM carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Vistra’s 2023 sales indicates an improvement of 47.8% from that reported in 2022. The Zacks Consensus Estimate for earnings has moved up 13.8% in the past 60 days.

ALLETE’s long-term earnings growth rate is 8.1%. The Zacks Consensus Estimate for 2023 sales indicates an improvement of 23.8% from that reported in 2022.

PNM Resources’ long-term earnings growth rate is 4.5%. The Zacks Consensus Estimate for 2023 sales indicates an improvement of 17.2% from that reported in 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TransAlta Corporation (TAC) : Free Stock Analysis Report

Allete, Inc. (ALE) : Free Stock Analysis Report

PNM Resources, Inc. (PNM) : Free Stock Analysis Report

Vistra Corp. (VST) : Free Stock Analysis Report