TransAlta (TAC): A Smart Investment or a Value Trap? An In-Depth Exploration

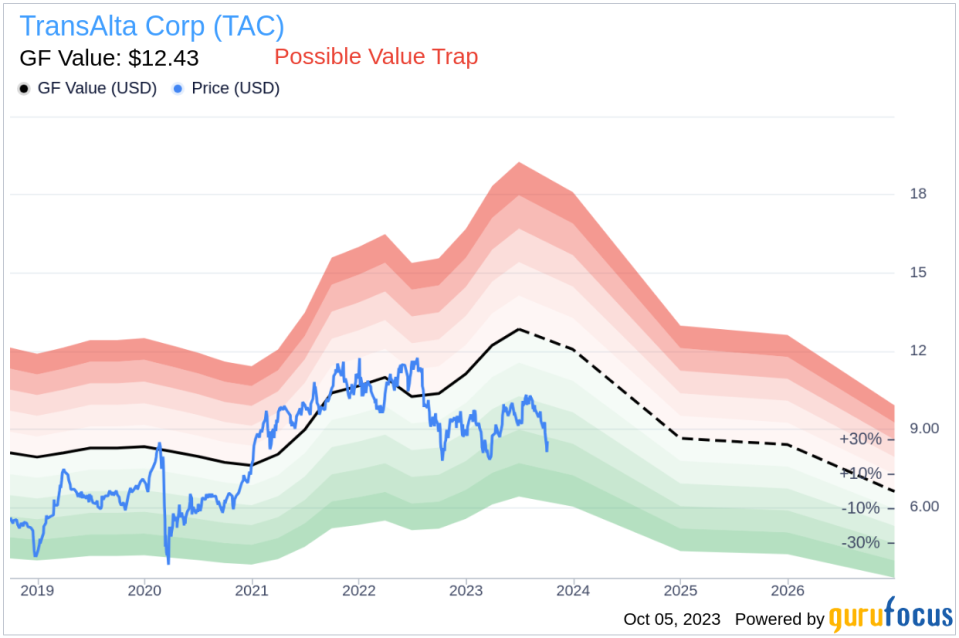

For value-focused investors, finding stocks priced below their intrinsic value is always a priority. TransAlta Corp (NYSE:TAC) is one such stock that demands attention. Currently priced at $8.52, TransAlta recorded a gain of 5.84% in a day and a 3-month decrease of 8.64%. Its fair valuation stands at $12.43, as indicated by its GF Value.

Understanding the GF Value

The GF Value represents the current intrinsic value of a stock derived from our exclusive method. It gives an overview of the fair value that the stock should trade at, based on historical multiples, GuruFocus adjustment factor, and future business performance estimates.

However, before making an investment decision, investors need to consider a more in-depth analysis. Despite its seemingly attractive valuation, certain risk factors associated with TransAlta cannot be ignored. These risks are primarily reflected through its low Altman Z-score of 0.72, suggesting that TransAlta might be a potential value trap.

What is the Altman Z-score?

The Altman Z-score is a financial model that predicts the probability of a company entering bankruptcy within a two-year time frame. The Altman Z-Score combines five different financial ratios, each weighted to create a final score. A score below 1.8 suggests a high likelihood of financial distress, while a score above 3 indicates a low risk.

An Overview of TransAlta Corp (NYSE:TAC)

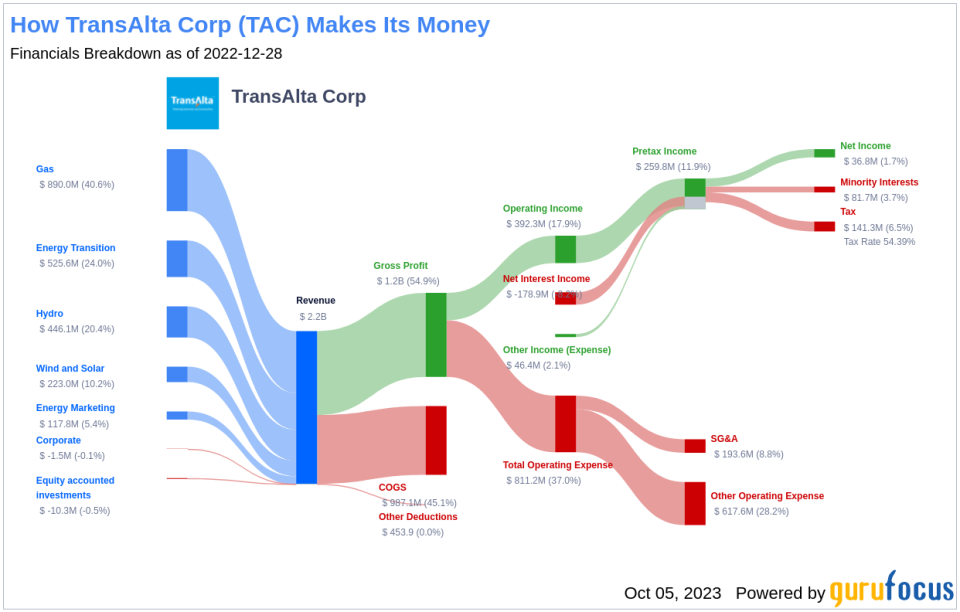

TransAlta is an independent power producer based in Alberta, Canada. The company operates a diverse and growing fleet of electrical power generation assets in Canada, the United States, and Australia. The majority of the company's revenues are derived from the sale of generation capacity, electricity, thermal energy, environmental attributes, and byproducts of power generation.

TransAlta's Low Altman Z-Score: Key Drivers

Analysis of TransAlta's Altman Z-score reveals possible financial distress. The Retained Earnings to Total Assets ratio provides insights into a company's capability to reinvest its profits or manage debt. Evaluating TransAlta's historical data, 2021: -0.20; 2022: -0.25; 2023: -0.23, we observe a declining trend in this ratio, indicating TransAlta's diminishing ability to reinvest or manage its debt effectively, thereby negatively impacting its Z-Score.

Conclusion: Is TransAlta a Value Trap?

Despite its seemingly attractive valuation, the low Altman Z-Score and declining Retained Earnings to Total Assets ratio suggest that TransAlta might be a potential value trap. These complexities underline the importance of thorough due diligence in investment decision-making.

GuruFocus Premium members can find stocks with high Altman Z-Score using the Walter Schloss Screen .

This article first appeared on GuruFocus.