Transcat Inc (TRNS): A High-Performing Industrial Distribution Stock with an Impressive GF ...

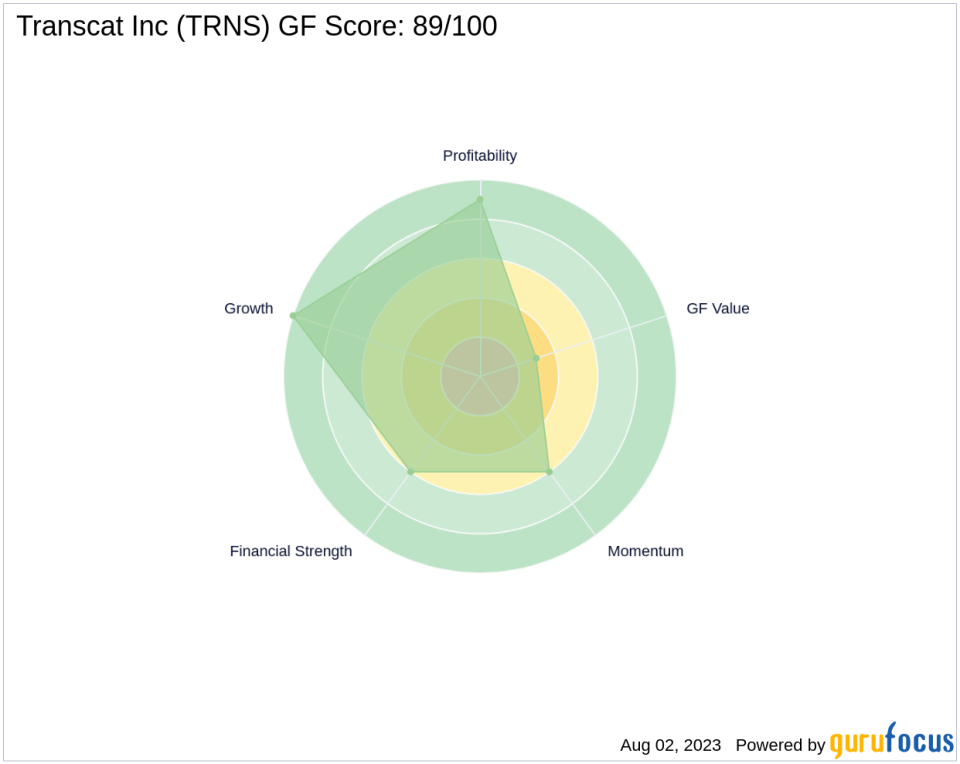

Transcat Inc (NASDAQ:TRNS), a prominent player in the Industrial Distribution sector, is currently trading at $91.73 with a market capitalization of $704.746 million. The company's stock has seen a gain of 4.84% today and a 7.80% increase over the past four weeks. According to GuruFocus, Transcat Inc has a GF Score of 89 out of 100, indicating a high outperformance potential. The GF Score is a comprehensive stock performance ranking system that considers five key aspects: Financial Strength, Profitability Rank, Growth Rank, GF Value Rank, and Momentum Rank.

Financial Strength Analysis

Transcat Inc's Financial Strength rank stands at 6/10. This ranking is based on several factors, including the company's debt burden, debt to revenue ratio, and Altman Z-Score. Transcat Inc's interest coverage is 5.88, indicating a manageable debt burden. The company's debt to revenue ratio is 0.27, suggesting a healthy financial position. Furthermore, the company's Altman Z-Score of 6.38 indicates a low probability of financial distress.

Profitability Rank Analysis

The company's Profitability Rank is 9/10, reflecting its strong profitability. Transcat Inc's operating margin is 7.05%, and its Piotroski F-Score is 6, indicating a healthy financial situation. The company has shown a consistent uptrend in its operating margin over the past five years, with a 5-year average of 3.60%. Moreover, the company has maintained consistent profitability over the past ten years, further enhancing its profitability rank.

Growth Rank Analysis

Transcat Inc's Growth Rank is 10/10, reflecting robust growth in terms of revenue and profitability. The company's 5-year revenue growth rate is 7.20%, and its 3-year revenue growth rate is 9.30%. Additionally, the company's 5-year EBITDA growth rate is 11.60%, indicating strong growth in its business operations.

GF Value Rank Analysis

The company's GF Value Rank is 3/10, suggesting that the stock is currently overvalued. The GF Value Rank is determined by the price-to-GF-Value ratio, a proprietary metric calculated based on historical multiples and an adjustment factor based on a company's past returns and growth and future estimates of the business' performance.

Momentum Rank Analysis

Transcat Inc's Momentum Rank is 6/10, indicating a moderate momentum in its stock price. The Momentum Rank is determined using the standardized momentum ratio and other momentum indicators.

Competitor Analysis

When compared to its competitors in the Industrial Distribution sector, Transcat Inc holds a strong position. DXP Enterprises Inc (NASDAQ:DXPE) has a GF Score of 72, Titan Machinery Inc (NASDAQ:TITN) has a GF Score of 87, and BlueLinx Holdings Inc (NYSE:BXC) has a GF Score of 77. This comparison can be found on the competitors page.

Conclusion

In conclusion, Transcat Inc's overall GF Score of 89 suggests a high outperformance potential. The company's strong financial strength, high profitability, robust growth, and moderate momentum contribute to its high GF Score. However, its current overvaluation may pose a risk. Therefore, investors should consider all aspects of the GF Score in their investment decisions.

This article first appeared on GuruFocus.