TransDigm Group Inc (TDG) Reports Stellar Fiscal 2024 First Quarter Results

Net Sales: Increased to $1,789 million, a 28% rise from the previous year.

Net Income: Grew significantly to $382 million, marking a 67% increase year-over-year.

Earnings Per Share (EPS): EPS stood at $4.87, up 46% from the prior year's quarter.

EBITDA As Defined: Rose by 30% to $912 million, with a margin of 51.0%.

Adjusted EPS: Adjusted earnings per share climbed to $7.16, a 56% increase from the previous year.

Fiscal 2024 Guidance: TransDigm raises its net sales and EBITDA As Defined guidance for the fiscal year.

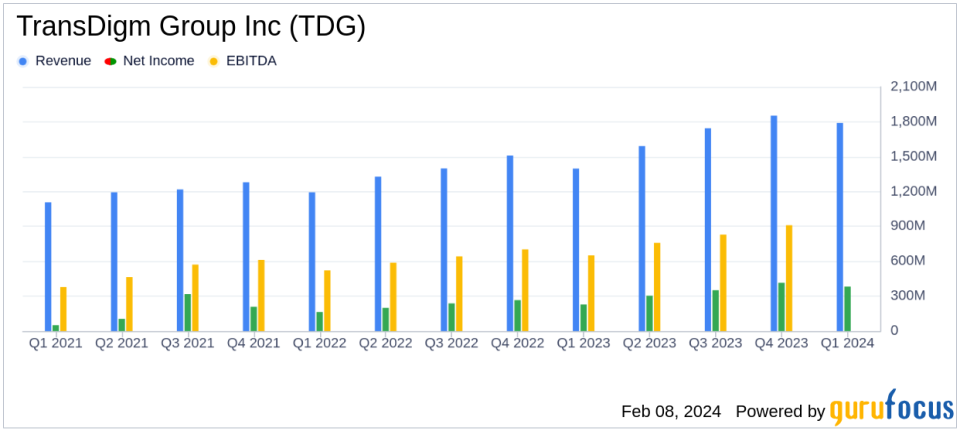

On February 8, 2024, TransDigm Group Inc (NYSE:TDG), a leading global designer, producer, and supplier of highly engineered aircraft components, announced a robust start to its fiscal year with the release of its 8-K filing. The company, which operates in segments including power and control, airframes, and nonaviation, reported a 28% increase in net sales to $1,789 million for the first quarter ended December 30, 2023, compared to the same period last year.

TransDigm's net income for the quarter saw a remarkable 67% increase to $382 million, while earnings per share rose by 46% to $4.87. The company's EBITDA As Defined also experienced a significant boost, increasing by 30% to $912 million, resulting in an EBITDA As Defined margin of 51.0%. Adjusted earnings per share followed suit, with a 56% increase to $7.16. These financial achievements underscore TransDigm's strong performance in the Aerospace & Defense industry, where aftermarket demand and proprietary products play a critical role in driving profitability.

Operational Highlights and Financial Metrics

TransDigm's President and CEO, Kevin Stein, expressed satisfaction with the company's first-quarter results, highlighting the expansion of commercial aftermarket revenues and a 100 basis-point increase in EBITDA As Defined margin compared to the prior year. The company's focus on its operating strategy and cost management was evident in its financial outcomes. The acquisition of Calspan in May 2023 and the pending acquisition of CPI's Electron Device Business, expected to close this fiscal year, are strategic moves that reinforce TransDigm's market position.

The company's financial strength was further supported by a successful private offering of $1.0 billion of 7.125% senior secured notes and the issuance of $1.0 billion in new Tranche J term loans. These funds are intended to finance the CPI acquisition and for general corporate purposes.

Forward-Looking Financial Guidance

TransDigm has raised its fiscal 2024 guidance, reflecting strong first-quarter results and positive expectations for the remainder of the year. The company now anticipates net sales to be between $7,575 million and $7,755 million, a 16.4% increase at the midpoint from fiscal 2023. Net income is expected to range from $1,560 million to $1,662 million, marking a 24.0% increase at the midpoint. Earnings per share are projected to be between $25.25 and $27.01, an 18.6% increase at the midpoint, while EBITDA As Defined is forecasted to be between $3,920 million and $4,050 million, a 17.4% increase at the midpoint, corresponding to an EBITDA As Defined margin of approximately 52.0% for fiscal 2024.

TransDigm's outlook is based on market growth assumptions that include commercial OEM revenue growth around 20%, commercial aftermarket revenue growth in the mid-teens percentage range, and defense revenue growth in the high-single digit to low double-digit percentage range.

Conclusion

TransDigm Group Inc (NYSE:TDG) has demonstrated a strong start to fiscal 2024, with significant increases in net sales, net income, and EBITDA As Defined. The company's strategic acquisitions and effective cost management have positioned it well for continued success in the Aerospace & Defense sector. With upward revisions to its full-year guidance, TransDigm is poised for sustained growth and value creation for its shareholders.

For more detailed information on TransDigm's financial performance and future outlook, investors and analysts are encouraged to attend the earnings conference call scheduled for February 8, 2024.

For inquiries, please contact TransDigm Group's Investor Relations at 216-706-2945 or email ir@transdigm.com.

Explore the complete 8-K earnings release (here) from TransDigm Group Inc for further details.

This article first appeared on GuruFocus.