TransMedics Group Inc (TMDX) Reports Stellar Revenue Growth in Q4 and Full Year 2023

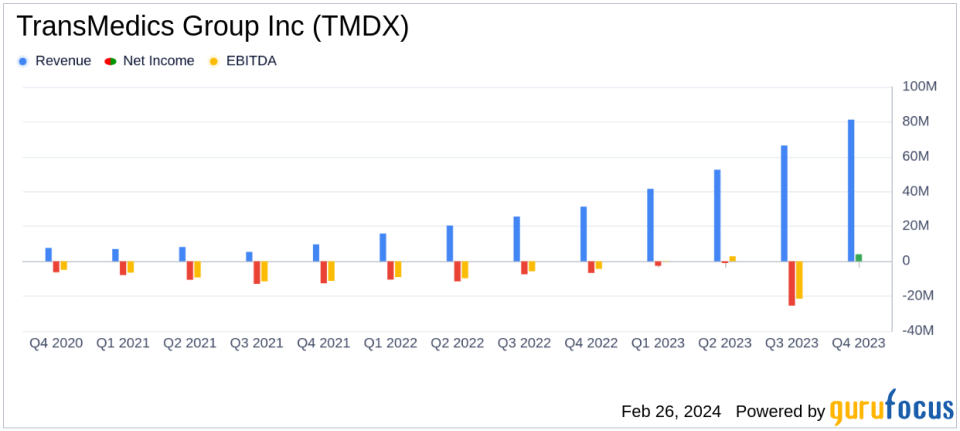

Q4 Revenue: Reached $81.2 million, marking a 159% increase year-over-year.

Full Year Revenue: Grew to $241.6 million, also up by 159% from the previous year.

Net Income: Achieved $4.0 million in Q4, a significant improvement from a net loss of $6.7 million in Q4 of the prior year.

Gross Margin: Reported at 59% in Q4, slightly down from 66% in the same quarter last year.

Operating Expenses: Increased to $45.3 million in Q4, driven by investments to support company growth.

2024 Outlook: Anticipates revenue between $360 million to $370 million, representing 49% to 53% growth.

Cash Position: Strong with $394.8 million as of December 31, 2023.

On February 26, 2024, TransMedics Group Inc (NASDAQ:TMDX), a pioneering medical technology company, announced its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its innovative Organ Care System (OCS), released its 8-K filing, revealing a significant increase in revenue and a positive net income for the quarter.

TransMedics Group Inc is revolutionizing organ transplant therapy for patients with end-stage organ failure. Its OCS technology is a portable organ perfusion, optimization, and monitoring system that maintains near-physiologic conditions for donor organs outside the human body.

Financial Performance and Challenges

The company's revenue for Q4 2023 was a record $81.2 million, a 159% increase from $31.4 million in the same period last year. This growth was primarily attributed to the increased utilization of the OCS through the National OCS Program (NOP) and additional revenue from TransMedics' transplant logistics services. For the full year, revenue also saw a 159% increase to $241.6 million. These numbers are crucial as they demonstrate the company's ability to scale its operations and the growing acceptance of its OCS technology in the medical community.

Despite the impressive revenue growth, TransMedics faced a decrease in gross margin, which was reported at 59% for Q4 2023, down from 66% in Q4 2022. This decline may signal cost pressures or changes in the company's product mix, which could potentially impact profitability if not managed effectively.

Operating expenses also saw a rise to $45.3 million in Q4 2023, up from $27.5 million in the same quarter of the previous year. This increase reflects the company's strategic investments to support its growth trajectory. However, it's important to monitor whether these investments will translate into sustainable long-term growth.

Financial Achievements and Importance

TransMedics' financial achievements, particularly the turnaround to a net income of $4.0 million in Q4 from a net loss of $6.7 million in the same quarter of the previous year, underscore the company's improving operational efficiency and market penetration. For a company in the Medical Devices & Instruments industry, such profitability is a positive indicator of the company's potential to leverage its innovative technology for commercial success.

Key Financial Metrics and Commentary

Key financial metrics from the income statement show a robust performance, with net product revenue at $51.9 million and service revenue at $29.3 million for Q4. The balance sheet reflects a strong cash position of $394.8 million, which is vital for the company's future R&D and operational expansion. Dr. Waleed Hassanein, President and CEO, commented on the company's performance:

2023 was a great year for TransMedics as we achieved 159% revenue growth and launched TransMedics transplant logistics services to provide a more operationally and economically efficient service to our transplant program users.

Looking ahead, TransMedics expects total revenue for the full year of 2024 to be in the range of $360 million to $370 million, indicating continued growth momentum.

Analysis and Prospects

TransMedics Group Inc's performance in 2023 reflects a company on the rise, with significant revenue growth and a positive shift towards profitability. The company's focus on expanding its OCS technology and logistics services has paid off, leading to a substantial increase in national heart and liver transplant volumes. With a strong cash reserve and a positive outlook for 2024, TransMedics is well-positioned to continue its growth trajectory and further cement its place as a leader in the medical technology space.

Investors and stakeholders will be watching closely to see if the company can maintain its growth rate, manage operating expenses, and continue to innovate in the organ transplant market. The full financial results and additional details can be accessed on the TransMedics website, and interested parties are encouraged to join the upcoming conference call to discuss these results further.

Explore the complete 8-K earnings release (here) from TransMedics Group Inc for further details.

This article first appeared on GuruFocus.