Transocean Ltd (RIG) Reports Narrowed Loss in Q4; Backlog Hits $9.01 Billion

Net Loss Improvement: Q4 net loss reduced to $104 million from $220 million in the previous quarter.

Revenue Efficiency: Achieved a company-best 97.6% uptime, with revenue efficiency rising to 97.0%.

Backlog Growth: Secured a substantial backlog of $9.01 billion, providing visibility into future cash flows.

Capital Expenditures: Q4 capital expenditures of $220 million, primarily for the newbuild ultra-deepwater drillship Deepwater Aquila.

Adjusted EBITDA: Posted $122 million in adjusted EBITDA, though down from $162 million in the prior quarter.

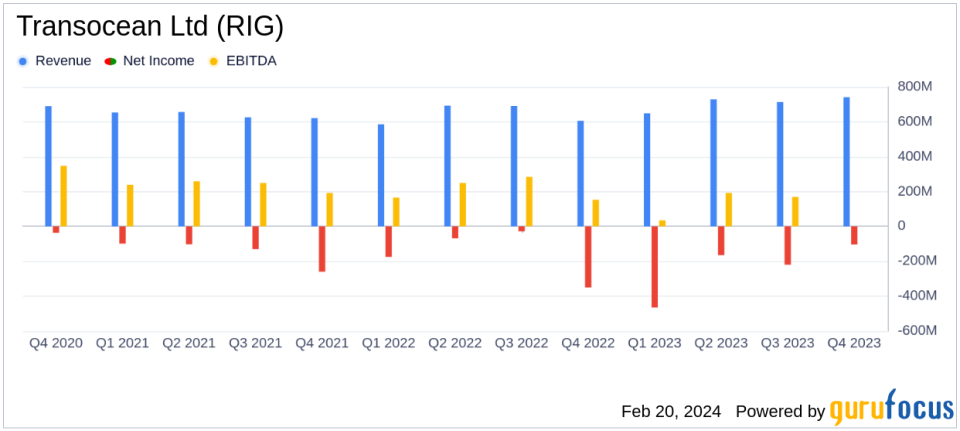

On February 19, 2024, Transocean Ltd (NYSE:RIG) released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023. The company, a leading international provider of offshore contract drilling services for oil and gas wells, reported a net loss attributable to controlling interest of $104 million, or $0.13 per diluted share, for the three months ended December 31, 2023. This marks a notable improvement from the $220 million loss, or $0.28 per diluted share, recorded in the previous quarter.

Financial Performance and Operational Highlights

Transocean's contract drilling revenues for Q4 2023 increased sequentially by $28 million to $741 million, driven by increased average daily revenue, higher fleet revenue efficiency, and increased utilization on several rigs. The company's revenue efficiency for the quarter was an impressive 97.0%, up from 95.4% in the previous quarter, reflecting a strong operational performance.

Operating and maintenance expenses rose to $569 million, up from $524 million in the prior quarter, primarily due to rigs returning to work after undergoing contract preparation and higher in-service maintenance costs. Despite the increase in expenses, the company's adjusted EBITDA was $122 million, with an adjusted EBITDA margin of 16.3%.

Transocean's backlog as of February 2024 stood at a robust $9.01 billion, providing a clear line of sight to future revenues and cash flows. This backlog is critical for the company's stability and growth prospects, especially in the volatile oil and gas market.

Capital Expenditures and Debt Management

The company reported capital expenditures of $220 million for the fourth quarter, mainly associated with the construction of the newbuild ultra-deepwater drillship Deepwater Aquila. This compares to $50 million in the previous quarter. Transocean's management of capital expenditures is essential for maintaining its fleet and securing its position in the competitive offshore drilling market.

Transocean's total debt stood at $7.413 billion at the end of 2023, with a cash and cash equivalents balance of $762 million. The management of debt and liquidity is a key focus for the company, as it balances investment in new assets with the servicing of existing obligations.

CEO Commentary and Outlook

"We are very proud of our performance in 2023," said Chief Executive Officer Jeremy Thigpen. "We added $3.2 billion of backlog in the calendar year, providing additional visibility to future cash flows. In addition to delivering standout personal and process safety results, we finished the year with a company-best 97.6% uptime performance."

Thigpen also highlighted the delivery and commissioning of two eighth-generation drillships and expressed optimism about the market's tightness and the potential for a multi-year upcycle, indicating a positive outlook for the offshore drilling industry and Transocean's position within it.

Year-End Review and Future Prospects

For the full year 2023, Transocean reported a net loss of $954 million, or $1.24 per diluted share, which included net unfavorable items of $215 million. The adjusted net loss for the year was $739 million, or $0.96 per diluted share. While the company faced challenges, the strategic focus on operational efficiency and securing new contracts has positioned it to capitalize on market opportunities as they arise.

Transocean's financial and operational strategies, combined with its high-specification fleet and significant backlog, suggest a company adapting to the dynamic energy market. As the offshore drilling industry navigates through recovery and growth phases, Transocean's latest earnings report provides valuable insights for value investors and potential GuruFocus.com members interested in the sector's prospects.

Explore the complete 8-K earnings release (here) from Transocean Ltd for further details.

This article first appeared on GuruFocus.