Transocean (RIG) Q3 Loss Wider Than Expected, Revenues Miss

Transocean Ltd. RIG reported an adjusted net loss of 36 cents per share in the third quarter of 2023, wider than the Zacks Consensus Estimate of a loss of 22 cents. This underperformance can be attributed to a weak result from Harsh Environment floaters. The bottom line also deteriorated from the year-ago period’s recorded loss of 6 cents.

Total adjusted revenues of $721 million missed the Zacks Consensus Estimate of $738 million. The top line also declined 3.6% from the prior-year quarter’s reported figure of $748 million.

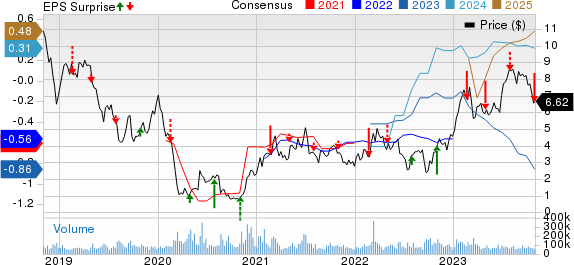

Transocean Ltd. Price, Consensus and EPS Surprise

Transocean Ltd. price-consensus-eps-surprise-chart | Transocean Ltd. Quote

Segmental Revenue Breakup

Transocean’s Ultra-deepwater floaters contributed 72.4% to net contract drilling revenues, while Harsh Environment floaters accounted for the remaining 27.6%. Revenues from the Ultra-deepwater and Harsh Environment floaters totaled $516 million and $197 million, respectively, compared with the year-ago quarter’s reported figures of $433 million and $258 million.

Day rates, Utilization & Backlog

Average day rates in the reported quarter increased to $391,300 from $343,400 in the year-ago quarter. The figure also beat our estimate of $367.200.

Average revenues per day from Ultra-deepwater floaters increased to $406,500 from $326,600 in the year-ago quarter. The same from Harsh Environment floaters, however, decreased to $357,400 from $374,000 in the comparable period of 2022.

The fleet utilization rate was 49.4% in the quarter, down from the prior-year period’s figure of 59.4%.

Transocean’s backlog of $9.4 billion increased sequentially from $9.2 billion.

Costs, Capex & Balance Sheet

Operations and maintenance (O&M) costs increased to $524 million from $484 million a year ago. The company spent $50 million on capital investments in the third quarter. Cash used in operating activities totaled $66 million. Cash and cash equivalents amounted to $594 million as of Sep 30, 2023. Long-term debt totaled $7.1 billion, with a debt-to-capitalization of 40.6% as of the same date.

Guidance

For the fourth quarter of 2023, Transocean expects adjusted contract drilling revenues of $760 million based on an average fleet-wide revenue efficiency of 96.5%.

It also projects O&M expenses of approximately $565 million for the same time frame. General and administrative costs are estimated to be $55 million. Cash taxes are anticipated to reach $24.3 million for the same quarter. RIG projects net interest expenses of $127 million in the fourth quarter, including $6.4 million in capitalized interest.

Capital expenses for the fourth quarter are expected to be around $270 million, including $210 million for preparing the Deepwater Aquila for a three-year contract with Petrobras in Brazil and $16 million for Deepwater Atlas and Deepwater Titan.

Transocean expects full-year O&M expenses in the range of $2.1-$2.3 billion, with G&A costs of around $195 million.

Zacks Rank and Key Picks

Currently, RIG carries a Zacks Rank #3 (Hold).

Investors interested in the energy sector might look at some better-ranked stocks like CVR Energy CVI and USA Compression Partners USAC, each sporting a Zacks Rank #1 (Strong Buy), and Harbour Energy HBRIY, carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

CVR Energy is valued at $3.16 billion. In the past year, its shares have lost 13.8%.

CVI currently pays a dividend of $2 per share or 6.36% on an annual basis. Its payout ratio currently sits at 30% of earnings.

USA Compression Partners is valued at around $2.42 billion. USAC currently pays a dividend of $2.10 per unit, or 8.52% on an annual basis.

USAC provides natural gas compression services and offers compression services to oil companies and independent producers, processors, gatherers, and transporters of natural gas and crude oil. It also operates stations.

Harbour Energy is worth approximately $2.28 billion. HBRIY currently pays a dividend of 21 cents per share, or 6.76% on an annual basis.

The company's activities include acquiring, exploring, developing, and producing oil and gas reserves. It has ownership stakes in several properties in the United Kingdom, Norway, Indonesia, Vietnam and Mexico.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Transocean Ltd. (RIG) : Free Stock Analysis Report

CVR Energy Inc. (CVI) : Free Stock Analysis Report

USA Compression Partners, LP (USAC) : Free Stock Analysis Report

Harbour Energy PLC Sponsored ADR (HBRIY) : Free Stock Analysis Report