Transphorm Inc (TGAN) Reports Modest Revenue Growth Amidst Acquisition Agreement

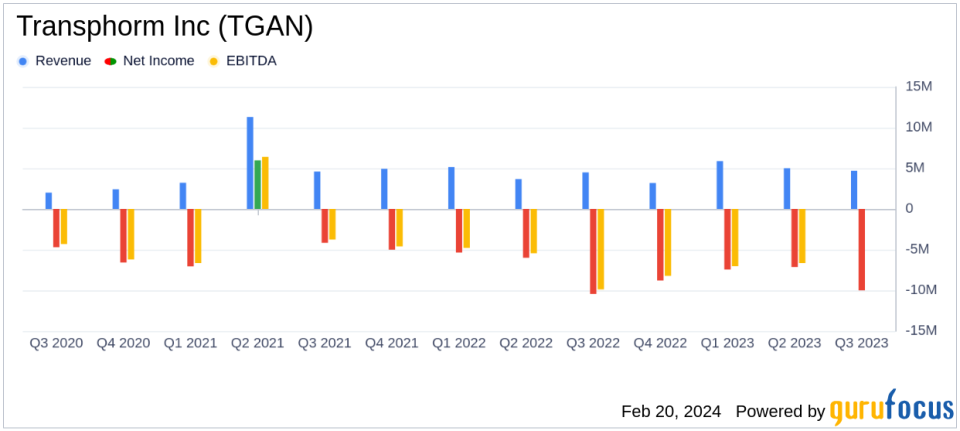

Revenue: Q3 Fiscal 2024 revenue increased by 4.0% year-over-year to $4.7 million but decreased by 6.8% from the previous quarter.

Net Loss: Net loss widened to ($10.0) million in Q3 Fiscal 2024, compared to ($7.1) million in the previous quarter and ($10.5) million year-over-year.

Gross Margin: Gross margin was significantly impacted, standing at 1.6% due to adjustments including a $250K Consumption tax and $170K in non-recurring scrap.

Operating Expenses: Increased to $9.0 million in Q3 Fiscal 2024, largely driven by legal expenses related to the acquisition agreement with Renesas.

Cash Position: Cash, cash equivalents, and restricted cash totaled $8.0 million as of December 31, 2023.

Acquisition Agreement: Transphorm entered into a definitive agreement to be acquired by a subsidiary of Renesas Electronics Corporation, valuing the company at approximately $339 million.

On February 14, 2024, Transphorm Inc (NASDAQ:TGAN), a semiconductor company specializing in the design and manufacture of GaN semiconductors, released its 8-K filing, detailing the financial results for the third quarter of its fiscal year ending March 31, 2024 (Q3 Fiscal 2024). The company, known for its high-voltage power conversion applications and JEDEC and AEC-Q101-qualified GaN FETs, operates a vertically integrated device business model that fosters innovation across all development stages.

Financial Performance and Challenges

Transphorm Inc (NASDAQ:TGAN) reported a slight year-over-year increase in total revenue, reaching $4.7 million for Q3 Fiscal 2024. However, this represents a decrease from the previous quarter, with product revenue falling due to short-term demand pushouts. The company's gross margin suffered a significant downturn, primarily affected by a consumption tax adjustment and non-recurring scrap costs. Operating expenses rose to $9.0 million, up from $7.7 million in the prior quarter and $7.2 million in Q3 Fiscal 2023, with the increase attributed to legal expenses incurred from the acquisition agreement with Renesas.

The net loss for the quarter expanded to ($10.0) million, or ($0.20) per share, from a net loss of ($7.1) million, or ($0.12) per share, in the prior quarter. This performance is crucial as it reflects the company's current challenges in managing costs and navigating market demand fluctuations, which are essential for maintaining financial health and investor confidence in a competitive semiconductor industry.

Financial Achievements and Industry Importance

Despite the challenges, Transphorm Inc (NASDAQ:TGAN) has made significant strides in its high power segment, with over 120 total design-ins for higher power applications and the launch of several new products and reference designs, particularly for the electric vehicle (EV) market. These achievements underscore the company's commitment to innovation and its potential to capture more market share in the evolving semiconductor industry.

Key Financial Metrics and Commentary

Transphorm's CEO and Co-Founder, Primit Parikh, commented on the quarter's performance:

"While our third quarter product revenue decreased marginally on a sequential basis, we continued to experience strong momentum in building our revenue pipeline and securing design-ins. During the third quarter, we successfully launched several new high power products and two key reference designs targeted for EV two- and three-wheeler market."

These insights from the CEO highlight the company's focus on expanding its product offerings and securing a stronger position in the high power and EV markets, despite the short-term revenue decline.

Analysis of Performance

Transphorm's financial performance in Q3 Fiscal 2024 reflects a mixed picture. While the company has demonstrated the ability to innovate and grow its design-ins, it faces challenges in maintaining product revenue growth and managing operating expenses. The acquisition by Renesas Electronics Corporation could provide strategic benefits and financial stability, but it also brings uncertainties that investors will closely monitor.

Value investors may find the acquisition agreement particularly noteworthy, as it could signal a significant change in Transphorm's market value and future prospects. The company's ability to innovate and penetrate new markets with its GaN technology remains a key factor for long-term growth and competitiveness in the semiconductor industry.

For further details on Transphorm Inc (NASDAQ:TGAN)'s financial performance and the implications of its pending acquisition, interested parties are encouraged to review the company's Quarterly Report on Form 10-Q for the quarter ended December 31, 2023, filed with the Securities and Exchange Commission.

Explore the complete 8-K earnings release (here) from Transphorm Inc for further details.

This article first appeared on GuruFocus.