The Transportation Sector is Highlighting Top Value Stocks to Buy in March

Known for distributing high dividends to investors when business operations are strong the Zacks Transportation-Shipping Industry will be one to watch in March. Alluding to this narrative is that the Zacks Transportation-Shipping Industry is currently in the top 22% of over 250 Zacks industries.

Standing out in terms of value including enticing dividends a few of these stocks are making the case for being bargains and here are several to consider.

Euroseas ESEA

In addition to sporting a Zacks Rank #1 (Strong Buy), Euroseas' stock also sports an “A” Zacks Style Scores grade for Value. Headquartered in Greece, Euroseas has a fleet of 20 vessels operating in the dry bulk and container shipping markets.

Euroseas transports major bulk such as coal, grains, and iron ore with its stock trading at just 3X earnings. This is a discount to the industry average of 5.8X and dirt-cheap considering fiscal 2024 EPS estimates are nicely up over the last 30 days. Furthermore, Euroseas’ bottom line is expected to be robust this year with FY24 earnings estimates jumping 8% over the last month from $11.26 a share to $12.23 per share.

Image Source: Zacks Investment Research

More enticing is that Euroseas currently has a 5.14% annual dividend yield that is roughly on par with the industry average and towers over the S&P 500’s 1.32% average. Better still, despite its extremely cheap valuation Euroseas’ stock has been one of the market's best performers climbing +97% in the last year and now up an astonishing +412% over the last three years. The strong price performance certainly makes Euroseas’ stock one of the best buy-the-dip prospects when the opportunity is given as ESEA shares still trade under $40.

Image Source: Zacks Investment Research

Danaos DAC

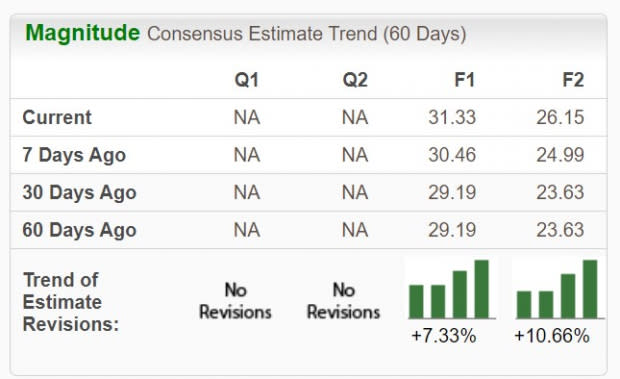

Also based in Greece, Danaos’ stock has an “A” Style Scores grade for Value as well and sports a Zacks Rank #2 (Buy). As one of the leading international owners of containerships, Danaos' profitability has remained immense with earnings estimate revisions noticeably higher for both FY24 and FY25 over the last 30 days.

Image Source: Zacks Investment Research

Plus, with Danaos EPS now expected at a whopping $31.33 per share this year its stock trades at just 2.4X forward earnings. Danaos stock has risen +22% in the last year and is now up +77% over the last three years. The company’s 4.45% dividend yield should certainly keep investors intrigued with DAC shares trading around $73 and looking due for another leg higher considering its monstrous earnings.

Image Source: Zacks Investment Research

Other Stocks to Watch

Diana Shipping DSX and ZIM Integrated Shipping ZIM are also worthy of investors' consideration at the moment with the broader transportation-shipping industry expected to receive a boost from improvements in digitalization along with enhancements from AI and blockchain technology.

At the moment Diana Shipping and ZIM Integrated Shipping’s stock both sport a Zacks Rank #2 (Buy) and flaunt “A” Zacks Style Scores grades for Value.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Euroseas Ltd. (ESEA) : Free Stock Analysis Report

Danaos Corporation (DAC) : Free Stock Analysis Report

Diana Shipping inc. (DSX) : Free Stock Analysis Report

ZIM Integrated Shipping Services Ltd. (ZIM) : Free Stock Analysis Report