Travelers (TRV) Boosts Cyber Capabilities With Corvus Buyout

The Travelers Companies TRV closed the Corvus Insurance Holdings buyout. The transaction was announced in November 2023 for a purchase consideration of $435 million. Addition of Corvus to the acquirer’s portfolio marks its step toward enhancing its cyber capabilities, a part of its strategic growth roadmap.

Corvus Insurance is a leading cyber insurance managing general underwriter powered by proprietary technology. Founded in 2017, the company developed an industry-leading suite of integrated cyber sales, underwriting, service and support capabilities. These are deployed to lower its policyholders’ exposure to cyber events. Leveraging its proprietary technology, the company could also effectively deliver improved loss ratios.

With this acquisition, TRV will have access to Corvus’ $200-plus million book of business. This apart, Corvus’ portfolio will enhance the return profile of its attractive cyber portfolio. Per Alan Schnitzer, chairman and chief executive officer of Travelers, “This transaction accelerates our access to cutting-edge cyber capabilities that were on our strategic roadmap, including sophisticated underwriting algorithms, advanced cyber vulnerability scanning and digital connectivity to customers and distribution partners.” Balance sheet strength driven by scale, profitability and cash flow supports it to invest more than $1 billion annually on technology.

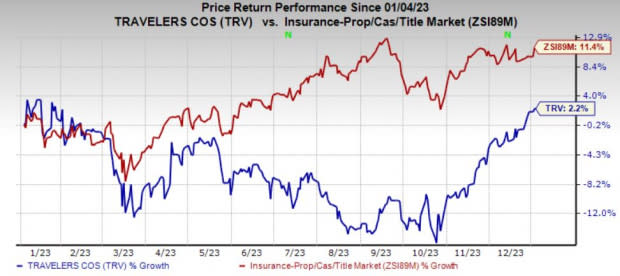

Travelers is one of the leading writers of auto and homeowners’ insurance plus commercial U.S. property-casualty insurance with solid inorganic growth. This Zacks Rank #3 (Hold) insurer has successfully maintained historically high levels of retention, improved pricing and increase in new business, while achieving a positive renewal premium change. Shares of TRV have gained 2.2% in a year compared with the industry’s 11.4% growth. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Other Acquisitions in Insurance Space

Brown & Brown, Inc. BRO recently announced that it has entered into an agreement to purchase Caton-Hosey Insurance. This acquisition is expected to boost Brown & Brown’s presence in the Florida market.

BRO and its subsidiaries continuously make strategic acquisitions to expand on a global scale, add capabilities, boost its operations and improve margins. Also, these strategic buyouts help it increase commissions and fees, which, in turn, drive revenues. Consistent operational results have been aiding Brown & Brown in generating solid cash flows for deployment in growth initiatives.

Arthur J. Gallagher & Co. AJG recently closed the buyout of The Evans Agency. The acquisition was announced last month. This will consolidate the acquirer’s presence in Western New York.

Arthur J. Gallagher is growing through mergers and acquisitions, most of which are within its Brokerage segment. AJG has a solid merger and acquisition pipeline with about 45 term sheets either agreed upon or being prepared, representing more than $450 million of annualized revenues. Revenue growth rates generally range from 5% to 20% for 2023 acquisitions. It continues to expect M&A capacity of upward of $3 billion through the end of 2023 and another $3.5 billion in 2024 without using any equity.

Marsh & McLennan Companies, Inc.’s MMC business, Oliver Wyman, recently agreed to buy SeaTec Consulting Inc., which caters to aerospace, defense, aviation and transportation industries. This move is expected to boost Oliver Wyman’s position in the aviation space.

The acquisition underscores MMC's strategic inorganic growth approach, exemplified by various purchases across its operating units. These acquisitions have facilitated entry into new regions, expansion in existing ones, diversification into new businesses and the development of new segments. The prudent acquisitions position the company for sustained long-term growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

Marsh & McLennan Companies, Inc. (MMC) : Free Stock Analysis Report

Arthur J. Gallagher & Co. (AJG) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report