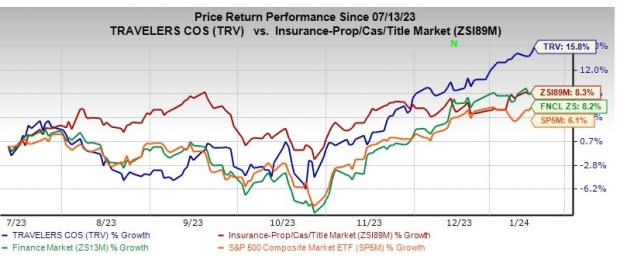

Travelers (TRV) Gains 15.8% in 6 Months: More Room to Run?

The Travelers Companies, Inc.’s TRV shares have gained 15.8% in the past six months compared with the industry’s growth of 8.3%. The Finance sector and the Zacks S&P 500 index have risen 8.2% and 6.1% in the said time frame, respectively.

With a market capitalization of $44.5 billion, the average volume of shares traded in the last three months was 1.4 million.

Image Source: Zacks Investment Research

Strong retention rates, positive renewal premium changes, strong returns from the non-fixed income portfolio and sufficient liquidity continue to drive this Zacks Rank #2 (Buy) insurer.

The Zacks Consensus Estimate for Travelers’ 2024 earnings is pegged at $16.75 per share, indicating a 51.2% increase from the year-ago reported figure on 11.6% higher revenues of $46.21 billion.

Travelers’ return on equity for the trailing 12 months is 10.4%, which compares favorably with the industry’s 7.2%, reflecting the company’s efficiency in utilizing shareholders’ funds.

Will the Bull Run Continue?

Riding on strong net earned premiums and an aggregate underlying combined ratio for Business Insurance and Bond & Specialty Insurance, strong underwriting results continued in the commercial businesses. Strong retention rates, positive renewal premium changes, higher new business premium in both Domestic Automobile and Domestic Homeowners and other across all the business segments should continue to drive Travelers.

The company’s commercial businesses continue to perform well on the back of stability in the markets where it operates, as well as the execution of its strategies. For 2024, the insurer expects renewal premium change to be elevated but moderate into the low-double digits as an automatic increase in limit factors returned to more normal levels, in line with stabilizing industry estimates of replacement costs. In Domestic Automobile, TRV expects renewal premium change in auto to remain very strong but begin to move down from here as more of the book reaches rate adequacy on a written basis.

Higher average levels of invested assets, reliable results from the fixed-income portfolio and strong returns from the non-fixed-income portfolio are likely to drive net investment income (NII) higher. With interest rates having moved higher during the third quarter, Travelers raised the outlook for fixed income NII, including earnings from short-term securities, to approximately $615 million after tax for the fourth quarter. NII should continue to improve as the portfolio gradually turns over and continues to grow.

TRV aims to generate increased earnings and capital, maintain a balanced approach to rightsizing capital and growing book value per share over time as part of its long-term financial strategy. Balance sheet strength driven by scale, profitability and cash flow supports it to invest more than $1 billion annually in technology.

The property & casualty insurer has an impressive dividend history, increasing its dividend for the last 18 years. Its current dividend yield of 2% is better than the industry average of 0.3%. This makes TRV an attractive pick for yield-seeking investors.

Travelers has a VGM Score of A. VGM Score helps identify stocks with the most attractive value, best growth and the most promising momentum. Back-tested results show that stocks with a VGM Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or 2, offer the best opportunities in the value investing space.

The Zacks Consensus Estimate for 2024 earnings has moved 0.05% north in the past seven days. This should instill investors' confidence in the stock.

The property & casualty insurer has an impressive Value Score of A, reflecting an attractive valuation of the stock.

Other Stocks to Consider

Some other top-ranked stocks from the same space are CNA Financial Corporation CNA, Chubb Limited CB and Berkshire Hathaway (BRK.B), each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

CNA Financial delivered a trailing four-quarter average earnings surprise of 9.24%. The stock has gained 10.5% in the past six months.

The Zacks Consensus Estimate for CNA’s 2024 earnings indicates an increase of 7.4% from the 2023 estimated figure. The expected long-term earnings growth rate is 5%. The consensus estimate for 2024 earnings has moved up 1.5% in the past 30 days.

Chubb’s earnings surpassed estimates in three of the last four quarters while missing in one, the average being 6.51%. The stock has risen 19.9% in the past six months.

The Zacks Consensus Estimate for Chubb’s 2024 earnings implies a rise of 7.4% from the 2023 estimated figure. The expected long-term earnings growth rate is 10%. The consensus estimate for CB’s 2024 earnings has moved up 0.4% in the past 60 days.

Berkshire delivered a trailing four-quarter average earnings surprise of 0.20%. In the past six months, the stock has gained 5.8%.

The Zacks Consensus Estimate for BRK.B’s 2024 earnings indicates an increase of 11.1% from the 2023 estimated figure. The expected long-term earnings growth rate is 7%. The consensus estimate for BRK.B’s 2024 earnings has moved up 2.8% in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

Chubb Limited (CB) : Free Stock Analysis Report

Berkshire Hathaway Inc. (BRK.B) : Free Stock Analysis Report

CNA Financial Corporation (CNA) : Free Stock Analysis Report