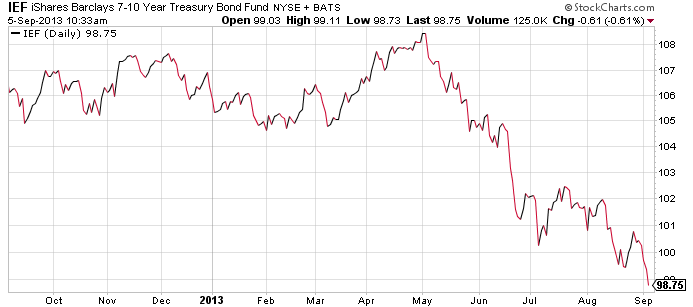

Treasury ETF Pullback Rekindles Talk of Rising Bond Rates

U.S. stock ETFs rallied Monday and Treasury bonds fell sharply on fiscal cliff deal hopes and after noted hedge fund manager David Tepper said equities look cheap compared to “rich” bonds.

The iShares Barclays 20+ Year Treasury Bond Fund (TLT) tumbled 1.5% on Monday as 10-year yields touched 1.8%, the highest level since October. Bond prices and yields move in opposite directions.

The latest jump in yields has brought back lingering speculation that interest rates could finally begin to rise meaningfully.

TLT, the Treasury fund, has dropped to an important technical level. The ETF is testing the 200-day moving average as well as a rising support line.

Also, the recent drop in the 10-year Treasury note has pushed its yield back above its 200-day moving average, according to Bespoke Investment Group. The last two times the 10-year yield has pushed above its 200-day, it has marked a short-term top, or short-term bottom in terms of bond prices. “Are we due for another pullback in Treasury yields or will this bounce continue through the end of the year?” it said.

Fed bond buying

Of course, the Federal Reserve will continue to use its considerable firepower to help keep rates low in a bid to stimulate the economy.

“But as we head into 2013 and investors look to position portfolios, many are asking whether next year might be the year when interest rates begin to rise. After all, the Fed doesn’t actually set interest rates; rather it tries to influence them through its monetary policy,” said Matt Tucker, head of fixed income strategy at iShares.

There are several key trends keeping rates low, he said. They include a slow U.S. economy, benign inflation, demand for safe havens amid the European debt crisis and macro uncertainty, and continued Treasury buying by the Fed and other central banks. [Bond ETFs: Will Interests Rates Rise in 2013?]

“The bottom line is that as we head into 2013, we are unlikely to see a significant increase in rates, at least in the near term. The factors that kept interest rates low throughout 2012 appear to be very much in place as the clock ticks down to the New Year,” Tucker said.

Bond bull market

Still, if rates do rise meaningfully, many investors who have piled into bonds the past couple years would get hurt.

The bull market in U.S. bonds and other developed countries stretching over 30 years has given rise to a “cult of bonds” among owners of financial assets, says Nicholas Colas, ConvergEx Group chief market strategist.

“The last five years in capital markets have been tumultuous, and the most crowded port in this storm has been fixed income investments,” he wrote in a recent note.

During that period, investors have pulled nearly $550 billion from U.S. stock mutual funds while plowing over $1.3 trillion to taxable fixed-income funds and ETFs.

“Based on the money flow data … combined with the Fed’s newly announced purchases, fixed income seems destined for another year of reasonable returns in 2013. At the same time, this is becoming a crowded trade. The lackluster state of the U.S. economy makes inflation an unlikely pin to pop this bubble, at least in the next 12 months,” Colas wrote.

“But if you are looking for non-consensus worries about the next 12 months, higher interest rates are a good place to start. Given how much capital has plowed its way into the fixed income market, it is probably naïve to think that a dramatic move higher for rates would be received with a shrug or a redirection of capital flows into riskier assets such as stocks,” the strategist concluded. “If the past decade teaches anything, it is that investors move further away from the fire when burned. As the old Wall Street saying goes, ‘They don’t ring a bell at the top or the bottom.’ For 2013 to be a good one for risk assets, we better not hear any bells in bond land.”

2013 rate outlook

At U.S. banks, the Treasury bond market’s 21 primary dealers are forecasting rates will rise in 2013, according to a Dow Jones Newswires survey.

They see a median 10-year yield of 2.25% at the end of 2013.

“The higher yield, which means lower prices, reflects these banks’ expectations that the U.S. economy will not only emerge largely unscathed from year-end budget negotiations to avert a mix of spending cuts and tax increases that could send the economy into recession if they take effect next month, but also gain momentum, particularly in the second half of the year,” according to the report.

iShares Barclays 20+ Year Treasury Bond Fund

Full disclosure: Tom Lydon’s clients own TLT.

The opinions and forecasts expressed herein are solely those of John Spence, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.