Has Treasury Wine Estates Limited (ASX:TWE) Been Employing Capital Shrewdly?

Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

Today we are going to look at Treasury Wine Estates Limited (ASX:TWE) to see whether it might be an attractive investment prospect. In particular, we’ll consider its Return On Capital Employed (ROCE), as that can give us insight into how profitably the company is able to employ capital in its business.

First up, we’ll look at what ROCE is and how we calculate it. Then we’ll compare its ROCE to similar companies. Finally, we’ll look at how its current liabilities affect its ROCE.

Understanding Return On Capital Employed (ROCE)

ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. In general, businesses with a higher ROCE are usually better quality. In brief, it is a useful tool, but it is not without drawbacks. Renowned investment researcher Michael Mauboussin has suggested that a high ROCE can indicate that ‘one dollar invested in the company generates value of more than one dollar’.

How Do You Calculate Return On Capital Employed?

Analysts use this formula to calculate return on capital employed:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

Or for Treasury Wine Estates:

0.12 = AU$523m ÷ (AU$5.9b – AU$843m) (Based on the trailing twelve months to December 2018.)

Therefore, Treasury Wine Estates has an ROCE of 12%.

Check out our latest analysis for Treasury Wine Estates

Does Treasury Wine Estates Have A Good ROCE?

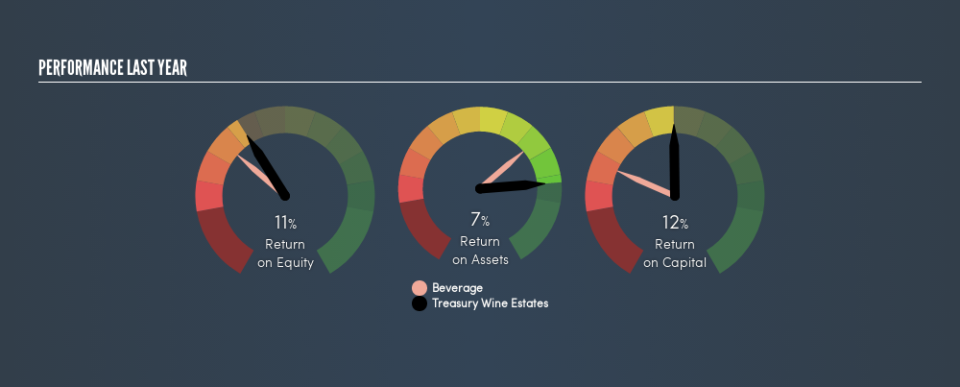

One way to assess ROCE is to compare similar companies. Using our data, Treasury Wine Estates’s ROCE appears to be around the 10% average of the Beverage industry. Independently of how Treasury Wine Estates compares to its industry, its ROCE in absolute terms appears decent, and the company may be worthy of closer investigation.

As we can see, Treasury Wine Estates currently has an ROCE of 12% compared to its ROCE 3 years ago, which was 4.0%. This makes us think the business might be improving.

When considering ROCE, bear in mind that it reflects the past and does not necessarily predict the future. ROCE can be deceptive for cyclical businesses, as returns can look incredible in boom times, and terribly low in downturns. ROCE is, after all, simply a snap shot of a single year. What happens in the future is pretty important for investors, so we have prepared a free report on analyst forecasts for Treasury Wine Estates.

How Treasury Wine Estates’s Current Liabilities Impact Its ROCE

Current liabilities are short term bills and invoices that need to be paid in 12 months or less. The ROCE equation subtracts current liabilities from capital employed, so a company with a lot of current liabilities appears to have less capital employed, and a higher ROCE than otherwise. To counteract this, we check if a company has high current liabilities, relative to its total assets.

Treasury Wine Estates has total assets of AU$5.9b and current liabilities of AU$843m. As a result, its current liabilities are equal to approximately 14% of its total assets. A fairly low level of current liabilities is not influencing the ROCE too much.

What We Can Learn From Treasury Wine Estates’s ROCE

This is good to see, and with a sound ROCE, Treasury Wine Estates could be worth a closer look. You might be able to find a better buy than Treasury Wine Estates. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

I will like Treasury Wine Estates better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.