Tredegar Corp (TG) Faces Significant Net Loss in 2023 Amid Strategic Shifts and Market Challenges

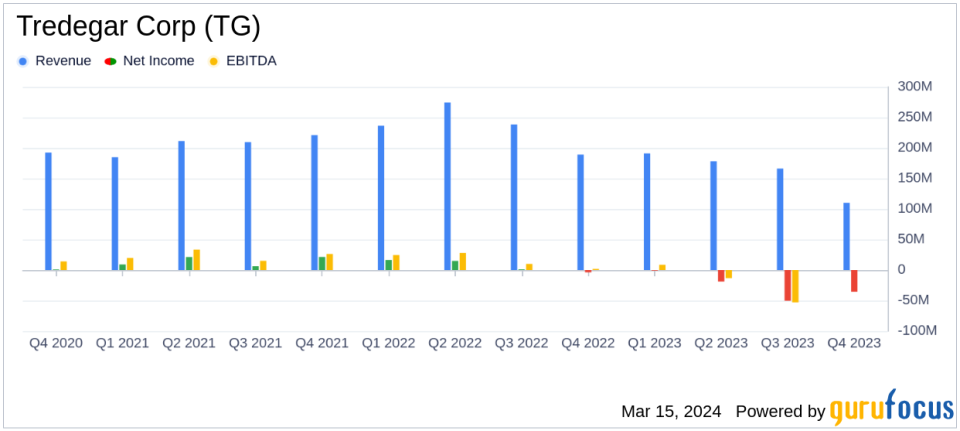

Net Loss: Tredegar Corp (NYSE:TG) reported a full year net loss of $(105.9) million in 2023, a stark contrast to the $28.5 million net income in 2022.

EBITDA: EBITDA from ongoing operations varied across segments, with Aluminum Extrusions and PE Films showing resilience in the fourth quarter.

Strategic Sale: Progress on the sale of Terphane, a Flexible Packaging Films segment, is on track with regulatory reviews.

Debt and Leverage: Total debt stood at $146.3 million at year-end, with the company focusing on managing net working capital and costs.

Market Challenges: Intense competition and global excess capacity impacted sales volumes and margins, particularly in the Flexible Packaging Films segment.

On March 15, 2024, Tredegar Corp (NYSE:TG) released its 8-K filing, disclosing its financial results for the fourth quarter and full year ended December 31, 2023. The company, which operates through its subsidiaries in the manufacture of Polyethylene Plastic films, Polyester Films, and Aluminum Extrusions, faced a challenging year with a significant net loss.

Financial Performance and Challenges

Tredegar's net income (loss) for the fourth quarter of 2023 was $(35.6) million ($(1.04) per diluted share), compared to $(3.9) million ($(0.11) per diluted share) in the fourth quarter of 2022. The full year net loss deepened to $(105.9) million ($(3.10) per diluted share) from a net income of $28.5 million ($0.84 per diluted share) in the previous year. The net loss from ongoing operations was $(4.7) million ($(0.15) per diluted share) in 2023, down from a net income of $39.5 million ($1.17 per diluted share) in 2022.

The company's Aluminum Extrusions segment, which serves various markets including building and construction, automotive, and specialty products, reported a decrease in EBITDA from ongoing operations to $8.0 million in the fourth quarter of 2023 from $8.9 million in the same period last year. Sales volume also declined, reflecting the impact of pandemic-related disruptions and increased competition from imports.

PE Films, which produces surface protection films and polyethylene overwrap films, showed a positive EBITDA from ongoing operations of $4.5 million in the fourth quarter of 2023, a significant improvement from the negative $2.6 million in the fourth quarter of 2022. This segment's sales volume increased, indicating a recovery in the consumer electronics market.

The Flexible Packaging Films segment, referred to as Terphane, experienced a decrease in EBITDA from ongoing operations to $2.3 million in the fourth quarter of 2023 from $7.0 million in the same quarter of the previous year. The company attributes the unfavorable variances to lower sales volume and margin pressures due to global excess capacity and intense competition.

Strategic Initiatives and Outlook

John Steitz, Tredegars president and CEO, commented on the results, stating, "Results for the fourth quarter were better than expected and improved compared with the third quarter of 2023." He highlighted signs of recovery in the Aluminum Extrusions segment and positive performance in PE Films, which is expected to continue into 2024.

"We continue to make progress on our corporate strategic initiatives. The process to complete the sale of Terphane is advancing as planned, including the review required by competition authorities in Brazil. In early November, we settled our pension plan. In late December, we executed an amendment of our credit agreement and conversion to an asset-based lending facility to support us during what has been an unprecedented cyclical downturn. Furthermore, favorable operating results have improved our outlook for our financial leverage," said Steitz.

The company is actively managing its debt and financial leverage, with total debt at $146.3 million at the end of 2023. The strategic sale of Terphane is progressing, with regulatory reviews in Brazil and Colombia underway.

Tredegar's performance in 2023 reflects the ongoing challenges in the industrial products industry, including intense competition, global excess capacity, and the residual impact of the pandemic. The company's strategic initiatives, including the sale of Terphane and the transition to an asset-based lending facility, are critical steps in navigating these challenges and positioning for future growth.

Value investors and potential GuruFocus.com members interested in the industrial products sector may find Tredegar's strategic moves and management of financial leverage points of interest as they evaluate the company's potential for recovery and long-term value creation.

For a detailed analysis of Tredegar Corp's financial results and strategic initiatives, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Tredegar Corp for further details.

This article first appeared on GuruFocus.