Treehouse Foods Inc (THS) Reports Notable Fiscal Year 2023 Results Despite Q4 Challenges

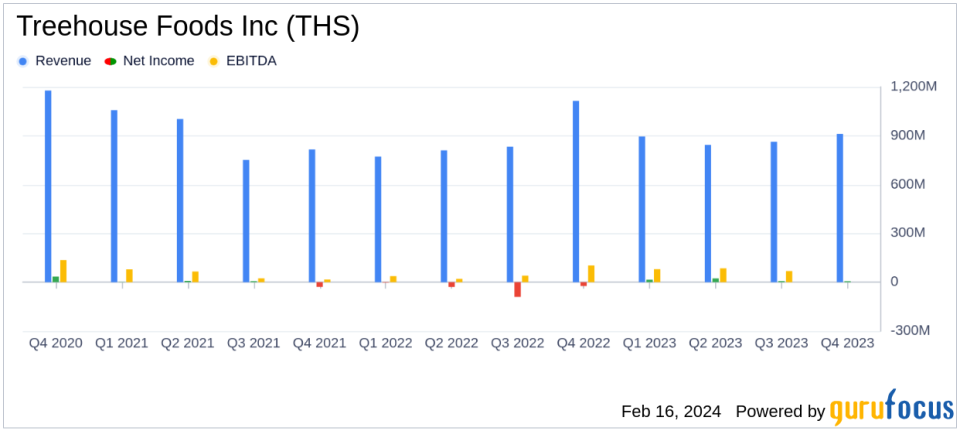

Net Sales: $3,431.6 million, a 4.1% increase from the previous year.

Net Income: $59.0 million from continuing operations, a significant rise from the prior year.

Adjusted EBITDA: $365.9 million, marking a $74.2 million improvement year-over-year.

Q4 Performance: Aligned with guidance despite a 4.8% decrease in net sales compared to the same period last year.

Share Repurchase: Approximately $100 million in shares repurchased during the fiscal year 2023.

FY 2024 Outlook: Projected net sales between $3.43 to $3.50 billion and adjusted EBITDA between $360 to $390 million.

On February 16, 2024, Treehouse Foods Inc (NYSE:THS), the largest private label manufacturer in the U.S., released its 8-K filing, detailing its financial results for the fourth quarter and the full fiscal year of 2023. The company, known for its extensive range of products across over 25 categories, has reported a solid fiscal year with significant improvements in net income and adjusted EBITDA.

Despite facing challenges such as supply chain disruptions, particularly in its broth facilities, and a decrease in net sales for the fourth quarter, Treehouse Foods managed to close the year with a 4.1% increase in net sales, amounting to $3,431.6 million. The company's net income from continuing operations saw a remarkable increase of $68.2 million compared to the previous year, reaching $59.0 million. Adjusted EBITDA also rose by $74.2 million to $365.9 million, reflecting the company's strong operational performance.

Financial Highlights and Challenges

The fourth quarter presented several challenges for Treehouse Foods, including a net sales decrease of 4.8% primarily due to volume/mix in the retail business. This was impacted by supply chain disruptions at one of the company's broth facilities and in its pretzels and cookies categories. Gross profit as a percentage of net sales also decreased by 1.6 percentage points due to these disruptions, unfavorable fixed cost absorption, increased labor and maintenance costs, and unfavorable category mix.

Operating expenses saw a slight increase of $4.2 million, mainly due to the termination of certain TSA services and higher severance expenses. Total other expense increased by $14.4 million, largely driven by non-cash mark-to-market impacts from hedging activities and a decrease in interest income.

Strategic Improvements and Shareholder Value

Treehouse Foods has made significant strides in improving its leverage profile and balance sheet over the year. The company also completed a substantial share repurchase program, buying back approximately $100 million worth of shares during the fiscal year 2023. This demonstrates the company's commitment to delivering value to its shareholders.

For the fiscal year 2024, Treehouse Foods has issued an outlook with net sales expected to range between $3.43 to $3.50 billion and adjusted EBITDA anticipated to be between $360 to $390 million. The company also projects a free cash flow of at least $130 million. However, the restart of one of the company's broth facilities in the first half of 2024 is expected to negatively impact net sales and adjusted EBITDA.

Management's Perspective

"TreeHouse Foods made important progress in 2023 to advance our portfolio strategy focused on higher-growth, higher-margin categories, enhance our supply chain capabilities, and improve our service levels," said Steve Oakland, Chairman, Chief Executive Officer and President. "I want to emphasize that our performance this year is a testament to the dedication and diligence of our entire TreeHouse team, whose efforts enabled the Company to deliver on our commitments to both our stakeholders and shareholders."

The company's management remains confident in the positioning of the business, citing the strength of the private brands market and the development of a robust net sales pipeline expected to contribute to growth in the second half of 2024 and beyond.

Treehouse Foods' performance in fiscal year 2023, despite the headwinds faced in the fourth quarter, reflects the resilience and strategic execution of the company. With a focus on higher-margin categories and supply chain enhancements, Treehouse Foods is poised to continue its growth trajectory and strengthen its position in the private brands food and beverage market in North America.

Explore the complete 8-K earnings release (here) from Treehouse Foods Inc for further details.

This article first appeared on GuruFocus.