TreeHouse Foods' (THS) Latest Buyout to Enhance Coffee Business

TreeHouse Foods, Inc. THS has been focused on refining its portfolio, as part of which it has been expanding product offerings through acquisitions. The company concluded the previously announced buyout of Farmer Brothers Company’s Northlake, TX, coffee facility and the non-Direct Store Delivery coffee business (known as Direct Ship).

The addition of Farmer Brothers’ state-of-the-art Northlake facility is likely to complement TreeHouse Foods’ single-serve pod and ready-to-drink coffee businesses by bringing roasting, flavoring, grinding and blending capacities. This nearly $100 million deal will enhance THS’ private-label coffee offering, helping the company expand in the coffee arena, which has solid growth potential.

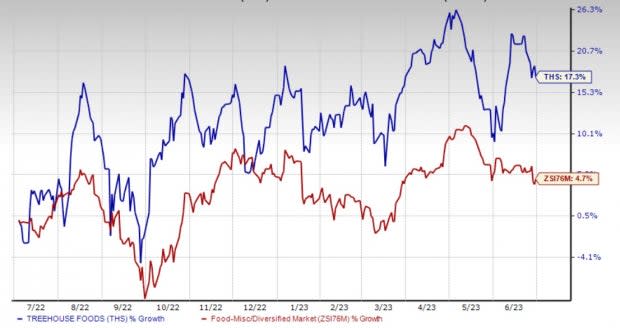

Image Source: Zacks Investment Research

Portfolio Refinement – a Key Focus Area

TreeHouse Foods has a history of undertaking prudent acquisitions and divestitures to enrich its portfolio. In April 2023, the company added seasoned pretzel capabilities to its portfolio. In December 2020, THS had acquired the majority of Riviana Foods’ U.S.-branded pasta portfolio.

Earlier, in February 2016, TreeHouse Foods had acquired the Private Brands business for $2.7 billion. The company’s other acquisitions include PFF Capital Group, Inc. (“Protenergy”), Cains Foods, L.P., Associated Brands and Naturally Fresh, Inc.

Meanwhile, THS remains committed to exiting underperforming businesses and shifting its focus toward areas with high growth potential. On Oct 3, 2022, TreeHouse Foods concluded the sale of a significant portion of its Meal Preparation business, which included pasta, pourable and spoonable dressing, preserves, red sauces, syrup, dry blends and baking, dry dinners, pie filling, pita chips and other sauces. The divestiture places TreeHouse Foods well to capitalize on solid demand trends and fuel growth across its higher-margin private-label snacking and beverage categories.

What’s More?

TreeHouse Foods’ first-quarter 2023 top and bottom lines increased year over year and cruised ahead of the Zacks Consensus Estimate. THS continued to gain from robust pricing actions to counter inflation. Despite a dynamic macro landscape, TreeHouse Foods witnessed supply-chain improvements, which helped it enhance services and cater to high customer demand. Quarterly revenues and profits exceeded expectations as the company benefited from better execution and a more focused portfolio.

TreeHouse Foods remains well-placed for 2023 due to its actions to focus on greater-margin private-label snacking and beverage categories. For fiscal 2023, TreeHouse Foods expects net sales growth of 6-8% year over year to the $3.66-$3.73 billion band. Adjusted EBITDA is likely to be in the $355-$370 million range, up nearly 26% year over year at the midpoint. Fiscal 2023 results are likely to be driven by pricing, better execution and supply-chain recovery.

In the first half of fiscal 2023, TreeHouse Foods anticipates revenues in the range of $1.705-$1.735 billion, suggesting 7.7-9.6% growth from the year-ago period. For the second quarter of 2023, revenues are projected in the range of $810-$840 million, indicating flat to 4% growth from the second quarter of 2022, driven by pricing. The company expects adjusted EBITDA in the band of $65-$80 million for the second quarter. The adjusted EBITDA margin is likely to be 7.9-9.4% in the quarter, calling for a 130-280 bps improvement.

Shares of this Zacks Rank #3 (Hold) company have rallied 17.3% in the past year compared with the industry’s growth of 4.7%.

Solid Staple Stocks

Some better-ranked consumer staple stocks are Nomad Foods NOMD, The Chef’s Warehouse CHEF and Lamb Weston LW.

Nomad Foods, a frozen food product company, currently sports a Zacks Rank #1 (Strong Buy). NOMD has a trailing four-quarter earnings surprise of 8.5%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Nomad Foods’ current fiscal-year sales suggests growth of around 8% from the year-ago reported figures.

The Chef’s Warehouse, which engages in the distribution of specialty food products, currently sports a Zacks Rank #1. CHEF has a trailing four-quarter earnings surprise of 33.8%, on average.

The Zacks Consensus Estimate for The Chef’s Warehouse’s current fiscal-year sales and earnings suggests growth of 25.5% and 7.1%, respectively, from the year-ago reported numbers.

Lamb Weston, which is a frozen potato product company, currently carries a Zacks Rank #2 (Buy). LW has a trailing four-quarter earnings surprise of 47.6%, on average.

The Zacks Consensus Estimate for Lamb Weston’s current fiscal-year sales and earnings suggests growth of 30% and 117.3%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

The Chefs' Warehouse, Inc. (CHEF) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

Nomad Foods Limited (NOMD) : Free Stock Analysis Report