TreeHouse Foods' (THS) Pricing Efforts Aid Despite Cost Woes

TreeHouse Foods, Inc. THS has been focusing on enhancing its services across most product categories, facilitating its ability to meet the heightened market demand. This leading player in the food and beverage industry has also been reaping the rewards of its efficient pricing strategies.

The company’s second-quarter 2023 sales bear testament to the above-mentioned upsides. In the quarter, net sales rose 4.1% year over year to $843.6 million, primarily fueled by pricing adjustments made to counter the challenges of commodity inflation. Pricing increased 11.2%, aiding organic sales growth of 4% in the second quarter.

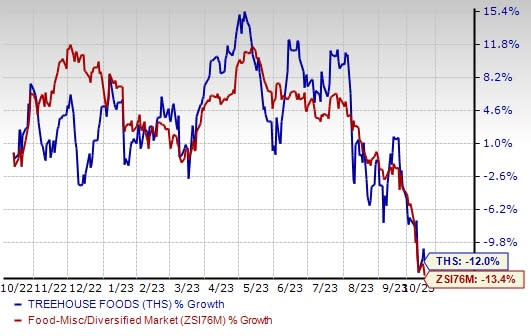

Image Source: Zacks Investment Research

Growth Strategies Underway

TreeHouse Foods has been focused on strategies like fueling category leadership in high-appeal sections, extending customer ties by offering private brand priorities, creating a robust supply chain, operating as a more focused organization, becoming a talent leader, and undertaking strict capital allocation.

The company has outlined a comprehensive growth strategy for 2024-2027. THS’s objectives encompass achieving net sales growth between 3% and 5%, attaining adjusted EBITDA growth of 8-10%, and generating a free cash flow in excess of $200 million.

Emphasis on Portfolio Improvement Bodes Well

The company has consistently shown a dedication to expanding its product offerings through strategic acquisitions. In June 2023, TreeHouse Foods acquired Farmer Brothers Company's Northlake, TX-based coffee facility and non-Direct Store Delivery coffee business. This move significantly solidified TreeHouse Foods' position as a major player in the private-label snacking and beverage industry, while bolstering its presence in the coffee sector. In April 2023, seasoned pretzel capabilities were added to the portfolio.

On the contrary, TreeHouse Foods has been dedicated to concentrating on areas with higher growth potential. It recently completed the divestiture of its manufacturing facility and snack bar business in Lakeville, MN, to John B. Sanfilippo & Son, Inc., generating proceeds of approximately $61 million. This strategic move aligns with the company's principal strategy of prioritizing its role as a premier provider of private-label products within high-growth and high-margin sectors.

High Cost Hurdles

TreeHouse Foods has been struggling with rising costs for an extended period. In the second quarter of 2023, the company continued to face challenges posed by extra expenses linked to its investments in supply-chain enhancements. The expenditure included high labor and manufacturing costs.

Shares of this Zacks Rank #3 (Hold) company have lost 12% in the past year compared with the industry’s decline of 13.4%.

Nonetheless, we believe that the focus on strategies like efficient pricing and portfolio refinement will aid growth for THS.

Three Solid Picks

We have highlighted three better-ranked stocks, namely Lamb Weston Holdings, Inc. LW, Flowers Foods FLO and The Kraft Heinz Company KHC.

Lamb Weston Holdings is a leading global manufacturer, marketer and distributor of value-added frozen potato products, particularly French fries. It also provides a range of appetizers. The company currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Lamb Weston Holdings’ current fiscal-year sales and EPS suggests growth of 27.4% and 20.1%, respectively, from the year-ago reported figures. LW has a trailing four-quarter earnings surprise of 46.2%, on average.

Flowers Foods emphasizes on providing high-quality baked items, developing strong brands, making innovations to improving capabilities and undertaking prudent acquisitions. It currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Flowers Foods’ current financial-year sales suggests growth of 6.7% from the year-ago reported figures. FLO has a trailing four-quarter earnings surprise of 7.6%, on average.

The Kraft Heinz Company (KHC) is one of the largest consumer packaged food and beverage companies in North America. The company currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Kraft Heinz’s current financial-year sales and EPS suggests growth of 2.2% and 4%, respectively, from the year-ago reported figures. KHC has a trailing four-quarter earnings surprise of 11.3%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

Kraft Heinz Company (KHC) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report