TreeHouse Foods (THS) Q2 Earnings Beat Estimates, View Raised

TreeHouse Foods, Inc. THS posted robust second-quarter 2023 results, wherein both the top and bottom lines grew year over year and surpassed the Zacks Consensus Estimate. Encouragingly, management raised its net sales and adjusted EBITDA guidance for fiscal 2023.

The company is likely to keep gaining from a more focused portfolio, greater service levels and prudent investments in enhancing capacities (such as the recently concluded coffee acquisition). Management remains confident about achieving its near and long-term targets due to favorable industry trends and its solid strategy.

Quarter in Detail

TreeHouse Foods reported adjusted earnings from continuing operations of 42 cents per share, which beat the Zacks Consensus Estimate of 40 cents. The bottom line grew significantly from the year-ago quarter’s adjusted earnings of 5 cents.

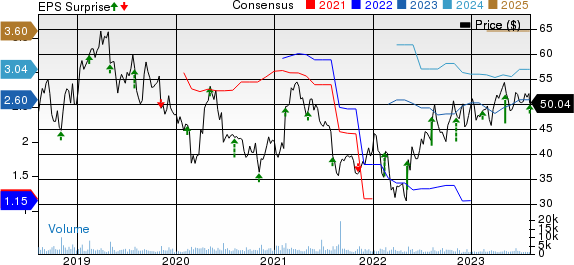

TreeHouse Foods, Inc. Price, Consensus and EPS Surprise

TreeHouse Foods, Inc. price-consensus-eps-surprise-chart | TreeHouse Foods, Inc. Quote

Net sales of $843.6 million advanced 4.1% year over year and came ahead of the Zacks Consensus Estimate of $830 million.

Growth in net sales was mainly driven by favorable pricing actions undertaken to recover commodity inflation. This was somewhat offset by lower volumes stemming from softness in food and beverage consumption, the exit of the lower-margin business and distribution losses.

The volume/mix fell 7.2%, whereas pricing increased 11.2%. Organic sales grew 4%. THS witnessed currency headwinds to the tune of 0.2%, and acquisitions contributed 0.3% to net sales.

The gross margin of 15.7% expanded 2 percentage points from the year-ago quarter’s figure, mainly due to pricing actions to recover commodity and freight inflation. These were somewhat offset by additional costs associated with investments to improve the supply chain to enhance service levels. These included higher labor and manufacturing-related costs.

Total operating expenses were $103.3 million, down from the $136.7 million reported in the year-ago quarter.

Adjusted EBITDA from continuing operations came in at $76.4 million, up from $53.1 million in the year-ago period. The upside can be attributed to the same factors that drove the gross margin.

Other Updates

TreeHouse Foods concluded the quarter with cash and cash equivalents of $16.9 million, long-term debt of $1,594.5 million and total shareholders’ equity of $1,734.9 million. In the first six months of 2023, the company’s net cash used in operating activities was $49.8 million.

Guidance

Management raised its fiscal 2023 guidance. For fiscal 2023, TreeHouse Foods now expects net sales growth of 7.5-9.5% to the range of $3.71-$3.78 billion. Earlier, TreeHouse Foods expected net sales growth of 6-8% to the $3.66-$3.73 billion band. The upgraded sales guidance mainly reflects the coffee acquisition effect.

Adjusted EBITDA is likely to be in the band of $360-$370 million, suggesting 27% growth at the midpoint. Management earlier expected adjusted EBITDA in the $345-$365 million range, up nearly 24% year over year at the midpoint. The updated adjusted EBITDA guidance includes certain anticipations for the fourth quarter of 2023.

For the fourth quarter, the gross margin is likely to improve year over year and sequentially, mainly due to TMOS and supply-chain saving efforts. The company also expects to incur temporary operating expenses of nearly $5-$7 million in the fourth quarter.

For the third quarter of 2023, revenues are projected in the range of $950-$970 million, indicating nearly 10% growth at the midpoint. This is likely to be backed by volume/mix, including volume gains from the coffee buyout. The company expects third-quarter adjusted EBITDA in the band of $81-$89 million, indicating 11% growth at the midpoint from the same year-ago period.

This Zacks Rank #2 (Buy) stock has risen 5% in the past six months compared with the industry’s 3.5% growth.

Other Solid Staple Stocks

Some other top-ranked consumer staple stocks are Vital Farms VITL, Post Holdings POST and Ingredion Incorporated INGR.

Vital Farms, which provides pasture-raised products, currently sports a Zacks Rank #1 (Strong Buy). VITL has a trailing four-quarter earnings surprise of 132.5%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Vital Farms’ current fiscal-year earnings suggests significant growth from the year-ago reported number.

Post Holdings, a consumer packaged goods holding company, currently has a Zacks Rank #2. POST has a trailing four-quarter earnings surprise of 59.6%, on average.

The Zacks Consensus Estimate for Post Holdings’ current fiscal-year earnings suggests growth of 141.1% from the year-ago reported figure.

Ingredion Incorporated, which produces and sells sweeteners, starches, nutrition ingredients and biomaterial solutions, currently carries a Zacks Rank #2. The Zacks Consensus Estimate for INGR’s current fiscal-year earnings per share has increased from $9.10 to $9.23 over the past seven days.

The consensus mark for Ingredion Incorporated’s current fiscal-year earnings suggests growth of 23.9% from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

Ingredion Incorporated (INGR) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report