Tri Pointe Homes Inc (TPH) Reports Mixed Results Amid Market Shifts

Net New Home Orders: Soared by 143% to 1,078 in Q4.

Backlog: Units rose by 58% to 2,320, with a dollar value increase of 38% to $1.6 billion.

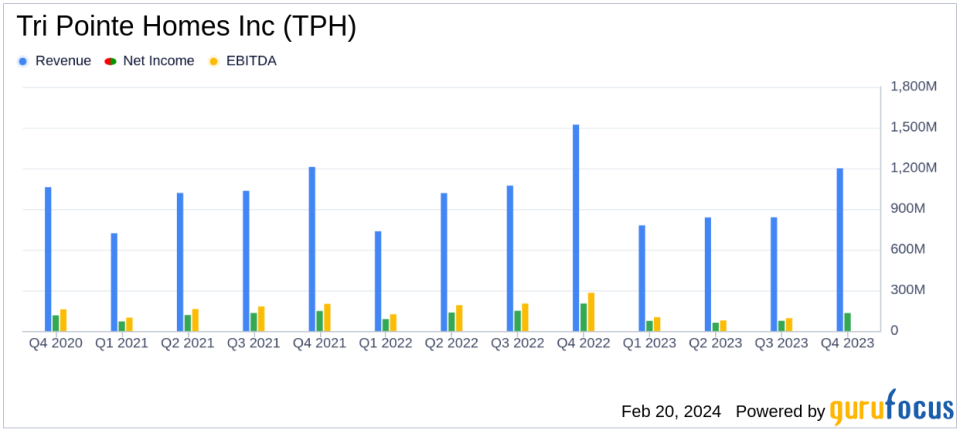

Home Sales Revenue: Declined by 17% to $1.2 billion in Q4.

Homebuilding Gross Margin: Decreased to 22.9% from 25.0% in the previous year.

Diluted Earnings Per Share (EPS): Dropped to $1.36 from $1.98 year-over-year.

Active Selling Communities: Increased by 14% to 155.

Liquidity: Ended Q4 with $1.6 billion, including cash and credit facility availability.

On February 20, 2024, Tri Pointe Homes Inc (NYSE:TPH) released its 8-K filing, detailing its financial results for the fourth quarter and full year of 2023. The American residential construction company, known for its single-family homes and condominiums, faced a challenging market environment characterized by fluctuating mortgage interest rates and a competitive landscape.

Company Overview

Tri Pointe Homes Inc operates across several states, with a significant presence in California, Arizona, and Nevada. The company's annual production hovers around 4,000 homes, with an average selling price of approximately $500,000. Tri Pointe is also engaged in land sale and development, contributing to its diverse revenue streams.

Financial Performance and Challenges

The company reported a 17% decrease in home sales revenue to $1.2 billion for Q4, with a 10% drop in new home deliveries compared to the same period last year. The average sales price of homes delivered was $685,000, down from $746,000. Despite these challenges, Tri Pointe saw a significant increase in net new home orders, which surged by 143% to 1,078, and an increase in active selling communities by 14% to 155.

Homebuilding gross margin percentage declined to 22.9% from 25.0% year-over-year, reflecting the impact of market volatility and cost pressures. Selling, general, and administrative expenses as a percentage of home sales revenue increased to 9.3% from 7.6%, indicating rising operational costs.

Financial Achievements

Tri Pointe's backlog units at the end of the quarter stood at 2,320, a 58% increase, with the dollar value of the backlog rising by 38% to $1.6 billion. This growth in backlog indicates a robust pipeline of future revenues. The company also maintained a strong liquidity position, ending the quarter with $1.6 billion in total liquidity.

Key Financial Metrics

Net income available to common stockholders was $132.8 million, or $1.36 per diluted share, compared to $203.0 million, or $1.98 per diluted share in the previous year. The company's balance sheet remained solid, with cash and cash equivalents totaling $868.9 million and a debt-to-capital ratio of 31.5%.

"2023 proved to be another strong year for Tri Pointe Homes, capped off by a successful fourth quarter," said Doug Bauer, Tri Pointe Homes Chief Executive Officer. "We remain encouraged by the fundamentals of the housing market, including household formations, strong demand from Millennial and Gen-Z buyers, a more normalized supply chain, and shorter cycle times," stated Tri Pointe Homes President and Chief Operating Officer Tom Mitchell.

Analysis of Performance

While Tri Pointe Homes Inc navigated a period of market adjustment, the company's strategic growth initiatives and increased community count position it for potential expansion. The company's focus on maintaining a strong balance sheet and liquidity profile, coupled with its ability to adapt to changing market conditions, underscores its resilience in a competitive industry.

For the full year of 2023, net income available to common stockholders was $343.7 million, or $3.45 per diluted share, compared to $576.1 million, or $5.54 per diluted share for the previous year. The decrease in net income reflects the broader market challenges, including increased interest rates and supply chain disruptions.

Looking ahead, Tri Pointe Homes Inc anticipates delivering between 6,000 and 6,300 homes in 2024, with an average sales price between $645,000 and $655,000. The company's strategic entries into new markets and its focus on growth-oriented initiatives may provide opportunities for value investors seeking exposure to the homebuilding sector.

For a more detailed analysis and additional information, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Tri Pointe Homes Inc for further details.

This article first appeared on GuruFocus.