Tri Pointe (TPH) Launches a New Homebuyer App Across the U.S.

Tri Pointe Homes, Inc. TPH launched the Tri Pointe Homes Homebuyer App to enhance its customer experience through thorough communication possibilities. This will allow direct communication opportunities between homebuyers and builders to increase collaboration and streamline communication.

The new digital platform was launched in each of Tri Pointe’s divisions in the United States, aiming to keep homebuyers engaged and provide ongoing communication throughout the home buying process. The application will help in delivering automated updates on the building process accompanied by photography of the homes, organizing key documents and appointments, along with setting expectations related to a customer’s newly purchased home as it moves through each construction stage.

As of Jan 1, 2024, the new application showcased 4,314 Tri Pointe-constructed homes, live with an average of nine sessions by users engaging for more than 11 minutes. From here on, the company will be seeking continuous support, feedback and refinements from its team members and homebuyers across the country to explore and add new enhancements to the application.

Technological innovations and digital modifications are aiding homebuilding companies to spark their growth prospects in an uncertain economic scenario. The usage of high-tech tools and the development of advanced digital platforms are helping these companies cater to the specific preferences of the customers and increase construction quality by creating and delivering high-quality houses.

Other Strategic Initiatives Boosting Growth

Apart from technological advancements, Tri Pointe also focuses on increasing its construction starts along with reducing cycle times. Given the current market backdrop of low existing home supply and year-over-year high-interest rate environment, such a strategy will work wonders in uplifting the top line of the company.

Per the third-quarter 2023 earnings call, TPH stated that its ability to increase its constructions starts with improving cycle times has notably sparked its inventory of spec homes. Given the softness in existing homes, this strategy has ramped up its delivery potential, allowing it to capture a significant housing market share. During the quarter, the company’s net new orders surged 122% to 1,513 homes from 681 homes in the year-ago comparable period. Furthermore, the quarter-end backlog units increased to 3,055 homes compared with 3,044 homes in the year-ago quarter, reflecting a 0.4% increase.

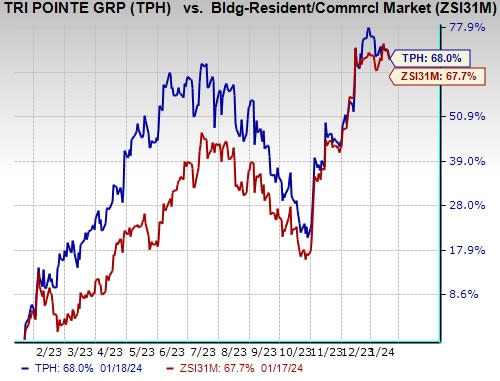

Image Source: Zacks Investment Research

Shares of this U.S.-based homebuilder have increased 68% in the past year, outperforming the Zacks Building Products - Home Builders industry’s 67.7% growth. The company’s effective implementation of its strategic initiatives will help it to continue moving through this uncertain economic condition and spark growth prospects.

Zacks Rank & Key Picks

Tri Pointe currently carries a Zacks Rank #3 (Hold).

Here are some better-ranked stocks from the Construction sector.

Martin Marietta Materials, Inc. MLM currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

MLM delivered a trailing four-quarter earnings surprise of 37.3%, on average. The stock has gained 43.8% in the past year. The Zacks Consensus Estimate for MLM’s 2024 sales and earnings per share (EPS) indicates growth of 9.2% and 13.1%, respectively, from a year ago.

Armstrong World Industries, Inc. AWI presently carries a Zacks Rank #2 (Buy). It has a trailing four-quarter earnings surprise of 7.9%, on average. Shares of AWI have gained 34.1% in the past year.

The Zacks Consensus Estimate for AWI’s 2024 sales and EPS indicates a rise of 1.3% and 6.8%, respectively, from the prior-year levels.

NVR, Inc. NVR currently carries a Zacks Rank of 2. NVR delivered a trailing four-quarter earnings surprise of 14.6%, on average. The stock has gained 44.2% in the past year.

The Zacks Consensus Estimate for NVR’s 2024 sales and EPS indicates a decline of 4.1% and 10.2%, respectively, from the prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Martin Marietta Materials, Inc. (MLM) : Free Stock Analysis Report

NVR, Inc. (NVR) : Free Stock Analysis Report

Armstrong World Industries, Inc. (AWI) : Free Stock Analysis Report

Tri Pointe Homes Inc. (TPH) : Free Stock Analysis Report