Tricon: A Play on Housing Shortages

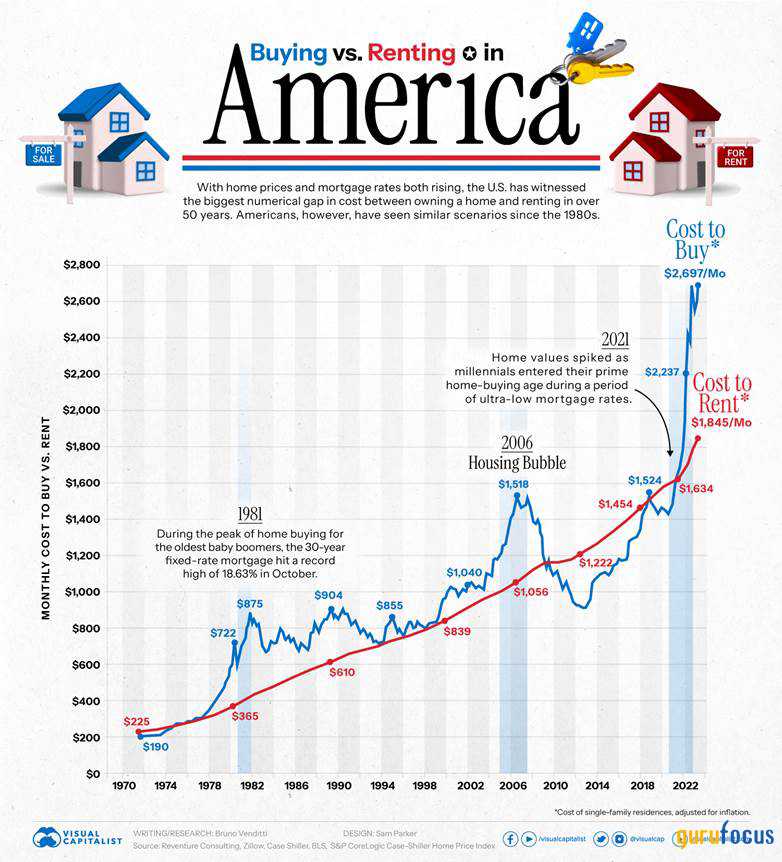

Single-family rental properties are thriving, marked by rising occupancy rates and rental prices. This trend has attracted consumers looking to enjoy the experience of having their own home without the substantial upfront costs associated with homeownership. The surge in mortgage rates has significantly increased the monthly cost of homeownership, making renting a more economical choice.

Historically, renting and owning have had comparable monthly costs, but the recent spike in mortgage rates has made renting considerably cheaper. This rational financial decision has boosted demand for both apartments and single-family homes. While apartment development has largely kept pace with demand, the single-family home market remains undersupplied.

Anticipated further growth in rents is expected for the sector, with strong occupancy rates in the mid-to-high 90s. The primary source of incremental demand is likely to come from renters by necessity, driven by financial considerations. Higher-end buyers may opt to purchase homes with cash, avoiding the burden of high mortgage rates, but most people are not able to do that and need mortgages. Data from a recent Visual Capitalist report supports the idea that renters by necessity are the stronger segment.

This scenario aligns well with Tricon Residential Inc. (NYSE:TCN) as its portfolio is positioned for the renters-by-necessity market, with an average rental rate of $1,792. Rental rates are expected to move closer to parity with the monthly cost of homeownership, either through rising rents or a decline in homeownership costs. The base case for mortgage rates is stabilization around 6%, suggesting a balanced approach to achieving this parity.

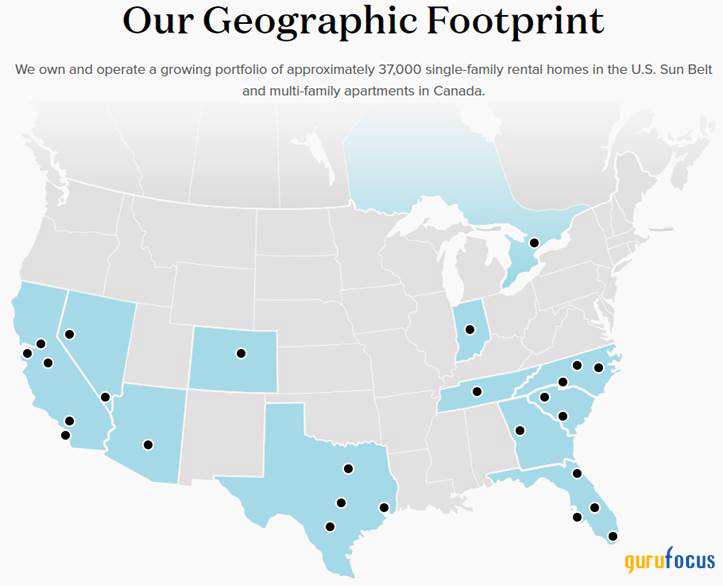

Tricon Residential is an important player in the single-family rental industry, boasting a portfolio of over 37,000 homes primarily situated in the U.S. Sunbelt region. Alongside its core operations, Tricon also manages two smaller business lines centered around multifamily rentals in Canada and residential development. Tricon is based in Toronto, Canada, but most of its assets and operations are in the U.S.

The SFR industry enjoys a favorable landscape marked by robust supply-demand dynamics. The anticipated growth rate of the 35 to 44-year-old demographic, a key housing demand cohort, is projected to outpace the broader population growth over the next five years. This demographic shift is fueling strong demand for homes. Meanwhile, the production of new single-family homes remains well below historical levels, resulting in a notable supply shortage. The increasing cost of homeownership is also driving more individuals and families toward the rental market. These favorable conditions have translated into substantial cash flow growth for Tricon, with the company anticipating remarkable 9%-plus growth in same-home net operating income for the current year.

Moreover, the SFR business enjoys several defensive attributes that may mitigate the risk of cash flow declines compared to other real estate sectors. First, institutional-quality SFR rentals, on average, command approximately $1 per square foot, representing a substantial 36% discount compared to the average rent for a three-bedroom apartment. Second, Tricon's tenant base predominantly comprises middle-market families, often with one or more children, who not only seek the space and convenience of a home, but also tend to be longer-term renters. This results in lower turnover and more stable cash flows. Lastly, with an estimated 20% gap between current and market rents, any substantial negative impact on rent growth for new leases and renewals would require a significant decline in market rents.

Despite its defensive qualities and the current strong growth exhibited by Tricon's SFR business, the company's shares are attractively valued. Analysts estimate they trade at a discount of around 30% compared to private market valuations, and the implied cap rate is approximately 150 basis points higher than that of its peers.

Recent results

During the second quarter, the company continued to experience strong demand for its homes, leading to robust financial performance. Key highlights from the quarter included solid operational results, with a 6.3% growth in same-home net operating income, a 68.3% NOI margin, 97.5% occupancy, 19.2% turnover and a steady 7.4% blended rent growth. The company also focused on cost reduction, achieving a 5% year-over-year decrease in maintenance costs.

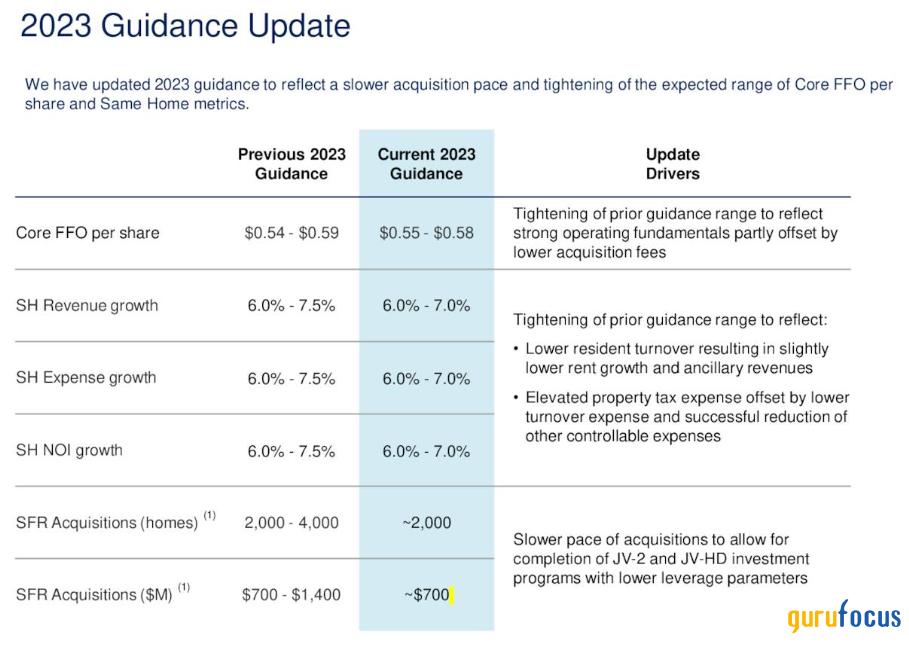

Furthermore, the company says it has responsibly expanded its portfolio by acquiring 805 homes at a competitive cap rate and successfully closed a securitization transaction with an attractive financing cost. Looking ahead, the company planned to slow its acquisitions to around 400 homes per quarter, adjusting to tougher market conditions while maintaining a strong financial position.

The company highlighted the growing demand for rental housing, driven by rising mortgage rates and the affordability of renting with the company. The company's strategy continues acquiring single-family homes, renovating them to high standards and providing hassle-free living for residents.

In terms of acquisition opportunities, home prices within target markets decreased by about 4% year over year, while rents increased by 1%, resulting in improved cap rates. Despite a smaller buying opportunity compared to the previous year, listings volume was increasing seasonally, allowing the company to achieve its acquisition targets. The decision to slow acquisitions was made in collaboration with joint venture partners to maintain a lower loan-to-value ratio, optimizing financing rates.

Tricon also provided an update on its Canadian multifamily portfolio, highlighting the success of recent projects, including The Taylor and The Selby, as well as the development of a 725-unit rental apartment community in Toronto's Etobicoke City Center neighborhood. Tricon's Canadian multifamily portfolio is poised for significant growth, with the potential to double the book value of its stake in the coming years, creating substantial value for shareholders. The company's prospects of the Canadian portfolio is experiencing strong tail winds in the Toronto area due to high immigration.

Valuation

Looking at the GF Score for Tricon, I see strong growth and value ranks, but very weak financial strength and a fair momentum rating.

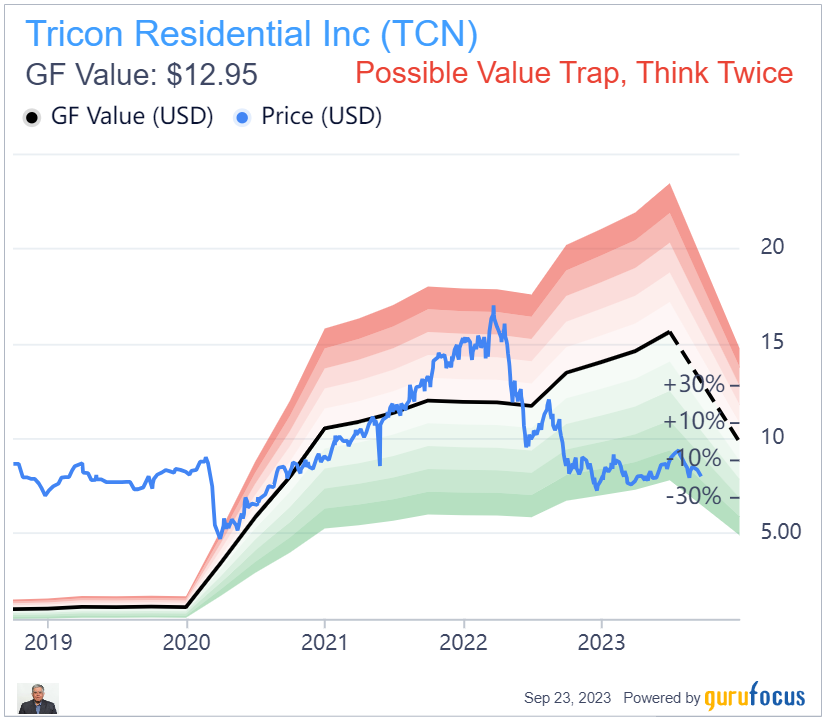

GF Value ratings are very high, so much so that the GuruFocus system is triggering a "value trap" warning. While the stock price is far below intrinsic value, I do not believe the stock is a value trap as the company did get overvalued during the pandemic and increased demand for single-family housing. Following the Federal Reserve's start of the tightening cycle, the stock has over-corrected.

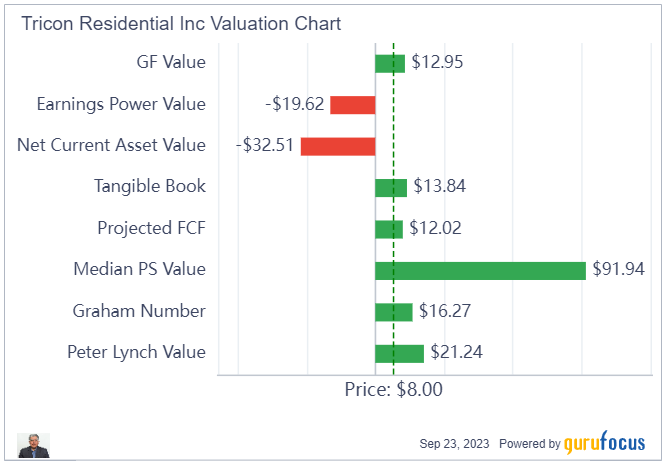

Looking at the valuation chart from GuruFocus, we see the stock looks undervalued against most metrics. Tangible book value, in particular, looks impressive at $13.84 versus the stock price of $8.

Debt

GuruFocus reports a low financial strength of only 3 out of 10 for Tricon. This is par-for-the-course for a real estate company which depends heavily on leverage. Managing debt and capitalization rates must be core competences for the company. The company can and does increase its rents to compensate for inflation and interest rates, so a high debt load is part and parcel of the risk-reward equation. The fact the stock price is substantially below tangible book value is a big plus.

Current | Industry Median | Historical Median | |

Cash-to-Debt | 0.02 | 0.27 | 0.03 |

Equity-to-Asset | 0.30 | 0.44 | 0.65 |

Interest Coverage | 1.71 | 4.36 | 1.44 |

Piotroski F-Score | 5 | 5 | 4 |

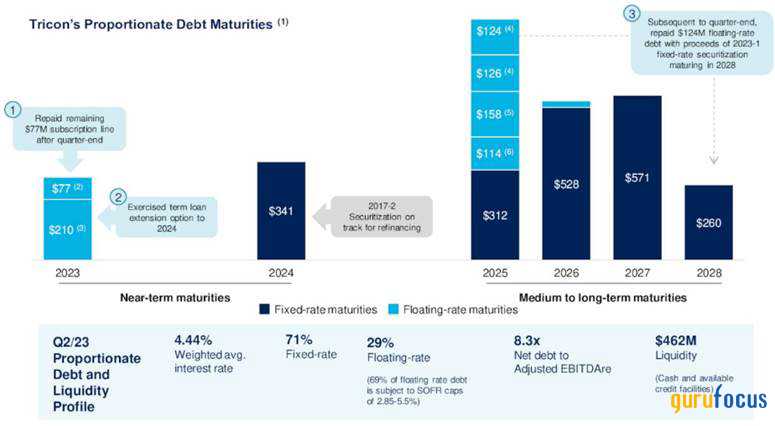

The following chart shows Tricon's maturity profile of its debt tranches. The company is constantly refinancing debt and moving near-term debt to medium- to long-term debt.

Cash flow

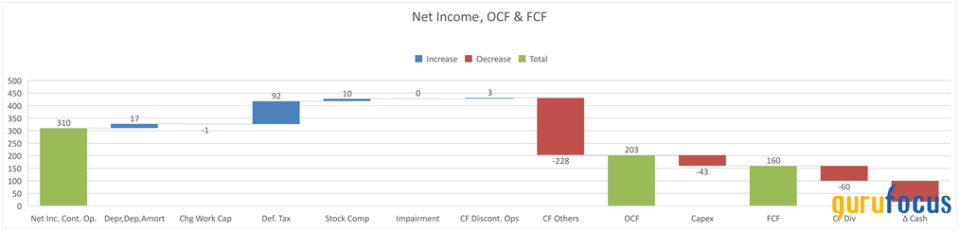

The company generated $160 million in free cash flow for the trailing 12 month period shown in the chart below. This works out to a cash flow yield of 7.1%. The company pays out a modest dividend of 2.9% with a three-year dividend growth rate of 4.1%. The dividend yield is covered by free cash flow easily.

Summary

Tricon's value proposition is driven by the current housing shortage in North America, especially in the entry-level housing market. With a scarcity of affordable housing and rising home ownership costs, Tricon is well-positioned to address this demand gap. Approximately one-third of U.S. households are renters, indicating a significant demand for its offerings.

The company's Vantage program, which offers rents typically below market rates, reduces tenant turnover and positively impacts home net operating income growth. It delivers high-quality homes at an average monthly rent of $1,688, catering to the needs of middle income families who cannot afford to buy. Tricon's focus is on the middle-market demographic, typically families with children, known for being long-term renters, ensures a steady cash flow. Targeting over 7 million U.S. renter households with incomes ranging from $75,000 to $125,000 per year, Tricon offers affordable monthly rental payments between $1,400 and $2,300.

The persistent housing supply shortage creates a competitive advantage for Tricon, along with the favorable population growth trends in the U.S. Sun Belt area, which is experiencing net migration, as well as high immigration in the Toronto area. The business-friendly environment, lower taxes and job growth make them even more attractive. Galvanized by housing shortages and public anger, all levels of governments are also now trying to incentivize build out of rental units in Canada as well.

Despite being a property rental company, Tricon astutely supports the American dream of home ownership by allowing long-term residents to purchase the homes they are renting. This initiative has resulted in 34 home sales since its launch in 2021. Additionally, qualifying residents receive financial backing if they decide to purchase a non-Tricon home, provided they meet specific criteria, including a minimum rental period and good financial standing with the company. Tricon has aggressively expanded its single-family rental portfolio, adding 7,227 homes, a 23% year-over-year increase from 2021 to 2022, further solidifying its position in the market.

GuruFocus data indicates the stock is currently significantly undervalued. However, the current high interest rates are holding down the stock price. Interest rates may start to come down by the middle or late 2024. This should remove some of the pressure from the stock. It may not be a bad idea to take a starter position in the stock and slowly build on it on weakness. The stock gives long-term investors a large margin of safety and positions them for the expected Fed easing next year.

This article first appeared on GuruFocus.