TriMas (TRS) Stock Down 8% in a Year: Will it Recover?

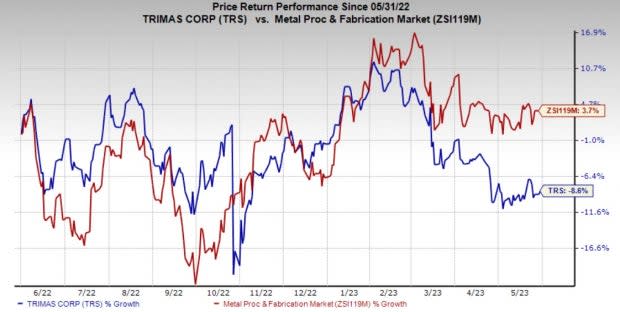

TriMas Corporation’s TRS shares have lost 8% in a year against the industry’s 3.7% growth reflecting the weakness in packaging demand in the past few quarters. Escalating raw material costs, supply-chain headwinds and labor shortages have also added to its woes.

Image Source: Zacks Investment Research

Packaging Demand, Costs Ails TriMas

TriMas’ packaging segment which accounted for 59% of the company’s sales, has witnessed year-over-year decline in its revenues over the past three quarters. This was mainly attributed to weak demand as several of its customers became cautious regarding their spending and rebalanced their inventories. This was largely due to the persisting inflationary pressure. Customer spending has been weak in Europe as well.

TRS anticipates some demand recovery this year as customers continue to work through high inventory levels. It also assumes a less favorable product sales mix related to acquisitions in the near term. TriMas anticipates the Packaging segment's year-over-year sales to grow 4-10% in 2023. The segment’s sales declined 2% in 2022. The company had delivered 9.2% year-over-year growth in sales in 2021. The segment's operating margin is projected at around 17-19% in 2023.

TriMas’ largest raw material purchases are for resins (polypropylene and polyethylene), steel, aluminum and other oil and metal-based purchased components. It has also been burdened with higher wage rates and freight costs. Supply-chain headwinds and labor shortages have also been impacting the company's results.

The company has a market capitalization of around $1.1 billion. It currently carries a Zacks Rank #3 (Hold). Let’s discuss the factors that indicate that the stock might stage a comeback.

Performance in Other Segments to Buoy TriMas

TriMas’ Specialty Products segment has been witnessing growth in sales on the back of higher demand for steel cylinders and engines and compressors used in construction, heating, ventilation and air conditioning applications. The Specialty Products segment's sales are likely to grow 10-20% on a year-over-year basis in 2023. The current backlog and near-term order intake for steel cylinders remain at high levels.

The order intake and backlog remain strong within the TriMas Aerospace segment. The company expects organic sales growth to accelerate in 2023. The production challenges experienced earlier will likely begin to ease on account of improved manufacturing efficiencies. The segment's sales are projected to grow 25-30% year over year in 2023. Strong performances in the Specialty Products and Aerospace segments will help counter the weakness in the Packaging segment.

Investments to Aid Growth

The company's strong balance sheet and track record of strong cash flow generation provide ample capacity and flexibility to fund organic growth initiatives and strategic acquisitions, while also returning capital to shareholders. TriMas’ strategy is to accelerate growth through acquisitions, particularly in its Packaging and Aerospace platforms, backed by their prospects. Its strong product and process innovation will sustain long-term growth.

Over the past three years, TriMas completed six acquisitions and so far in 2023, the company has acquired Aarts Packaging and Weldmac Manufacturing. Aarts Packaging is an innovative, luxury packaging solutions provider for beauty and lifestyle brands, as well as for customers in the food and life sciences end markets. Weldmac Manufacturing Company is a leading designer and manufacturer of high-performance, complex metal fabricated components and assemblies for the aerospace, defense and space launch end markets.

Stocks to Consider

Some top-ranked stocks from the Industrial Products sector are Worthington Industries, Inc. WOR, The Manitowoc Company, Inc. MTW and Pentair plc PNR. WOR and MTW sport a Zacks Rank #1 (Strong Buy) at present, and PNR carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Worthington Industries has an average trailing four-quarter earnings surprise of 27.5%. The Zacks Consensus Estimate for WOR’s fiscal 2023 earnings is pegged at $4.93 per share. The consensus estimate for 2023 earnings has moved north by 17.7% in the past 60 days. Its shares have gained 23% in the last year.

Manitowoc has an average trailing four-quarter earnings surprise of 38.8%. The Zacks Consensus Estimate for MTW’s 2023 earnings is pegged at 85 cents per share. The consensus estimate for 2023 earnings has moved 63.5% north in the past 60 days. MTW’s shares have gained 13% in the last year.

The Zacks Consensus Estimate for Pentair’s 2023 earnings per share is pegged at $3.66, up 3% in the past 60 days. It has a trailing four-quarter average earnings surprise of 7.2%. PNR has gained 13.9% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Manitowoc Company, Inc. (MTW) : Free Stock Analysis Report

Worthington Industries, Inc. (WOR) : Free Stock Analysis Report

Pentair plc (PNR) : Free Stock Analysis Report

TriMas Corporation (TRS) : Free Stock Analysis Report